Question: YTM= 8.57% RISK FREE RATE = 1.3% BETA = 3.13 Ch 14: Using the Risk Free rate from above, and assuming a 4 percent market

YTM= 8.57% RISK FREE RATE = 1.3% BETA = 3.13

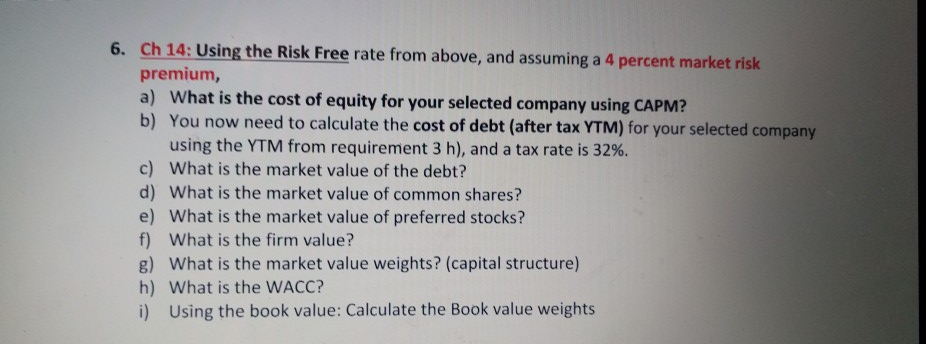

Ch 14: Using the Risk Free rate from above, and assuming a 4 percent market risk premium a) What is the cost of equity for your selected company using CAPM:? 6. b) You now need to calculate the cost of debt (after tax YTM) for your selected company using the YTM from requirement 3 h), and a tax rate is 32%. c) What is the market value of the debt? d) What is the market value of common shares? e) What is the market value of preferred stocks? f) What is the firm value? g) What is the market value weights? (capital structure) h) What is the WACC? i) Using the book value: Calculate the Book value weights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts