Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zero Company is a Delaware corporation engaged in multinational operations. Information related to Zero and its subsidiaries is as follows: Zero makes automobile parts

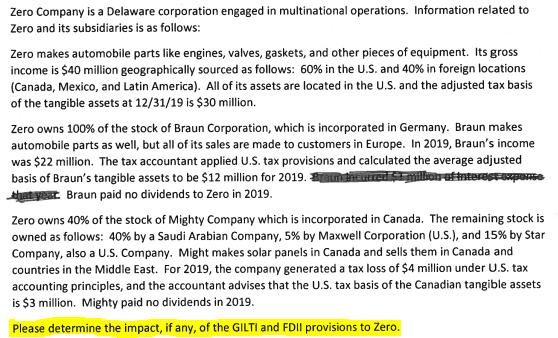

Zero Company is a Delaware corporation engaged in multinational operations. Information related to Zero and its subsidiaries is as follows: Zero makes automobile parts like engines, valves, gaskets, and other pieces of equipment. Its gross income is $40 million geographically sourced as follows: 60% in the U.S. and 40% in foreign locations (Canada, Mexico, and Latin America). All of its assets are located in the U.S. and the adjusted tax basis of the tangible assets at 12/31/19 is $30 million. Zero owns 100% of the stock of Braun Corporation, which is incorporated in Germany. Braun makes automobile parts as well, but all of its sales are made to customers in Europe. In 2019, Braun's income was $22 million. The tax accountant applied U.S. tax provisions and calculated the average adjusted basis of Braun's tangible assets to be $12 million for 2019. Brom the vered 4 million of interest expense that year Braun paid no dividends to Zero in 2019. Zero owns 40% of the stock of Mighty Company which is incorporated in Canada. The remaining stock is owned as follows: 40 % by a Saudi Arabian Company, 5% by Maxwell Corporation (U.S.), and 15% by Star Company, also a U.S. Company. Might makes solar panels in Canada and sells them in Canada and countries in the Middle East. For 2019, the company generated a tax loss of $4 million under U.S. tax accounting principles, and the accountant advises that the U.S. tax basis of the Canadian tangible assets is $3 million. Mighty paid no dividends in 2019. Please determine the impact, if any, of the GILTI and FDII provisions to Zero.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

he impact of the G IL TI and FD II provisions to Zero would be as f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started