Answered step by step

Verified Expert Solution

Question

1 Approved Answer

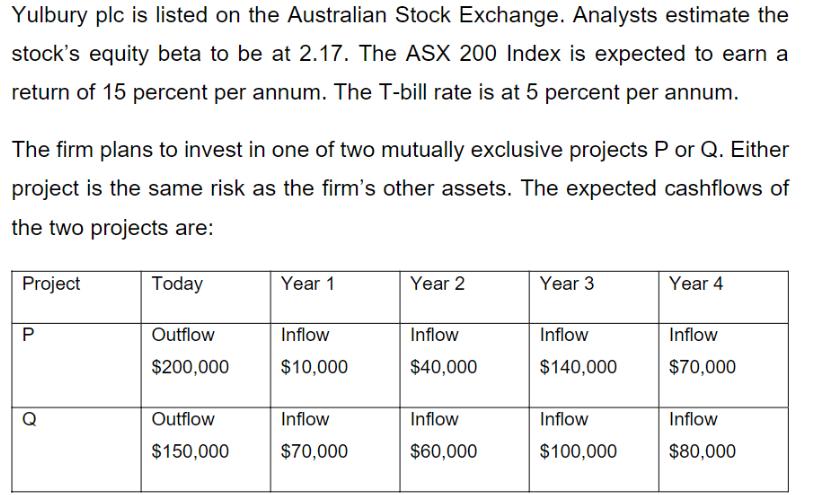

Yulbury plc is listed on the Australian Stock Exchange. Analysts estimate the stock's equity beta to be at 2.17. The ASX 200 Index is

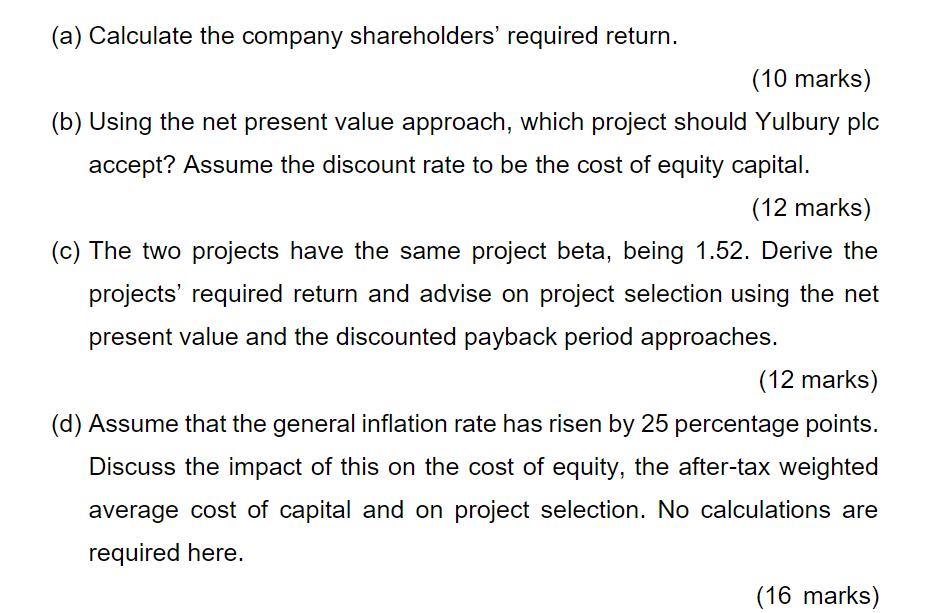

Yulbury plc is listed on the Australian Stock Exchange. Analysts estimate the stock's equity beta to be at 2.17. The ASX 200 Index is expected to earn a return of 15 percent per annum. The T-bill rate is at 5 percent per annum. The firm plans to invest in one of two mutually exclusive projects P or Q. Either project is the same risk as the firm's other assets. The expected cashflows of the two projects are: Project P O Today Outflow $200,000 Outflow $150,000 Year 1 Inflow $10,000 Inflow $70,000 Year 2 Inflow $40,000 Inflow $60,000 Year 3 Inflow $140,000 Inflow $100,000 Year 4 Inflow $70,000 Inflow $80,000

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Yulbury Plc a Cost of Equity The cost of equity is the return that a company must realize in exchange for a given investment or project or the return that an individual requires for an equity i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started