Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Z Pane 1. If the interest rate is 4%, what are the proceeds of a $5,000 investment after 10 years? a) assuming simple interest

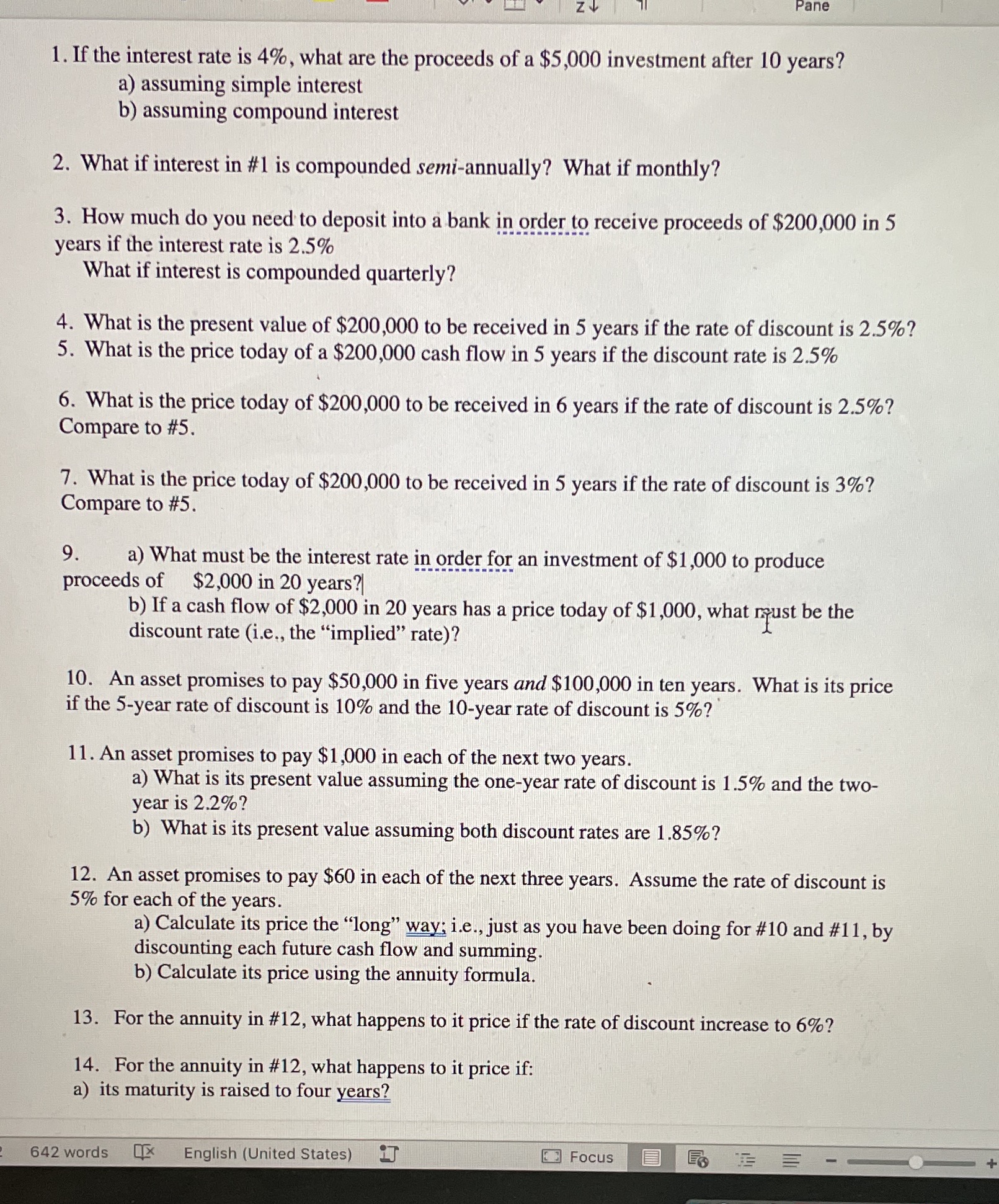

Z Pane 1. If the interest rate is 4%, what are the proceeds of a $5,000 investment after 10 years? a) assuming simple interest b) assuming compound interest 2. What if interest in #1 is compounded semi-annually? What if monthly? 3. How much do you need to deposit into a bank in order to receive proceeds of $200,000 in 5 years if the interest rate is 2.5% What if interest is compounded quarterly? 4. What is the present value of $200,000 to be received in 5 years if the rate of discount is 2.5%? 5. What is the price today of a $200,000 cash flow in 5 years if the discount rate is 2.5% 6. What is the price today of $200,000 to be received in 6 years if the rate of discount is 2.5%? Compare to #5. 7. What is the price today of $200,000 to be received in 5 years if the rate of discount is 3%? Compare to #5. 9. a) What must be the interest rate in order for an investment of $1,000 to produce proceeds of $2,000 in 20 years? b) If a cash flow of $2,000 in 20 years has a price today of $1,000, what discount rate (i.e., the "implied" rate)? must be the 10. An asset promises to pay $50,000 in five years and $100,000 in ten years. What is its price if the 5-year rate of discount is 10% and the 10-year rate of discount is 5%? 11. An asset promises to pay $1,000 in each of the next two years. a) What is its present value assuming the one-year rate of discount is 1.5% and the two- year is 2.2%? b) What is its present value assuming both discount rates are 1.85%? 12. An asset promises to pay $60 in each of the next three years. Assume the rate of discount is 5% for each of the years. a) Calculate its price the "long" way; i.e., just as you have been doing for #10 and #11, by discounting each future cash flow and summing. b) Calculate its price using the annuity formula. 13. For the annuity in #12, what happens to it price if the rate of discount increase to 6%? 14. For the annuity in #12, what happens to it price if: a) its maturity is raised to four years? 2 642 words English (United States) J Focus +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 a For simple interest the formula to calculate the proceeds A of an investment after a certain period of time t is given by A P1 rt where P is the principal amount r is the interest rate and t is th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started