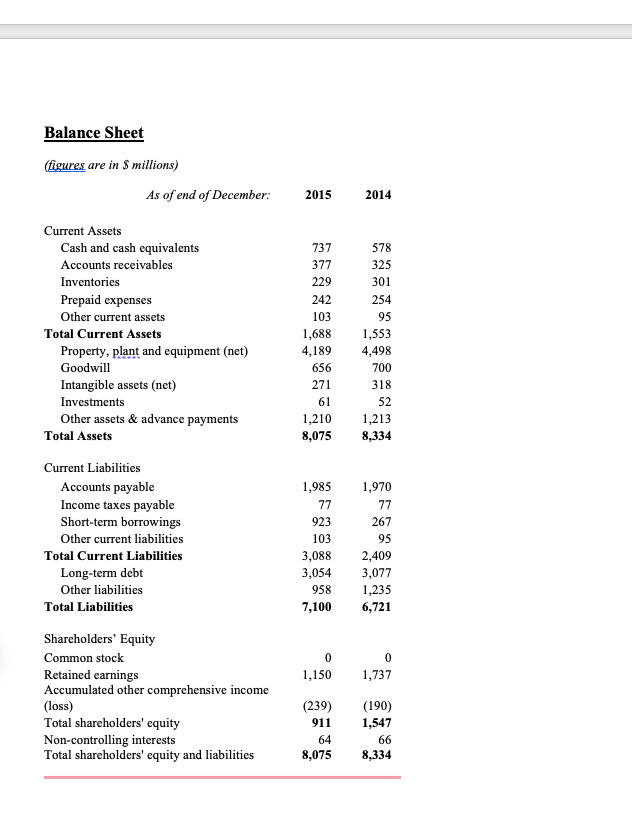

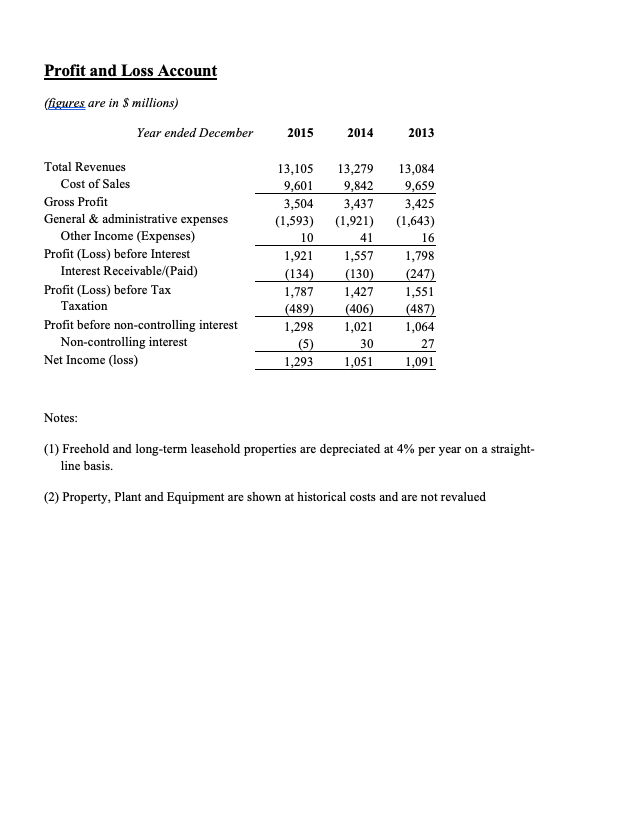

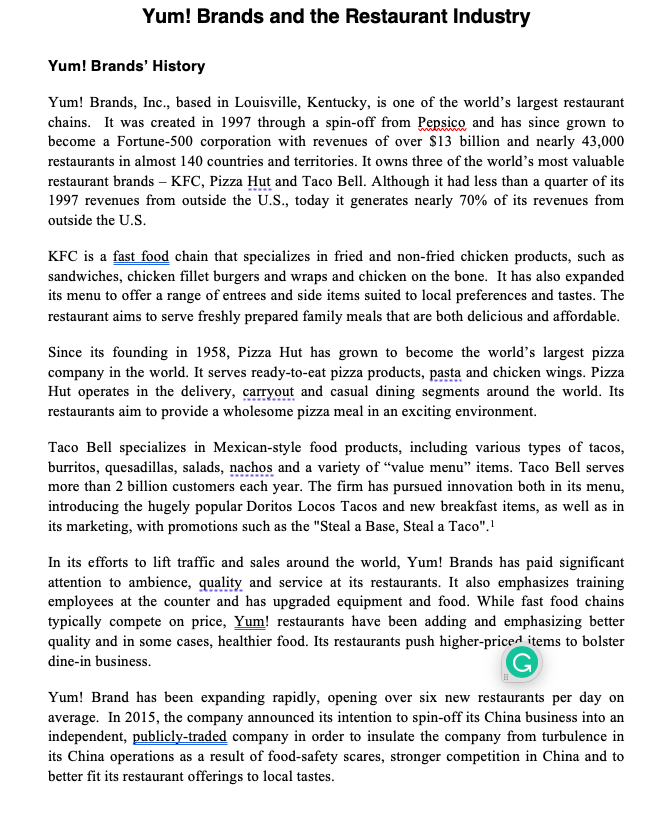

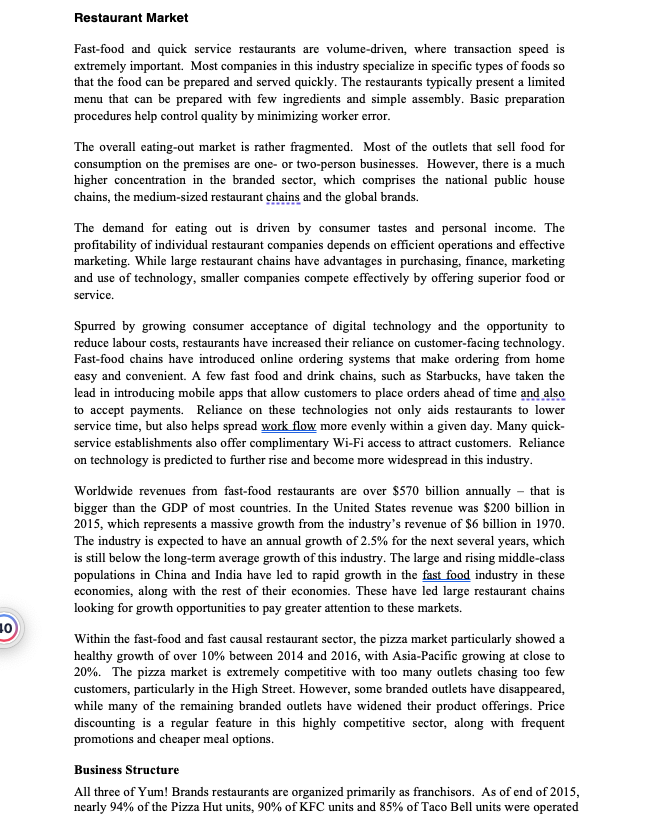

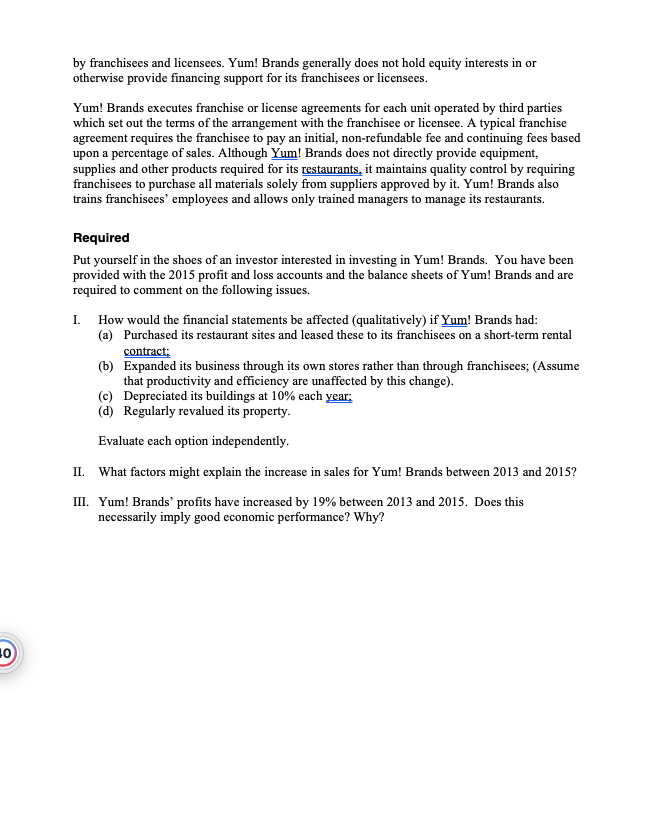

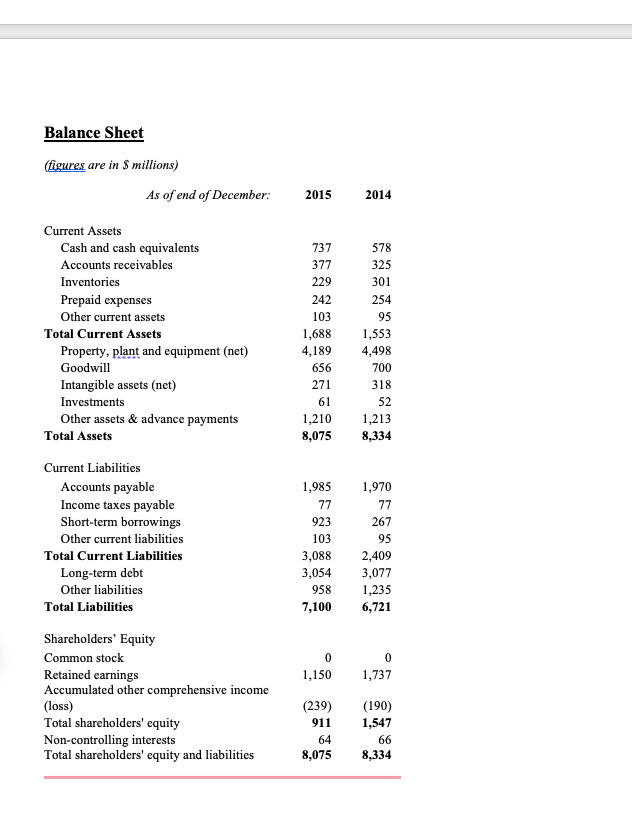

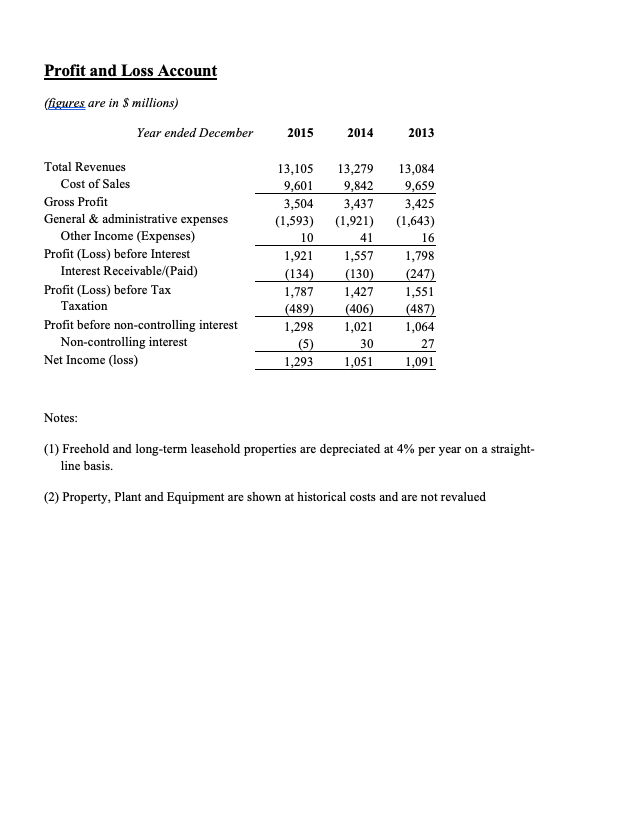

Yum! Brands and the Restaurant Industry Yum! Brands' History Yum! Brands, Inc., based in Louisville, Kentucky, is one of the world's largest restaurant chains. It was created in 1997 through a spin-off from Pepsico and has since grown to become a Fortune-500 corporation with revenues of over $13 billion and nearly 43,000 restaurants in almost 140 countries and territories. It owns three of the world's most valuable restaurant brands - KFC, Pizza Hut and Taco Bell. Although it had less than a quarter of its 1997 revenues from outside the U.S., today it generates nearly 70% of its revenues from outside the U.S. KFC is a fast food chain that specializes in fried and non-fried chicken products, such as sandwiches, chicken fillet burgers and wraps and chicken on the bone. It has also expanded its menu to offer a range of entrees and side items suited to local preferences and tastes. The restaurant aims to serve freshly prepared family meals that are both delicious and affordable. Since its founding in 1958, Pizza Hut has grown to become the world's largest pizza company in the world. It serves ready-to-eat pizza products, pasta and chicken wings. Pizza Hut operates in the delivery, carryout and casual dining segments around the world. Its restaurants aim to provide a wholesome pizza meal in an exciting environment. Taco Bell specializes in Mexican-style food products, including various types of tacos, burritos, quesadillas, salads, nachos and a variety of "value menu" items. Taco Bell serves more than 2 billion customers each year. The firm has pursued innovation both in its menu, introducing the hugely popular Doritos Locos Tacos and new breakfast items, as well as in its marketing, with promotions such as the "Steal a Base, Steal a Taco".1 In its efforts to lift traffic and sales around the world, Yum! Brands has paid significant attention to ambience, quality and service at its restaurants. It also emphasizes training employees at the counter and has upgraded equipment and food. While fast food chains typically compete on price, Yum! restaurants have been adding and emphasizing better quality and in some cases, healthier food. Its restaurants push higher-priced items to bolster dine-in business. Yum! Brand has been expanding rapidly, opening over six new restaurants per day on average. In 2015, the company announced its intention to spin-off its China business into an independent, publicly-traded company in order to insulate the company from turbulence in its China operations as a result of food-safety scares, stronger competition in China and to better fit its restaurant offerings to local tastes. Restaurant Market Fast-food and quick service restaurants are volume-driven, where transaction speed is extremely important. Most companies in this industry specialize in specific types of foods so that the food can be prepared and served quickly. The restaurants typically present a limited menu that can be prepared with few ingredients and simple assembly. Basic preparation procedures help control quality by minimizing worker error. The overall eating-out market is rather fragmented. Most of the outlets that sell food for consumption on the premises are one- or two-person businesses. However, there is a much higher concentration in the branded sector, which comprises the national public house chains, the medium-sized restaurant chains and the global brands. The demand for eating out is driven by consumer tastes and personal income. The profitability of individual restaurant companies depends on efficient operations and effective marketing. While large restaurant chains have advantages in purchasing, finance, marketing and use of technology, smaller companies compete effectively by offering superior food or service. Spurred by growing consumer acceptance of digital technology and the opportunity to reduce labour costs, restaurants have increased their reliance on customer-facing technology. Fast-food chains have introduced online ordering systems that make ordering from home easy and convenient. A few fast food and drink chains, such as Starbucks, have taken the lead in introducing mobile apps that allow customers to place orders ahead of time and also to accept payments. Reliance on these technologies not only aids restaurants to lower service time, but also helps spread work flow more evenly within a given day. Many quickservice establishments also offer complimentary Wi-Fi access to attract customers. Reliance on technology is predicted to further rise and become more widespread in this industry. Worldwide revenues from fast-food restaurants are over $570 billion annually - that is bigger than the GDP of most countries. In the United States revenue was $200 billion in 2015 , which represents a massive growth from the industry's revenue of $6 billion in 1970 . The industry is expected to have an annual growth of 2.5% for the next several years, which is still below the long-term average growth of this industry. The large and rising middle-class populations in China and India have led to rapid growth in the fast food industry in these economies, along with the rest of their economies. These have led large restaurant chains looking for growth opportunities to pay greater attention to these markets. Within the fast-food and fast causal restaurant sector, the pizza market particularly showed a healthy growth of over 10\% between 2014 and 2016, with Asia-Pacific growing at close to 20%. The pizza market is extremely competitive with too many outlets chasing too few customers, particularly in the High Street. However, some branded outlets have disappeared, while many of the remaining branded outlets have widened their product offerings. Price discounting is a regular feature in this highly competitive sector, along with frequent promotions and cheaper meal options. Business Structure All three of Yum! Brands restaurants are organized primarily as franchisors. As of end of 2015, nearly 94% of the Pizza Hut units, 90% of KFC units and 85% of Taco Bell units were operated by franchisees and licensees. Yum! Brands generally does not hold equity interests in or otherwise provide financing support for its franchisees or licensees. Yum! Brands executes franchise or license agreements for each unit operated by third parties which set out the terms of the arrangement with the franchisee or licensee. A typical franchise agreement requires the franchisee to pay an initial, non-refundable fee and continuing fees based upon a percentage of sales. Although Yum! Brands does not directly provide equipment, supplies and other products required for its restaurants, it maintains quality control by requiring franchisees to purchase all materials solely from suppliers approved by it. Yum! Brands also trains franchisees' employees and allows only trained managers to manage its restaurants. Required Put yourself in the shoes of an investor interested in investing in Yum! Brands. You have been provided with the 2015 profit and loss accounts and the balance sheets of Yum! Brands and are required to comment on the following issues. I. How would the financial statements be affected (qualitatively) if Yum! Brands had: (a) Purchased its restaurant sites and leased these to its franchisees on a short-term rental contract: (b) Expanded its business through its own stores rather than through franchisees; (Assume that productivity and efficiency are unaffected by this change). (c) Depreciated its buildings at 10% each year: (d) Regularly revalued its property. Evaluate each option independently. II. What factors might explain the increase in sales for Yum! Brands between 2013 and 2015 ? III. Yum! Brands' profits have increased by 19% between 2013 and 2015 . Does this necessarily imply good economic performance? Why? Balance Sheet (figures are in $ millions) Profit and Loss Account (figures are in \$millions) Notes: (1) Freehold and long-term leasehold properties are depreciated at 4% per year on a straightline basis. (2) Property, Plant and Equipment are shown at historical costs and are not revalued Yum! Brands and the Restaurant Industry Yum! Brands' History Yum! Brands, Inc., based in Louisville, Kentucky, is one of the world's largest restaurant chains. It was created in 1997 through a spin-off from Pepsico and has since grown to become a Fortune-500 corporation with revenues of over $13 billion and nearly 43,000 restaurants in almost 140 countries and territories. It owns three of the world's most valuable restaurant brands - KFC, Pizza Hut and Taco Bell. Although it had less than a quarter of its 1997 revenues from outside the U.S., today it generates nearly 70% of its revenues from outside the U.S. KFC is a fast food chain that specializes in fried and non-fried chicken products, such as sandwiches, chicken fillet burgers and wraps and chicken on the bone. It has also expanded its menu to offer a range of entrees and side items suited to local preferences and tastes. The restaurant aims to serve freshly prepared family meals that are both delicious and affordable. Since its founding in 1958, Pizza Hut has grown to become the world's largest pizza company in the world. It serves ready-to-eat pizza products, pasta and chicken wings. Pizza Hut operates in the delivery, carryout and casual dining segments around the world. Its restaurants aim to provide a wholesome pizza meal in an exciting environment. Taco Bell specializes in Mexican-style food products, including various types of tacos, burritos, quesadillas, salads, nachos and a variety of "value menu" items. Taco Bell serves more than 2 billion customers each year. The firm has pursued innovation both in its menu, introducing the hugely popular Doritos Locos Tacos and new breakfast items, as well as in its marketing, with promotions such as the "Steal a Base, Steal a Taco".1 In its efforts to lift traffic and sales around the world, Yum! Brands has paid significant attention to ambience, quality and service at its restaurants. It also emphasizes training employees at the counter and has upgraded equipment and food. While fast food chains typically compete on price, Yum! restaurants have been adding and emphasizing better quality and in some cases, healthier food. Its restaurants push higher-priced items to bolster dine-in business. Yum! Brand has been expanding rapidly, opening over six new restaurants per day on average. In 2015, the company announced its intention to spin-off its China business into an independent, publicly-traded company in order to insulate the company from turbulence in its China operations as a result of food-safety scares, stronger competition in China and to better fit its restaurant offerings to local tastes. Restaurant Market Fast-food and quick service restaurants are volume-driven, where transaction speed is extremely important. Most companies in this industry specialize in specific types of foods so that the food can be prepared and served quickly. The restaurants typically present a limited menu that can be prepared with few ingredients and simple assembly. Basic preparation procedures help control quality by minimizing worker error. The overall eating-out market is rather fragmented. Most of the outlets that sell food for consumption on the premises are one- or two-person businesses. However, there is a much higher concentration in the branded sector, which comprises the national public house chains, the medium-sized restaurant chains and the global brands. The demand for eating out is driven by consumer tastes and personal income. The profitability of individual restaurant companies depends on efficient operations and effective marketing. While large restaurant chains have advantages in purchasing, finance, marketing and use of technology, smaller companies compete effectively by offering superior food or service. Spurred by growing consumer acceptance of digital technology and the opportunity to reduce labour costs, restaurants have increased their reliance on customer-facing technology. Fast-food chains have introduced online ordering systems that make ordering from home easy and convenient. A few fast food and drink chains, such as Starbucks, have taken the lead in introducing mobile apps that allow customers to place orders ahead of time and also to accept payments. Reliance on these technologies not only aids restaurants to lower service time, but also helps spread work flow more evenly within a given day. Many quickservice establishments also offer complimentary Wi-Fi access to attract customers. Reliance on technology is predicted to further rise and become more widespread in this industry. Worldwide revenues from fast-food restaurants are over $570 billion annually - that is bigger than the GDP of most countries. In the United States revenue was $200 billion in 2015 , which represents a massive growth from the industry's revenue of $6 billion in 1970 . The industry is expected to have an annual growth of 2.5% for the next several years, which is still below the long-term average growth of this industry. The large and rising middle-class populations in China and India have led to rapid growth in the fast food industry in these economies, along with the rest of their economies. These have led large restaurant chains looking for growth opportunities to pay greater attention to these markets. Within the fast-food and fast causal restaurant sector, the pizza market particularly showed a healthy growth of over 10\% between 2014 and 2016, with Asia-Pacific growing at close to 20%. The pizza market is extremely competitive with too many outlets chasing too few customers, particularly in the High Street. However, some branded outlets have disappeared, while many of the remaining branded outlets have widened their product offerings. Price discounting is a regular feature in this highly competitive sector, along with frequent promotions and cheaper meal options. Business Structure All three of Yum! Brands restaurants are organized primarily as franchisors. As of end of 2015, nearly 94% of the Pizza Hut units, 90% of KFC units and 85% of Taco Bell units were operated by franchisees and licensees. Yum! Brands generally does not hold equity interests in or otherwise provide financing support for its franchisees or licensees. Yum! Brands executes franchise or license agreements for each unit operated by third parties which set out the terms of the arrangement with the franchisee or licensee. A typical franchise agreement requires the franchisee to pay an initial, non-refundable fee and continuing fees based upon a percentage of sales. Although Yum! Brands does not directly provide equipment, supplies and other products required for its restaurants, it maintains quality control by requiring franchisees to purchase all materials solely from suppliers approved by it. Yum! Brands also trains franchisees' employees and allows only trained managers to manage its restaurants. Required Put yourself in the shoes of an investor interested in investing in Yum! Brands. You have been provided with the 2015 profit and loss accounts and the balance sheets of Yum! Brands and are required to comment on the following issues. I. How would the financial statements be affected (qualitatively) if Yum! Brands had: (a) Purchased its restaurant sites and leased these to its franchisees on a short-term rental contract: (b) Expanded its business through its own stores rather than through franchisees; (Assume that productivity and efficiency are unaffected by this change). (c) Depreciated its buildings at 10% each year: (d) Regularly revalued its property. Evaluate each option independently. II. What factors might explain the increase in sales for Yum! Brands between 2013 and 2015 ? III. Yum! Brands' profits have increased by 19% between 2013 and 2015 . Does this necessarily imply good economic performance? Why? Balance Sheet (figures are in $ millions) Profit and Loss Account (figures are in \$millions) Notes: (1) Freehold and long-term leasehold properties are depreciated at 4% per year on a straightline basis. (2) Property, Plant and Equipment are shown at historical costs and are not revalued