Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Z, Inc. has no debt right now. You project that this company can generate EBIT of 10 million per year for the next few

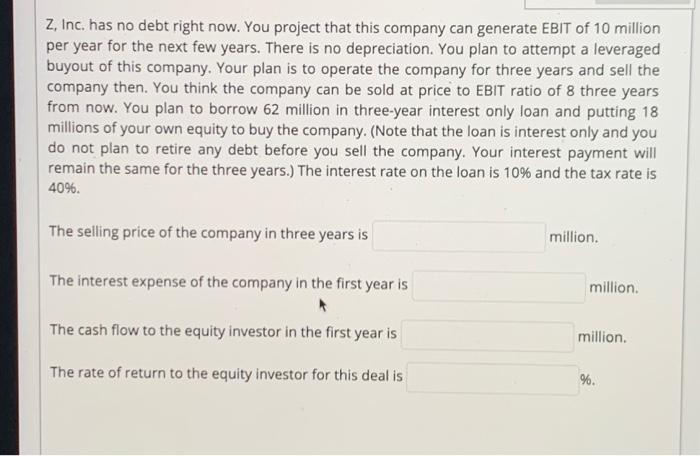

Z, Inc. has no debt right now. You project that this company can generate EBIT of 10 million per year for the next few years. There is no depreciation. You plan to attempt a leveraged buyout of this company. Your plan is to operate the company for three years and sell the company then. You think the company can be sold at price to EBIT ratio of 8 three years from now. You plan to borrow 62 million in three-year interest only loan and putting 18 millions of your own equity to buy the company. (Note that the loan is interest only and you do not plan to retire any debt before you sell the company. Your interest payment will remain the same for the three years.) The interest rate on the loan is 10% and the tax rate is 40%. The selling price of the company in three years is The interest expense of the company in the first year is The cash flow to the equity investor in the first year is The rate of return to the equity investor for this deal is million. million. million. %.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER a Selling Price Selling Price 108 80 millions b Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started