Question

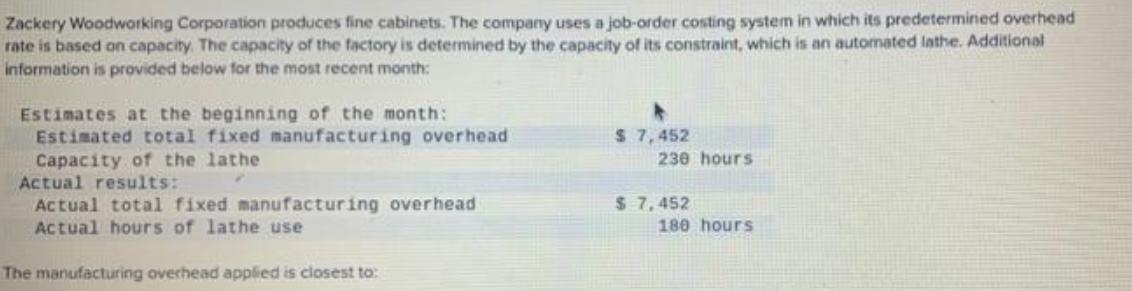

Zackery Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The

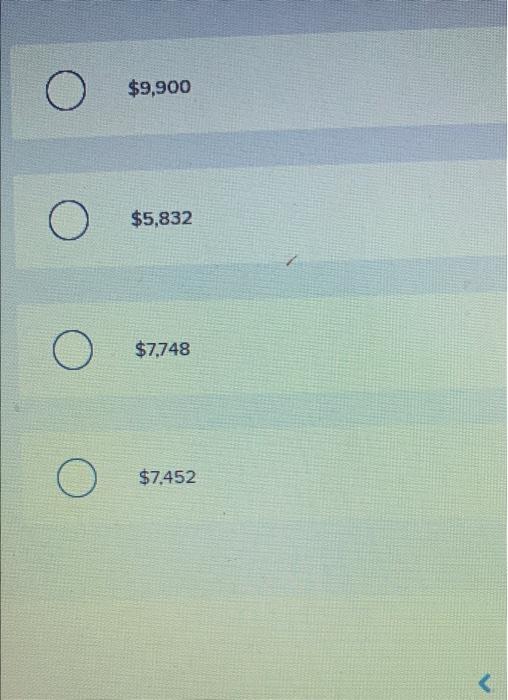

Zackery Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated lathe. Additional information is provided below for the most recent month: Estimates at the beginning of the month: $ 7,452 Estimated total fixed manufacturing overhead Capacity of the lathe 230 hours Actual results: $ 7,452 Actual total fixed manufacturing overhead Actual hours of lathe use 180 hours The manufacturing overhead applied is closest to: O O O O $9,900 $5,832 $7,748 $7,452

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of applied manufacturing overhead The formula for applied man...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting for Managers

Authors: Eric Noreen, Peter Brewer, Ray Garrison

2nd edition

978-0077403485, 77403487, 73527130, 978-0073527130

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App