Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zera Construction Company (ZCC) started business in 2021 and accepted its first contract to construct a building for $2.3 million, starting March 1, 2021.

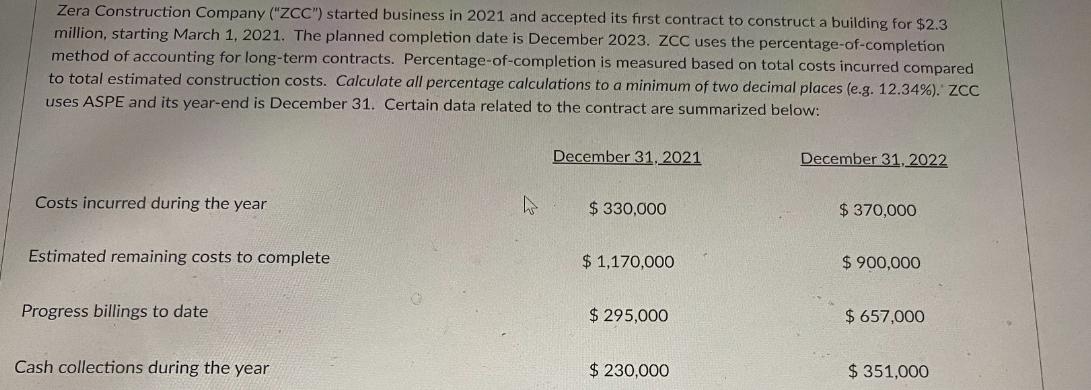

Zera Construction Company ("ZCC") started business in 2021 and accepted its first contract to construct a building for $2.3 million, starting March 1, 2021. The planned completion date is December 2023. ZCC uses the percentage-of-completion method of accounting for long-term contracts. Percentage-of-completion is measured based on total costs incurred compared to total estimated construction costs. Calculate all percentage calculations to a minimum of two decimal places (e.g. 12.34%). ZCC uses ASPE and its year-end is December 31. Certain data related to the contract are summarized below: December 31, 2021 December 31, 2022 Costs incurred during the year D $330,000 $370,000 Estimated remaining costs to complete $ 1,170,000 Progress billings to date $ 295,000 Cash collections during the year $ 230,000 $900,000 $ 657,000 $ 351,000 Assume the journal entries for 2021 have already been properly recorded. Using a well-formatted TABLE in your answer, prepare the journal entry or entries that should be recorded for the year ended December 31, 2022. Show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started