Answered step by step

Verified Expert Solution

Question

1 Approved Answer

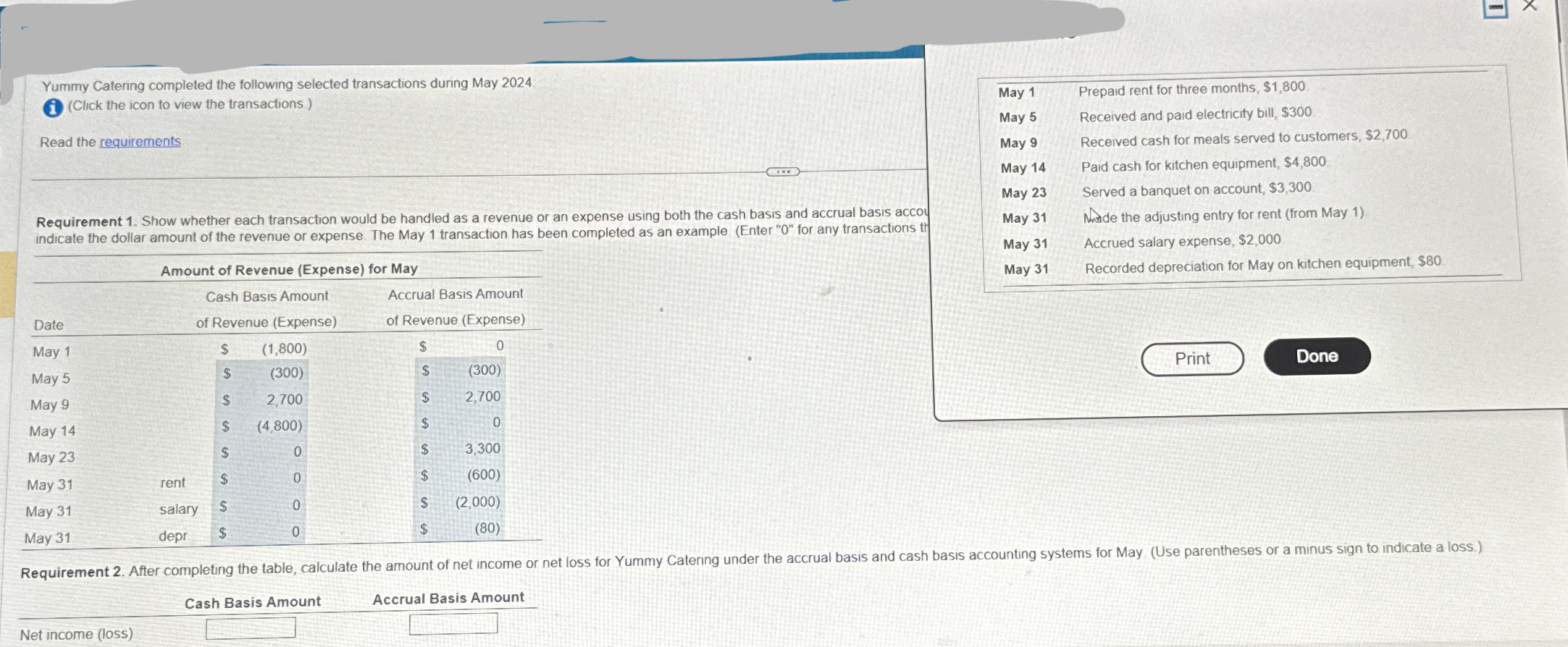

Yummy Catering completed the following selected transactions during May 2024 (Click the icon to view the transactions.) Read the requirements May 1 Prepaid rent

Yummy Catering completed the following selected transactions during May 2024 (Click the icon to view the transactions.) Read the requirements May 1 Prepaid rent for three months, $1,800 May 5 Received and paid electricity bill, $300 May 9 Received cash for meals served to customers, $2,700 May 14 Paid cash for kitchen equipment, $4,800 Requirement 1. Show whether each transaction would be handled as a revenue or an expense using both the cash basis and accrual basis accou indicate the dollar amount of the revenue or expense. The May 1 transaction has been completed as an example (Enter "0" for any transactions th May 23 Served a banquet on account, $3,300 May 31 Made the adjusting entry for rent (from May 1). Amount of Revenue (Expense) for May May 31 Accrued salary expense, $2,000 May 31 Recorded depreciation for May on kitchen equipment, $80. Cash Basis Amount Accrual Basis Amount Date of Revenue (Expense) of Revenue (Expense) May 1 $ (1,800) $ 0 May 5 $ (300) $ (300) May 9 $ 2,700 $ 2,700 May 14 $ (4,800) $ 0 May 23 $ 0 $ 3,300 May 31 rent $ 0 $ (600) May 31 salary $ 0 $ May 31 depr $ 0 $ (2,000) (80) Print Done Requirement 2. After completing the table, calculate the amount of net income or net loss for Yummy Catering under the accrual basis and cash basis accounting systems for May (Use parentheses or a minus sign to indicate a loss.) Cash Basis Amount Accrual Basis Amount Net income (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether each transaction would be treated as revenue or expense and calculate the dollar amount under both cash and accrual bases lets go ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started