Answered step by step

Verified Expert Solution

Question

1 Approved Answer

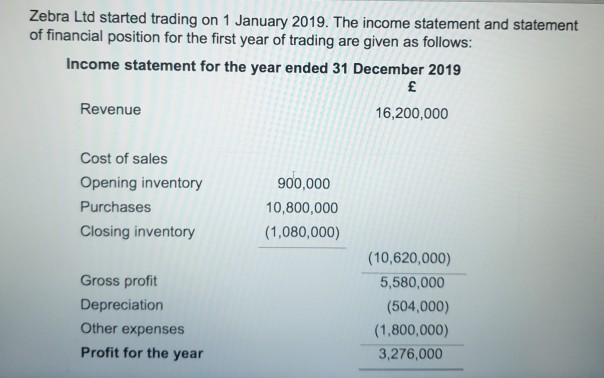

Zebra Ltd started trading on 1 January 2019. The income statement and statement of financial position for the first year of trading are given as

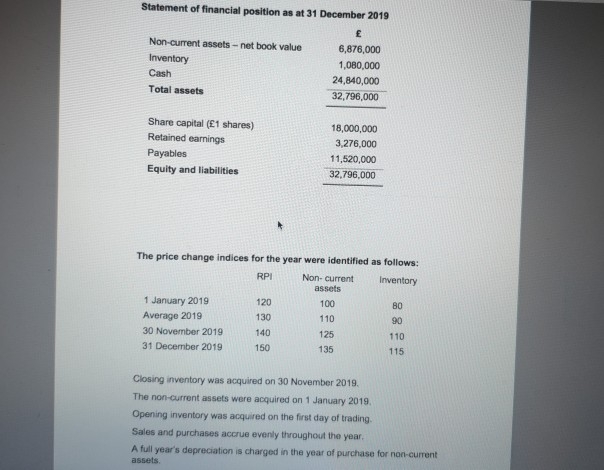

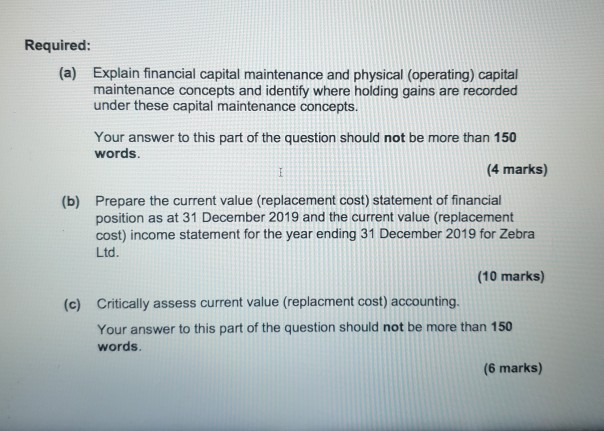

Zebra Ltd started trading on 1 January 2019. The income statement and statement of financial position for the first year of trading are given as follows: Income statement for the year ended 31 December 2019 Revenue 16,200,000 Cost of sales Opening inventory Purchases Closing inventory 900,000 10,800,000 (1,080,000) Gross profit Depreciation Other expenses Profit for the year (10,620,000) 5,580,000 (504,000) (1,800,000) 3,276,000 Statement of financial position as at 31 December 2019 E Non-current assets - net book value 6,876,000 Inventory 1,080,000 Cash 24,840,000 Total assets 32,796,000 Share capital (E1 shares) Retained earnings Payables Equity and liabilities 18,000,000 3,276,000 11,520,000 32,796,000 The price change indices for the year were identified as follows: RPI Non-current Inventory assets 1 January 2019 120 100 BO Average 2019 130 90 30 November 2019 140 110 31 December 2019 150 135 115 110 125 Closing inventory was acquired on 30 November 2019. The non-current assets were acquired on 1 January 2019, Opening inventory was acquired on the first day of trading Sales and purchases accrue evenly throughout the year A full year's depreciation is charged in the year of purchase for non-current assets Required: (a) Explain financial capital maintenance and physical (operating) capital maintenance concepts and identify where holding gains are recorded under these capital maintenance concepts. Your answer to this part of the question should not be more than 150 words. (4 marks) 1 (b) Prepare the current value (replacement cost) statement of financial position as at 31 December 2019 and the current value (replacement cost) income statement for the year ending 31 December 2019 for Zebra Ltd. (10 marks) (c) Critically assess current value (replacment cost) accounting, Your answer to this part of the question should not be more than 150 words. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started