Answered step by step

Verified Expert Solution

Question

1 Approved Answer

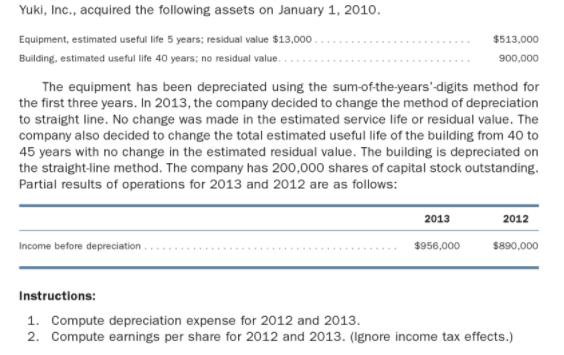

Yuki, Inc., acquired the following assets on January 1, 2010. Equipment, estimated usefui life 5 years; residual value $13,000.. $513,000 Building, estimated useful life

Yuki, Inc., acquired the following assets on January 1, 2010. Equipment, estimated usefui life 5 years; residual value $13,000.. $513,000 Building, estimated useful life 40 years; no residual value. 900,000 The equipment has been depreciated using the sum-of the-years'-digits method for the first three years. In 2013, the company decided to change the method of depreciation to straight line. No change was made in the estimated service life or residual value. The company also decided to change the total estimated useful life of the building from 40 to 45 years with no change in the estimated residual value. The building is depreciated on the straight-line method. The company has 200,000 shares of capital stock outstanding. Partial results of operations for 2013 and 2012 are as follows: 2013 2012 Income before depreciation.. $956,000 $890,000 Instructions: 1. Compute depreciation expense for 2012 and 2013. 2. Compute earnings per share for 2012 and 2013. (Ignore income tax effects.)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Yuki inc had purchased 2 assets on 01012010 We have given cost salvage valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started