Question

Youve recently been hired by B2B Consultants to provide financial advisory services to small business managers. B2Bs clients often need advice on how to improve

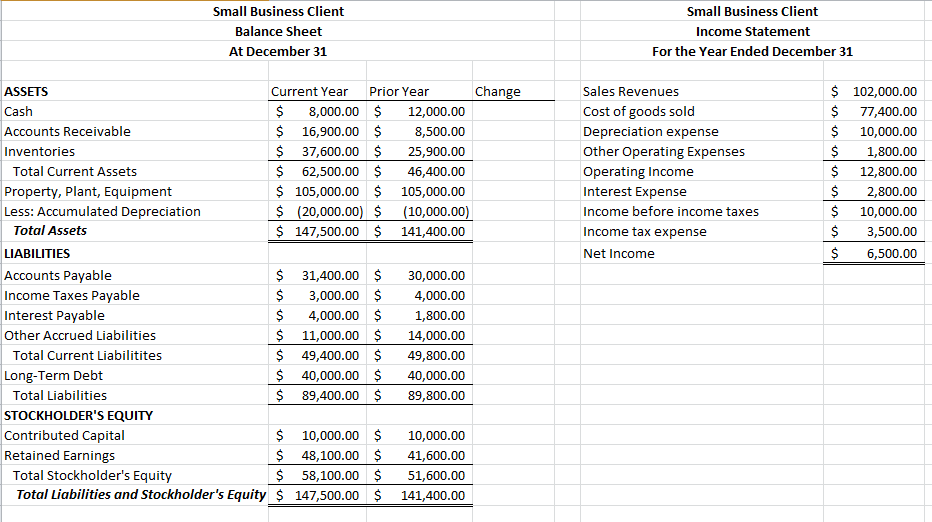

Youve recently been hired by B2B Consultants to provide financial advisory services to small business managers. B2Bs clients often need advice on how to improve their operating cash flows and, given your accounting background, youre frequently called upon to show them how operating cash flows would change if they were to speed up their sales of inventory and their collections of accounts receivable or delay their payment of accounts payable. Each time youre asked to show the effects of these business decisions on the cash flows from operating activities, you get the uneasy feeling that you might inadvertently miscalculate their effects. To deal with this once and for all, you e-mail your friend Owen and ask him to prepare a template that automatically calculates the net operating cash flows from a simple comparative balance sheet. You received his reply today.

Required:

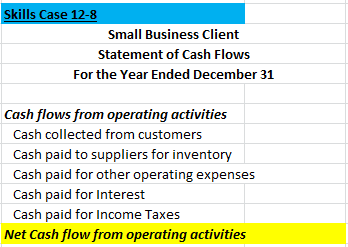

Using the direct method only, complete the following Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started