Answered step by step

Verified Expert Solution

Question

1 Approved Answer

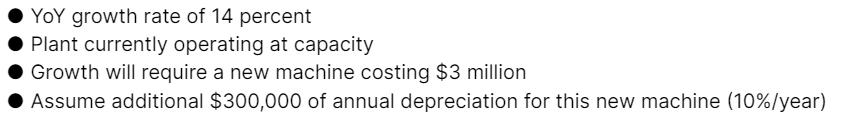

YoY growth rate of 14 percent Plant currently operating at capacity Growth will require a new machine costing $3 million Assume additional $300,000 of

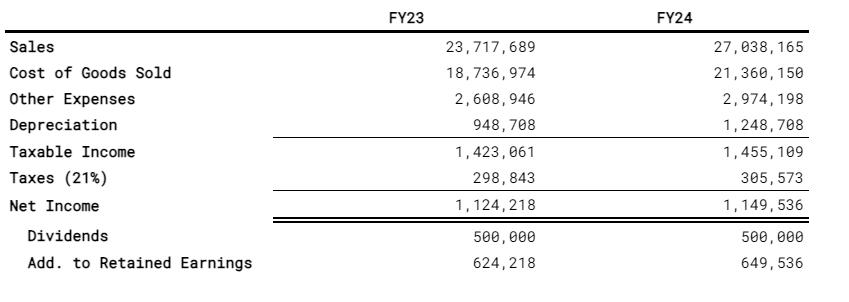

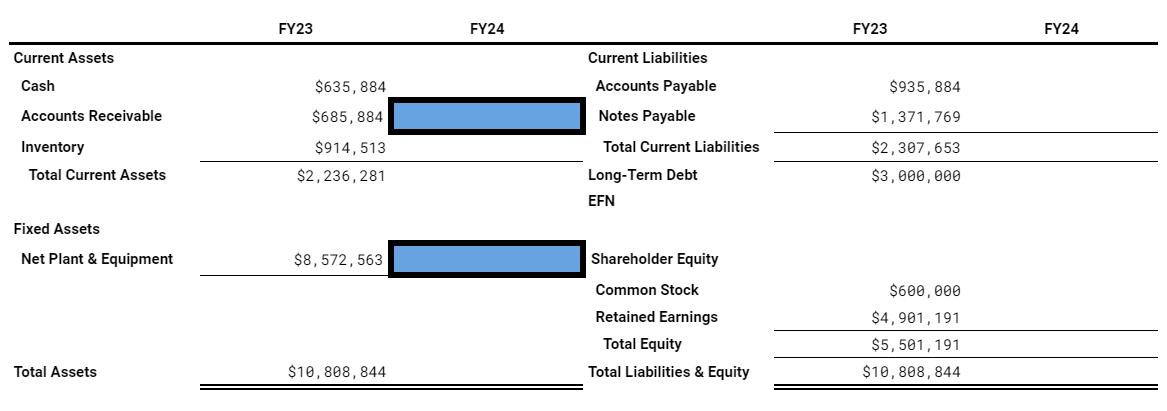

YoY growth rate of 14 percent Plant currently operating at capacity Growth will require a new machine costing $3 million Assume additional $300,000 of annual depreciation for this new machine (10%/year) Sales Cost of Goods Sold Other Expenses Depreciation Taxable Income Taxes (21%) FY23 23,717,689 18,736,974 2,608,946 948,708 1,423,061 298,843 Net Income 1,124,218 Dividends 500,000 Add. to Retained Earnings 624,218 FY24 27,038,165 21,360,150 2,974, 198 1,248,708 1,455,109 305,573 1,149,536 500,000 649,536 Current Assets Cash Accounts Receivable FY23 $635,884 $685,884 Inventory $914,513 Total Current Assets $2,236,281 Fixed Assets Net Plant & Equipment $8,572,563 FY24 Current Liabilities Accounts Payable FY23 $935,884 Notes Payable $1,371,769 Total Current Liabilities $2,307,653 Long-Term Debt $3,000,000 EFN Shareholder Equity Common Stock Retained Earnings Total Equity $600,000 $4,901,191 $5,501,191 Total Assets $10,808,844 Total Liabilities & Equity $10,808,844 FY24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started