Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ZAOU Limited has nominal capital of K150 000 divided into 100 000 6% Preference shares of K1 each and 50000 ordinary shares of K1 each,

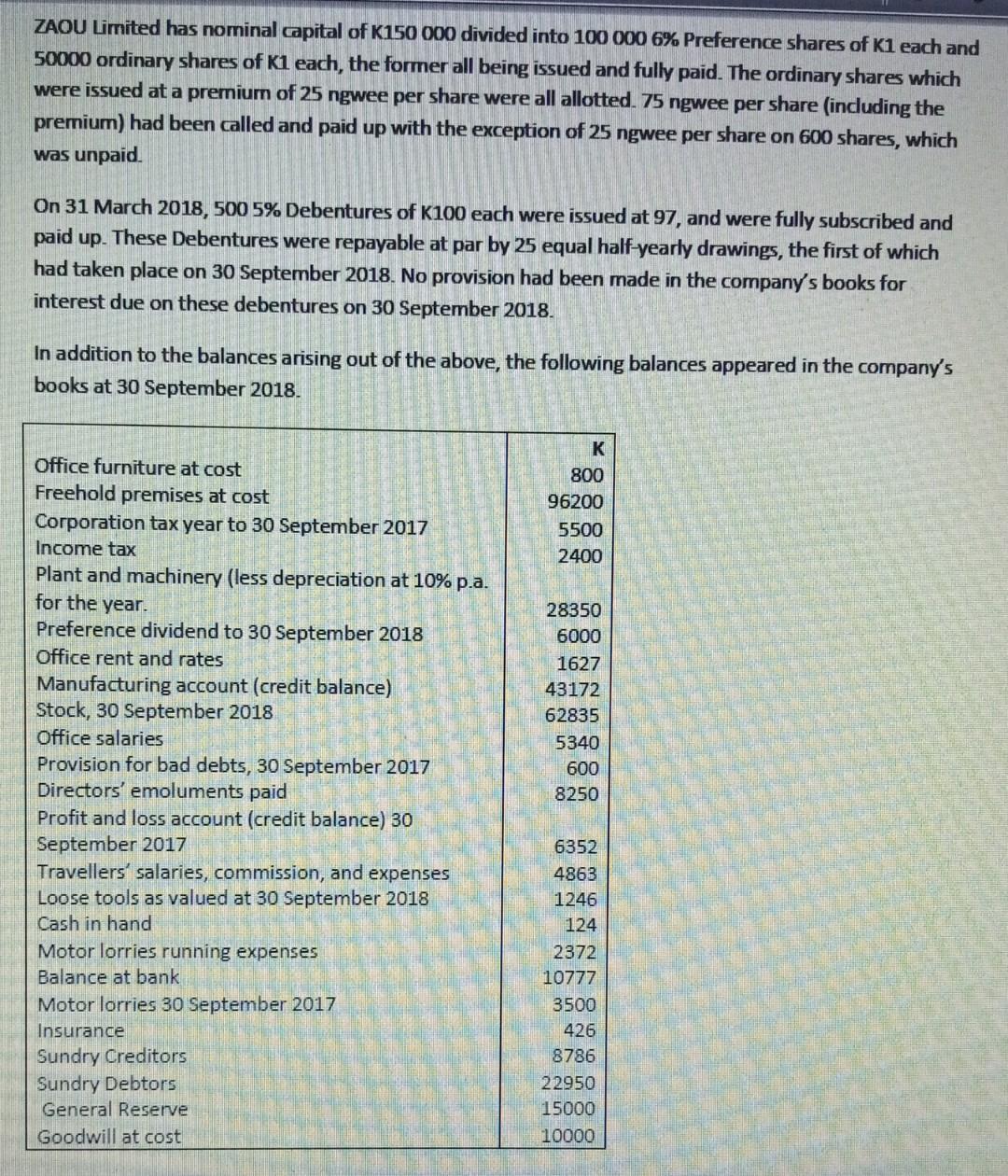

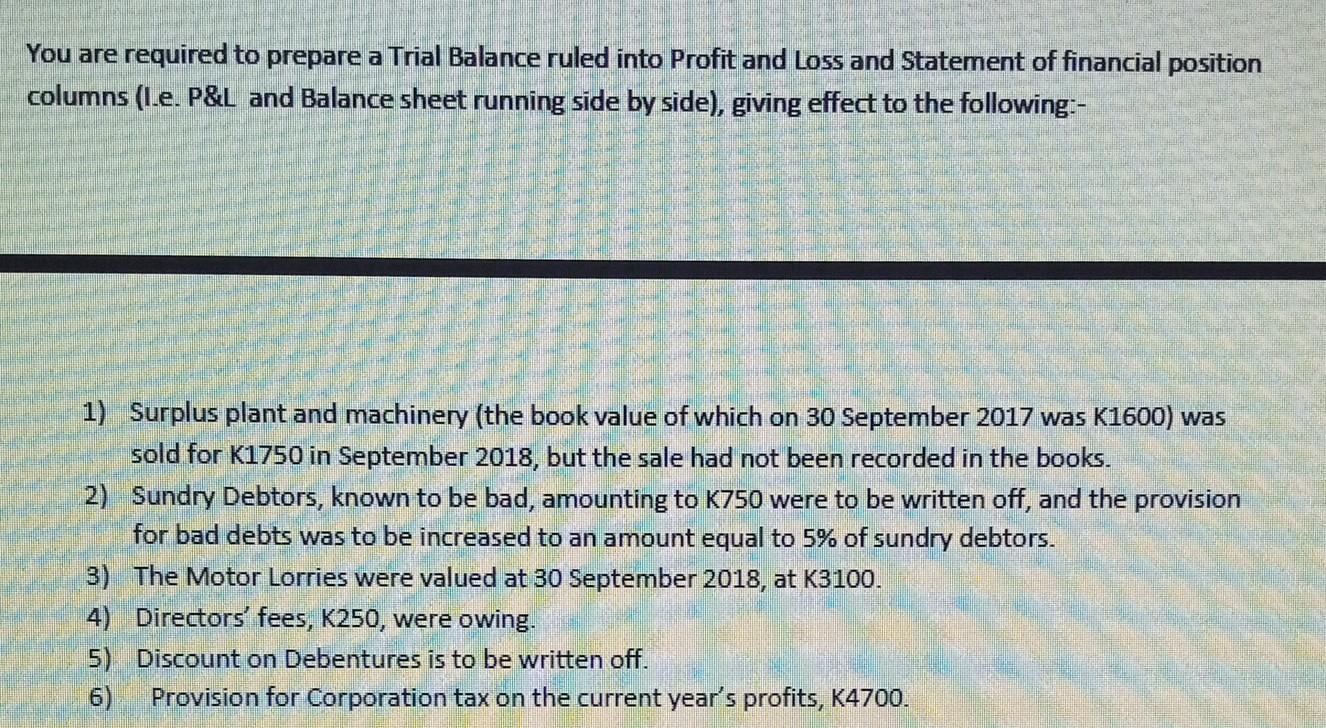

ZAOU Limited has nominal capital of K150 000 divided into 100 000 6% Preference shares of K1 each and 50000 ordinary shares of K1 each, the former all being issued and fully paid. The ordinary shares which were issued at a premium of 25 ngwee per share were all allotted. 75 ngwee per share (including the premium) had been called and paid up with the exception of 25 ngwee per share on 600 shares, which was unpaid. On 31 March 2018,500 5% Debentures of K100 each were issued at 97, and were fully subscribed and paid up. These Debentures were repayable at par by 25 equal half-yearly drawings, the first of which had taken place on 30 September 2018. No provision had been made in the company's books for interest due on these debentures on 30 September 2018. In addition to the balances arising out of the above, the following balances appeared in the company's books at 30 September 2018. K 800 96200 5500 2400 Office furniture at cost Freehold premises at cost Corporation tax year to 30 September 2017 Income tax Plant and machinery (less depreciation at 10% p.a. for the year. Preference dividend to 30 September 2018 Office rent and rates Manufacturing account (credit balance) Stock, 30 September 2018 Office salaries Provision for bad debts, 30 September 2017 Directors' emoluments paid Profit and loss account (credit balance) 30 September 2017 Travellers' salaries, commission, and expenses Loose tools as valued at 30 September 2018 Cash in hand Motor lorries running expenses Balance at bank Motor lorries 30 September 2017 Insurance Sundry Creditors Sundry Debtors General Reserve Goodwill at cost 28350 6000 1627 43172 62835 5340 600 8250 6352 4863 1246 124 2372 10777 3500 426 8786 22950 15000 10000 You are required to prepare a Trial Balance ruled into Profit and Loss and Statement of financial position columns (I.e. P&L and Balance sheet running side by side), giving effect to the following:- 1) Surplus plant and machinery (the book value of which on 30 September 2017 was K1600) was sold for K1750 in September 2018, but the sale had not been recorded in the books. 2) Sundry Debtors, known to be bad, amounting to K750 were to be written off, and the provision for bad debts was to be increased to an amount equal to 5% of sundry debtors. 3) The Motor Lorries were valued at 30 September 2018, at K3100. 4) Directors' fees, K250, were owing. 5) Discount on Debentures is to be written off. 6) Provision for Corporation tax on the current year's profits, K4700. ZAOU Limited has nominal capital of K150 000 divided into 100 000 6% Preference shares of K1 each and 50000 ordinary shares of K1 each, the former all being issued and fully paid. The ordinary shares which were issued at a premium of 25 ngwee per share were all allotted. 75 ngwee per share (including the premium) had been called and paid up with the exception of 25 ngwee per share on 600 shares, which was unpaid. On 31 March 2018,500 5% Debentures of K100 each were issued at 97, and were fully subscribed and paid up. These Debentures were repayable at par by 25 equal half-yearly drawings, the first of which had taken place on 30 September 2018. No provision had been made in the company's books for interest due on these debentures on 30 September 2018. In addition to the balances arising out of the above, the following balances appeared in the company's books at 30 September 2018. K 800 96200 5500 2400 Office furniture at cost Freehold premises at cost Corporation tax year to 30 September 2017 Income tax Plant and machinery (less depreciation at 10% p.a. for the year. Preference dividend to 30 September 2018 Office rent and rates Manufacturing account (credit balance) Stock, 30 September 2018 Office salaries Provision for bad debts, 30 September 2017 Directors' emoluments paid Profit and loss account (credit balance) 30 September 2017 Travellers' salaries, commission, and expenses Loose tools as valued at 30 September 2018 Cash in hand Motor lorries running expenses Balance at bank Motor lorries 30 September 2017 Insurance Sundry Creditors Sundry Debtors General Reserve Goodwill at cost 28350 6000 1627 43172 62835 5340 600 8250 6352 4863 1246 124 2372 10777 3500 426 8786 22950 15000 10000 You are required to prepare a Trial Balance ruled into Profit and Loss and Statement of financial position columns (I.e. P&L and Balance sheet running side by side), giving effect to the following:- 1) Surplus plant and machinery (the book value of which on 30 September 2017 was K1600) was sold for K1750 in September 2018, but the sale had not been recorded in the books. 2) Sundry Debtors, known to be bad, amounting to K750 were to be written off, and the provision for bad debts was to be increased to an amount equal to 5% of sundry debtors. 3) The Motor Lorries were valued at 30 September 2018, at K3100. 4) Directors' fees, K250, were owing. 5) Discount on Debentures is to be written off. 6) Provision for Corporation tax on the current year's profits, K4700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started