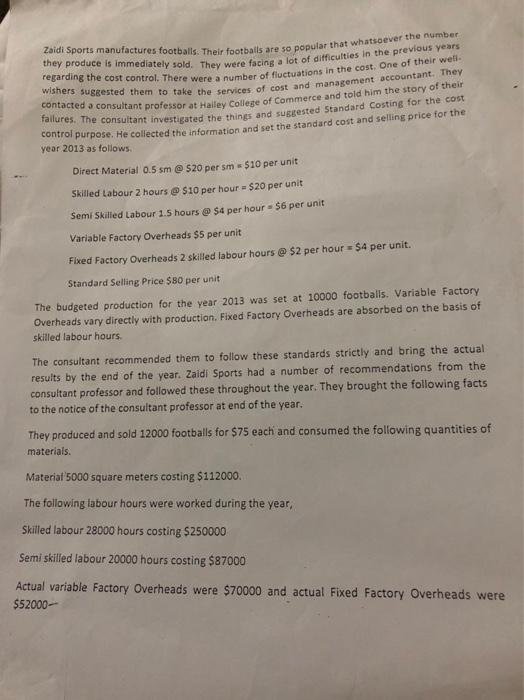

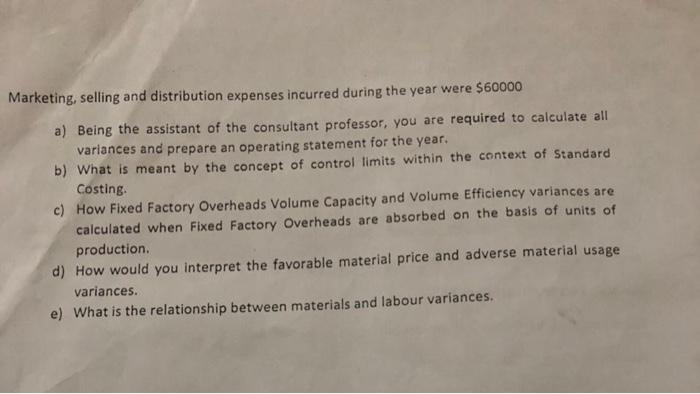

Zaidi Sports manufactures footballs. Their footballs are so popular that whatsoever the number regarding the cost control. There were a number of fluctuations in the cost. One of their wef. they produce is immediately sold. They were facing a lot of difficulties in the previous years wishers contacted a consultant professor at Halley College of Commerce and told him the story of their fallures. The consultant investigated the things and suggested Standard Costing for the cost control purpose. He collected the information and set the standard cost and selling price for the year 2013 as follows Direct Material 0.5 sm @ $20 per sm = $10 per unit Skilled Labour 2 hours $10 per hour = $20 per unit Semi Skilled Labour 1.5 hours @ $4 per hour - 56 per unit Variable Factory Overheads $5 per unit Fixed Factory Overheads 2 skilled labour hours @ $2 per hour $4 per unit. Standard Selling Price $80 per unit The budgeted production for the year 2013 was set at 10000 footballs. Variable Factory Overheads vary directly with production. Fixed Factory Overheads are absorbed on the basis of skilled labour hours The consultant recommended them to follow these standards strictly and bring the actual results by the end of the year. Zaidi Sports had a number of recommendations from the consultant professor and followed these throughout the year. They brought the following facts to the notice of the consultant professor at end of the year. They produced and sold 12000 footballs for $75 each and consumed the following quantities of materials. Materiat 5000 square meters costing $112000 The following labour hours were worked during the year, Skilled labour 28000 hours costing $250000 Semi skilled labour 20000 hours costing $87000 Actual variable Factory Overheads were $70000 and actual Fixed Factory Overheads were $52000- Marketing, selling and distribution expenses incurred during the year were $60000 a) Being the assistant of the consultant professor, you are required to calculate all variances and prepare an operating statement for the year. b) What is meant by the concept of control limits within the context of Standard Costing c) How Fixed Factory Overheads Volume Capacity and Volume Efficiency variances are calculated when Fixed Factory Overheads are absorbed on the basis of units of production d) How would you interpret the favorable material price and adverse material usage variances. e) What is the relationship between materials and labour variances