Answered step by step

Verified Expert Solution

Question

1 Approved Answer

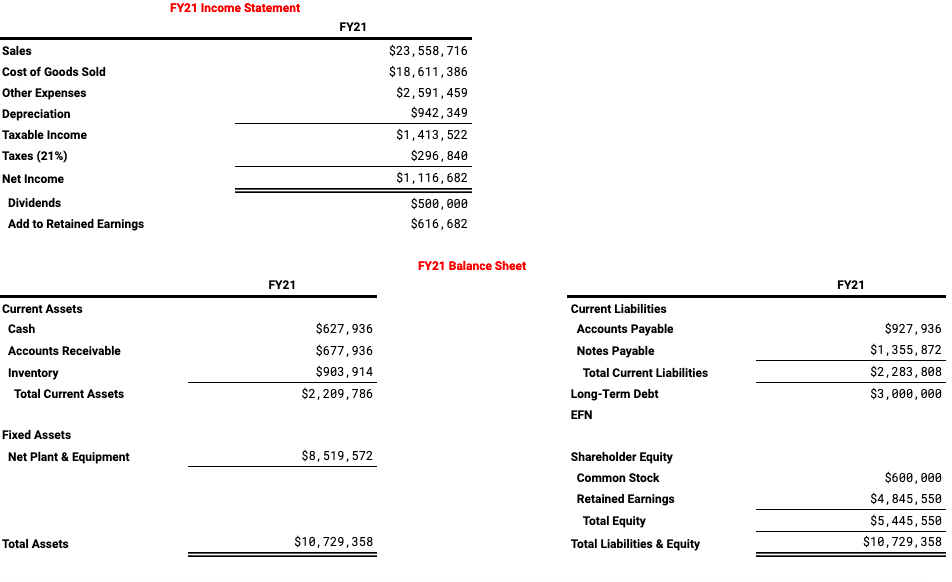

YoY growth rate of 13 % Plan currently operating at capacity Growth will require a new machine costing $3million Assume additional $300,000 of annual depreciation

YoY growth rate of 13 %

Plan currently operating at capacity

Growth will require a new machine costing $3million

Assume additional $300,000 of annual depreciation for this new machine(10%/Year)

What sort of growth are the company hoping to achieve next year?

What is next day companys retention ratio (a.k.a. plowback ratio)?

FY21 Income Statement FY21 Sales Cost of Goods Sold Other Expenses Depreciation Taxable income Taxes (21%) Net Income Dividends Add to Retained Earnings $23,558, 716 $18,611,386 $2,591, 459 $942, 349 $1,413, 522 $296,840 $1,116,682 $500,000 $616,682 FY21 Balance Sheet FY21 FY21 Current Assets Cash Accounts Receivable Inventory Total Current Assets $627,936 $677,936 $903,914 $2,209,786 Current Liabilities Accounts Payable Notes Payable Total Current Liabilities Long-Term Debt EFN $927,936 $1,355, 872 $2,283, 808 $3,000,000 Fixed Assets Net Plant & Equipment $8,519,572 Shareholder Equity Common Stock Retained Earnings Total Equity Total Liabilities & Equity $600,000 $4,845, 550 $5,445, 550 $10,729,358 Total Assets $10,729,358 FY21 Income Statement FY21 Sales Cost of Goods Sold Other Expenses Depreciation Taxable income Taxes (21%) Net Income Dividends Add to Retained Earnings $23,558, 716 $18,611,386 $2,591, 459 $942, 349 $1,413, 522 $296,840 $1,116,682 $500,000 $616,682 FY21 Balance Sheet FY21 FY21 Current Assets Cash Accounts Receivable Inventory Total Current Assets $627,936 $677,936 $903,914 $2,209,786 Current Liabilities Accounts Payable Notes Payable Total Current Liabilities Long-Term Debt EFN $927,936 $1,355, 872 $2,283, 808 $3,000,000 Fixed Assets Net Plant & Equipment $8,519,572 Shareholder Equity Common Stock Retained Earnings Total Equity Total Liabilities & Equity $600,000 $4,845, 550 $5,445, 550 $10,729,358 Total Assets $10,729,358

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started