Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zeina & Lody have decided to constitute a partnership company with a capital of 150,000L.L. Lody has paid 50,000 L.L.in cash. Zeina liberates her

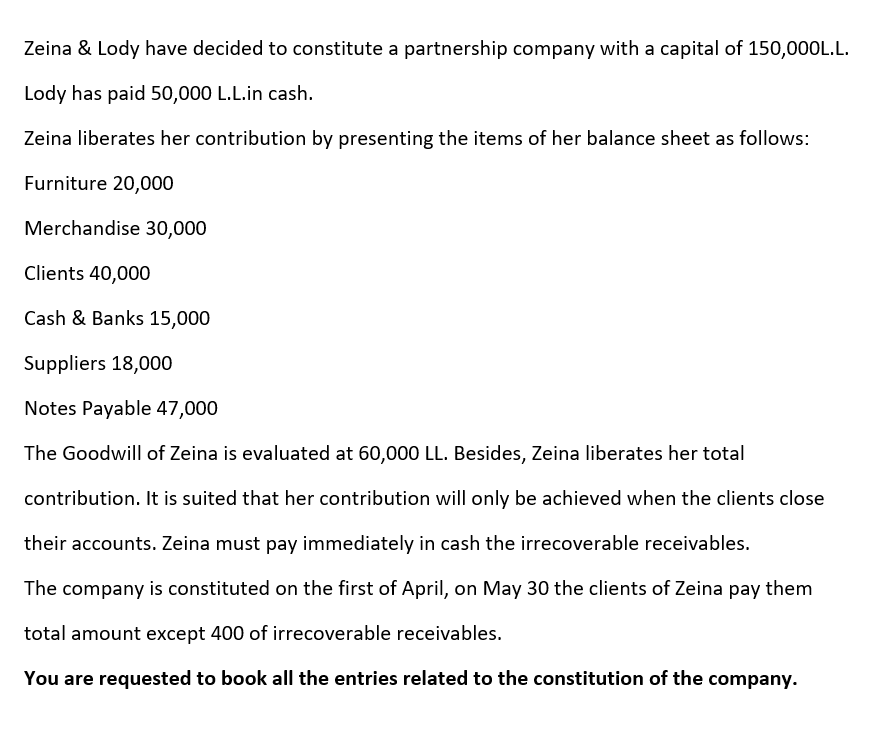

Zeina & Lody have decided to constitute a partnership company with a capital of 150,000L.L. Lody has paid 50,000 L.L.in cash. Zeina liberates her contribution by presenting the items of her balance sheet as follows: Furniture 20,000 Merchandise 30,000 Clients 40,000 Cash & Banks 15,000 Suppliers 18,000 Notes Payable 47,000 The Goodwill of Zeina is evaluated at 60,000 LL. Besides, Zeina liberates her total contribution. It is suited that her contribution will only be achieved when the clients close their accounts. Zeina must pay immediately in cash the irrecoverable receivables. The company is constituted on the first of April, on May 30 the clients of Zeina pay them total amount except 400 of irrecoverable receivables. You are requested to book all the entries related to the constitution of the company.

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Given Following are the journal entries in the books of partnership business of Zeina and lody Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started