Question

Yuki is a Japanese corporation, and Smith is a U.S., corporation. There are significant differences between Japanese and U.S. GAAP. These differences must be adjusted

Yuki is a Japanese corporation, and Smith is a U.S., corporation. There are significant differences between Japanese and U.S. GAAP. These differences must be adjusted in order to make a meaningful comparison between the two companies. Financial statements and detailed footnotes for Yuki are listed below. You are required to identify the major differences between Japanese and US GAAP and develop adjusting procedures.

Notes to Yuki's Financial Statements:

The balance sheet and income statement were prepared in accordance with the Japanese Commercial Code and related regulations.

Investments in subsidiaries and affiliated companies are stated at cost

Inventories are stated at average cost. Ending inventories restated to a LIFO basis would have been ¥25 million lower.

Plant and equipment are carried at cost. Depreciation, with minor exceptions, is computed by the sum-of-the-years-digits method. Plant and equipment, purchased 2 years ago, have an estimated life of 4 years.

Operating expenses include lease rental payments of ¥40 million. The average term of the lease contracts is 5 years. All leases transfer ownership to the lessor at the end of the lease term. Smith Enterprise’s cost of capital is estimated to be 8 percent.

A translation gain of ¥20 million relating to the consolidation of foreign operations with a net monetary liability position is being deferred under long-term debt.

Purchased goodwill, the premium paid in a merger or acquisition transaction, was ¥12 million for the year and is included under other operating expenses. Under U.S. generally accepted accounting principles (GAAP), it would have been capitalized and written off as impairment loss only if the asset is impaired.

Yuki Enterprise is allowed to set up special-purpose reserves (i.e., government-sanctioned charges against earnings) equal to a certain percentage of total export revenues. This year’s charge (including in other operating expenses) was ¥26,400,000. Similarly, this year’s addition to Yuki's general-purpose reserves was ¥30,800,000.

Deferred taxes are not provided in Japan for book-tax purposes.

The ¥/$ exchange rate at year-end was ¥140 = $1.

Yuki Enterprise’s marginal income tax rate is 35 percent.

Notes to Smith Corp financial statements:

The balance sheet and income statement are based on U.S. GAAP.

Inventories are carried at LIFO cost

Plant and equipment are depreciated in straight-line fashion.

Foreign operations are consolidated with those of the parent using the temporal method of currency translation as Smith adopts the U.S. dollar as its functional currency.

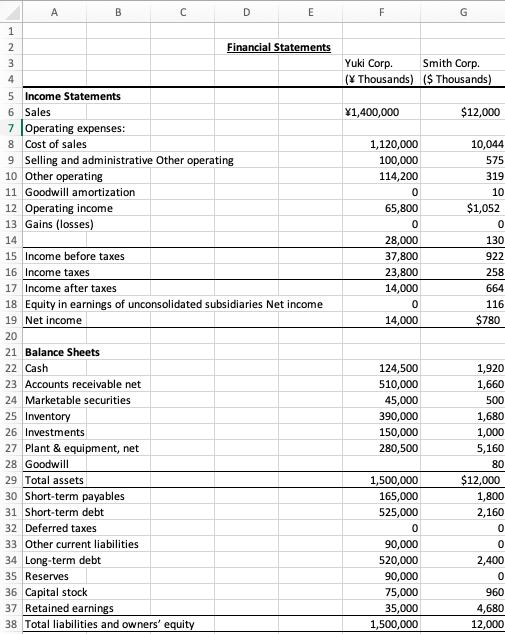

1 2 3 4 A 5 Income Statements 6 Sales 7 Operating expenses: 8 Cost of sales 12 Operating income 13 Gains (losses) B 9 Selling and administrative Other operating 10 Other operating 11 Goodwill amortization 14 15 Income before taxes. 20 21 Balance Sheets 22 Cash 23 Accounts receivable net 24 Marketable securities 25 Inventory 26 Investments 27 Plant & equipment, net 28 Goodwill 29 Total assets 30 Short-term payables 31 Short-term debt C 32 Deferred taxes 33 Other current liabilities 34 Long-term debt 35 Reserves 16 Income taxes 17 Income after taxes 18 Equity in earnings of unconsolidated subsidiaries Net income 19 Net income D 36 Capital stock 37 Retained earnings 38 Total liabilities and owners' equity E Financial Statements F Yuki Corp. (X Thousands) 1,400,000 1,120,000 100,000 114,200 0 65,800 0 28,000 37,800 23,800 14,000 0 14,000 124,500 510,000 45,000 390,000 150,000 280,500 1,500,000 165,000 525,000 0 90,000 520,000 90,000 75,000 35,000 1,500,000 Smith Corp. ($ Thousands) $12,000 10,044 575 319 10 $1,052 0 130 922 258 664 116 $780 1,920 1,660 500 1,680 1,000 5,160 80 $12,000 1,800 2,160 0 0 2,400 0 960 4,680 12,000

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

You are required to identify the major differences between Japanese and US GAAP and develop adjusting procedures 1 Japanese corporations are allowed to set up specialpurpose reserves which are governm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started