Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zakrie and Emely have been married for 20 years and have 4 children, aged 6 10 18 years old. One of their daughter is

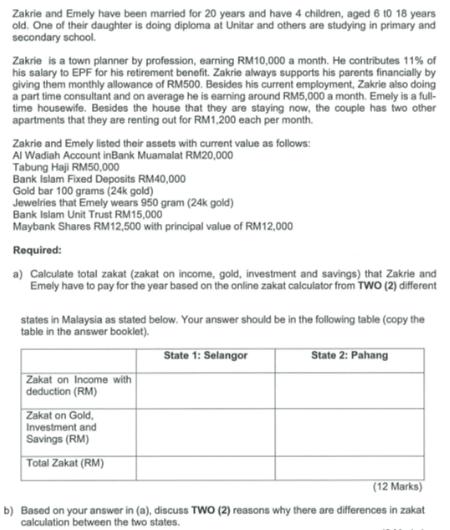

Zakrie and Emely have been married for 20 years and have 4 children, aged 6 10 18 years old. One of their daughter is doing diploma at Unitar and others are studying in primary and secondary school. Zakrie is a town planner by profession, earning RM10,000 a month. He contributes 11% of his salary to EPF for his retirement benefit. Zakrie always supports his parents financially by giving them monthly allowance of RM500. Besides his current employment, Zakrie also doing a part time consultant and on average he is earning around RM5,000 a month. Emely is a full- time housewife. Besides the house that they are staying now, the couple has two other apartments that they are renting out for RM1,200 each per month. Zakrie and Emely listed their assets with current value as follows: Al Wadiah Account inBank Muamalat RM20,000 Tabung Haji RM50,000 Bank Islam Fixed Deposits RM40,000 Gold bar 100 grams (24k gold) Jewelries that Emely wears 950 gram (24k gold) Bank Islam Unit Trust RM15,000 Maybank Shares RM12,500 with principal value of RM12,000 Required: a) Calculate total zakat (zakat on income, gold, investment and savings) that Zakrie and Emely have to pay for the year based on the online zakat calculator from TWO (2) different states in Malaysia as stated below. Your answer should be in the following table (copy the table in the answer booklet). Zakat on Income with deduction (RM) Zakat on Gold, Investment and Savings (RM) State 1: Selangor State 2: Pahang Total Zakat (RM) (12 Marks) b) Based on your answer in (a), discuss TWO (2) reasons why there are differences in zakat calculation between the two states.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started