Question

Zachary L. (SSN 123-45-6789) and Cici K. Mao (SSN 987-65-4321) reside at 520 Chestnut Street, Philadelphia, Pennsylvania 19106. They are both under 65 years

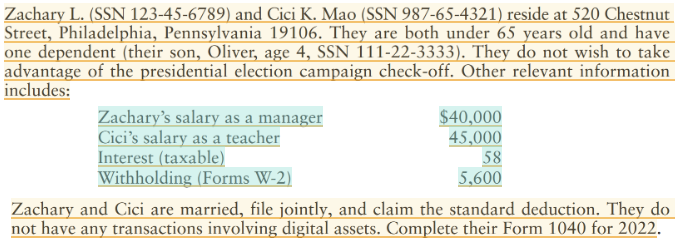

Zachary L. (SSN 123-45-6789) and Cici K. Mao (SSN 987-65-4321) reside at 520 Chestnut Street, Philadelphia, Pennsylvania 19106. They are both under 65 years old and have one dependent (their son, Oliver, age 4, SSN 111-22-3333). They do not wish to take advantage of the presidential election campaign check-off. Other relevant information includes: Zachary's salary as a manager Cici's salary as a teacher Interest (taxable) Withholding (Forms W-2) $40,000 45,000 58 5,600 Zachary and Cici are married, file jointly, and claim the standard deduction. They do not have any transactions involving digital assets. Complete their Form 1040 for 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Pearsons Federal Taxation 2024 Individuals

Authors: Mitchell Franklin, Luke E. Richardson

37th Edition

0138238100, 9780138238100

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App