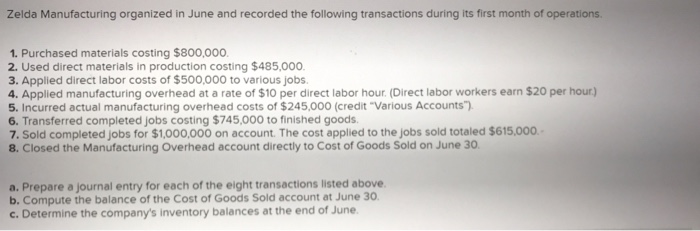

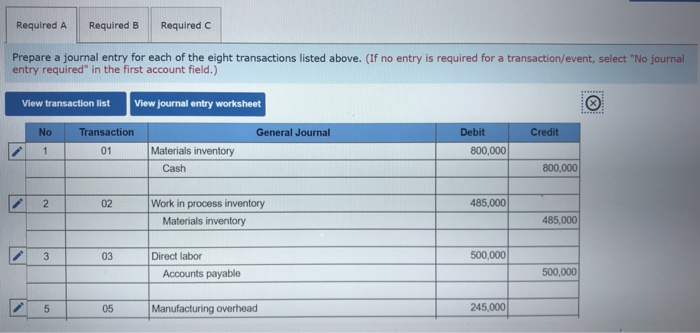

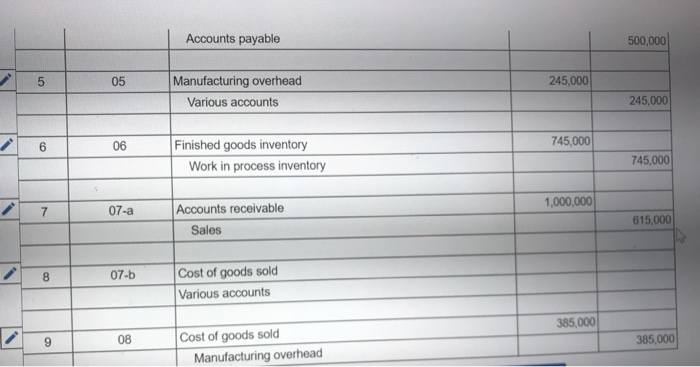

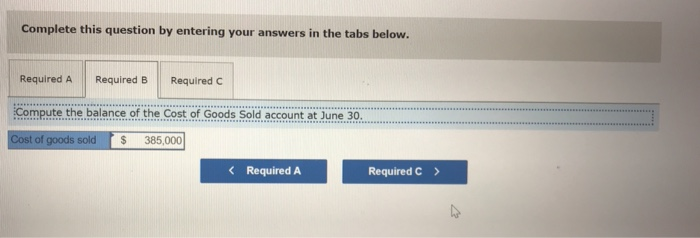

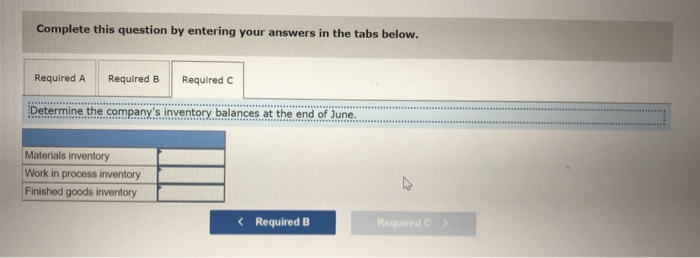

Zelda Manufacturing organized in June and recorded the following transactions during its first month of operations 1. Purchased materials costing $800,000. 2. Used direct materials in production costing $485,000 3. Applied direct labor costs of $500,000 to various jobs. 4. Applied manufacturing overhead at a rate of $10 per direct labor hour. (Direct labor workers earn $20 per hour) 5. Incurred actual manufacturing overhead costs of $245,000 (credit "Various Accounts 6. Transferred completed jobs costing $745,000 to finished goods. 7. Sold completed jobs for $1,000,000 on account. The cost applied to the jobs sold totaled $615,000 8. Closed the Manufacturing Overhead account directly to Cost of Goods Sold on June 30 a. Prepare a journal entry for each of the eight transactions listed above b. Compute the balance of the Cost of Goods Sold account at June 30 c. Determine the company's inventory balances at the end of June Required A Required B RequiredC Prepare a journal entry for each of the eight transactions listed above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 01 Materials inventory 800,000 Cash 800,000 02 485,000 Work in process inventory Materials inventory 485,000 3 03 Direct labor 500,000 Accounts payable 500,000 05 Manufacturing overhead 245,000 Accounts payable 500,000 05 245,000 Manufacturing overhead Various accounts 245,000 6 06 Finished goods inventory 45,000 745,000 Work in process inventory 1,000,000 7 07- Accounts receivable 615,000 Sales Cost of goods sold Various accounts 8 07-b 385,000 9 08 Cost of goods sold 385,000 Manufacturing overhead Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the balance of the Cost of Goods Sold account at June 30 of goods sold $ 385,000 Required A Required C Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine the company's inventory balances at the end of June Materials inventory Work in process inventory Finished goods inventory Required B Required C