Question

Z Wholesale Company began the year with merchandise inventory of $7,000. During the year, Z purchased $92,000 of goods and returned $6,200 due to

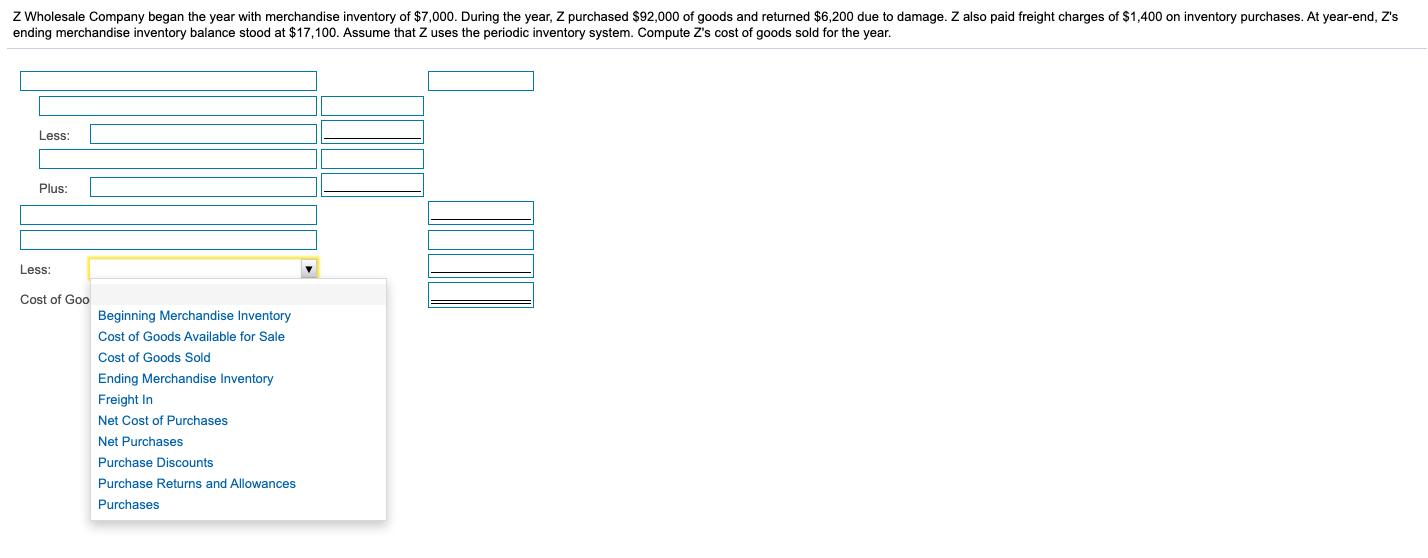

Z Wholesale Company began the year with merchandise inventory of $7,000. During the year, Z purchased $92,000 of goods and returned $6,200 due to damage. Z also paid freight charges of $1,400 on inventory purchases. At year-end, Z's ending merchandise inventory balance stood at $17,100. Assume that Z uses the periodic inventory system. Compute Z's cost of goods sold for the year. Less: Plus: Less: Cost of Goo Beginning Merchandise Inventory Cost of Goods Available for Sale Cost of Goods Sold Ending Merchandise Inventory Freight In Net Cost of Purchases Net Purchases Purchase Discounts Purchase Returns and Allowances Purchases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate cost of goods sold Beginning merchandise invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App