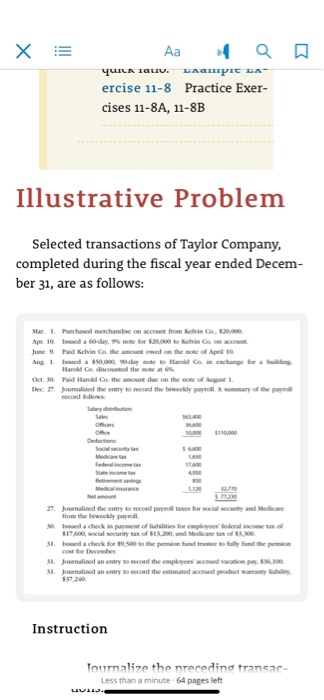

!!! Yun tauu. LAGI DA- ercise 11-8 Practice Exer- cises 11-8A, 11-8B Illustrative Problem Selected transactions of Taylor Company, completed during the fiscal year ended Decem- ber 31, are as follows: Mar Purchased merchandise on account from Kevin Co. $20,000 Apt. 10 Issued a 60-day 9 note for $20,000 to Khin a con June Paid Kelvin Co the amount owed on the more of Apeil 10 Aug, 1. da 50.000 day sote Hardca in change for a Harold Co. discounted the seat Oct 30. Paid Harold Co the amount due on the note of August Dec 29. Jumalized the entry to record the weekly payroll. A summary of the $110.000 Deduction www 2. Journalised the entry to record you for social security and Medicare from the biweekly payroll 3 wed a check in payment of liabilities for employees federal income tus $17.600, social security tax of $13.200, and Medicare of $3.30 31. ued a check for $9.500 to the pension fund trust to fully fund te permice cost for December 31. Journalized an entry to record the employees accrued vacation pes 53.100 31. Journalined an entry to record the estimated accrued product way Instruction Tournalize the preceding transac- Less than a minute 64 pages left LUIS. !!! Yun tauu. LAGI DA- ercise 11-8 Practice Exer- cises 11-8A, 11-8B Illustrative Problem Selected transactions of Taylor Company, completed during the fiscal year ended Decem- ber 31, are as follows: Mar Purchased merchandise on account from Kevin Co. $20,000 Apt. 10 Issued a 60-day 9 note for $20,000 to Khin a con June Paid Kelvin Co the amount owed on the more of Apeil 10 Aug, 1. da 50.000 day sote Hardca in change for a Harold Co. discounted the seat Oct 30. Paid Harold Co the amount due on the note of August Dec 29. Jumalized the entry to record the weekly payroll. A summary of the $110.000 Deduction www 2. Journalised the entry to record you for social security and Medicare from the biweekly payroll 3 wed a check in payment of liabilities for employees federal income tus $17.600, social security tax of $13.200, and Medicare of $3.30 31. ued a check for $9.500 to the pension fund trust to fully fund te permice cost for December 31. Journalized an entry to record the employees accrued vacation pes 53.100 31. Journalined an entry to record the estimated accrued product way Instruction Tournalize the preceding transac- Less than a minute 64 pages left LUIS