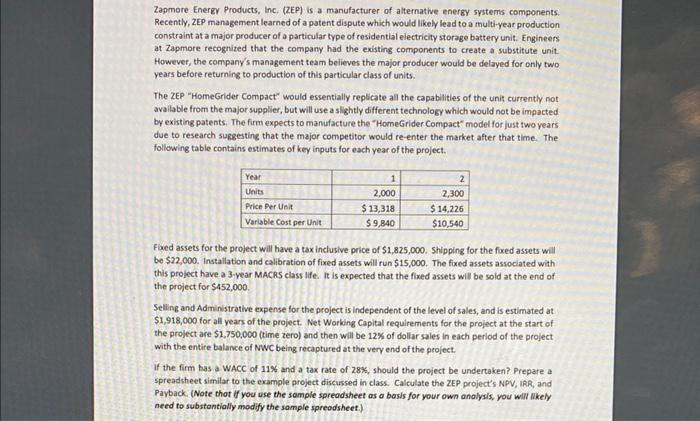

Zapmore Energy Products, Inc. (ZEP) is a manufacturer of alternative energy systeris components: Recently, ZEP management learned of a patent dispute which would likely lead to a multi-year production constraint at a major producer of a particular type of residential electricity storage battery unit. Engineers at Zapmore recognited that the company had the existing components to create a substitute unit. However, the company's management team believes the major producer would be delayed for only two years before returning to production of this particular class of units. The ZEP "HomeGrider Compact" would essentially replicate all the capabilities of the unit currently not avallable from the major supplier, but will use a slightly different technology which would not be impacted by existing patents. The firm expects to manufacture the "HomeGrider Compact" model for just two years due to research suggesting that the major competitor would re-enter the market after that time. The following table contains estimates of key inputs for each year of the project. Fixed assets for the project will have a tax inclusive price of $1,825,000. Shipping for the fixed assets will be $22,000. Installation and calibration of fixed assets will run $15,000. The fixed assets associated with this project have a 3-year MACRS class life. It is expected that the fixed assets will be sold at the end of the project for $452,000. Selling and Administrative expense for the project is independent of the level of sales, and is estimated at $1,918,000 for all years of the project. Net Working Capital requirements for the project at the start of the project are $1,750,000 (time zero) and then will be 12% of dollar sales in each period of the project with the entire balance of NWC being recaptured at the very end of the project. If the firm has a WACC of 11% and a tax rate of 28%, should the project be undertaken? Prepare a spreadsheet similar to the example project discussed in class. Calculate the ZEP project's NPV, IRR, and Payback. (Note thot if you use the sample spreadsheet as a basis for your own analys/s, you will Mkely need to substantially modify the somple spreodsheet.)