Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zeibart Company purchases equipment for $235,000 on July 1, 2012, with an estimated useful life of 10 years and expected salvage value of $28,000.

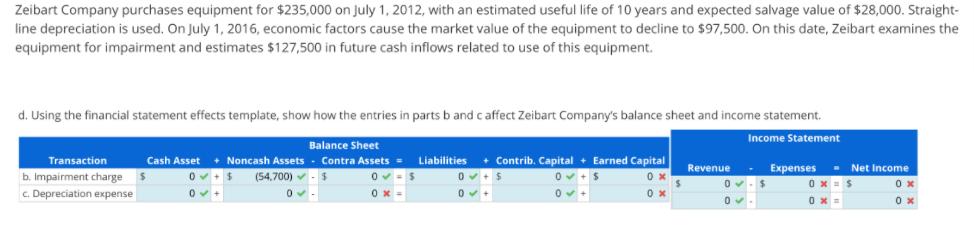

Zeibart Company purchases equipment for $235,000 on July 1, 2012, with an estimated useful life of 10 years and expected salvage value of $28,000. Straight- line depreciation is used. On July 1, 2016, economic factors cause the market value of the equipment to decline to $97,500. On this date, Zeibart examines the equipment for impairment and estimates $127,500 in future cash inflows related to use of this equipment. d. Using the financial statement effects template, show how the entries in parts b and caffect Zeibart Company's balance sheet and income statement. Income Statement Balance Sheet: + Contrib. Capital + Earned Capital + Noncash Assets (54,700) -$ Transaction Cash Asset Contra Assets- Liabilities Revenue Expenses Net Income b. Impairment charge c. Depreciation expense Ov + $ 0 x = S 0 x -

Step by Step Solution

★★★★★

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Straight line Depreciation 23500028000 10 20700 Boo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started