Question

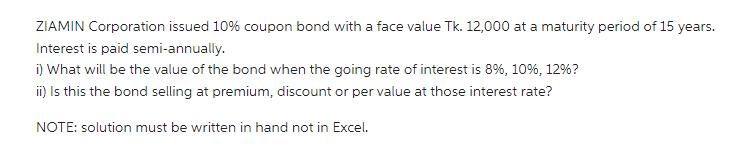

ZIAMIN Corporation issued 10% coupon bond with a face value Tk. 12,000 at a maturity period of 15 years. Interest is paid semi-annually. i)

ZIAMIN Corporation issued 10% coupon bond with a face value Tk. 12,000 at a maturity period of 15 years. Interest is paid semi-annually. i) What will be the value of the bond when the going rate of interest is 8%, 10%, 12%? ii) Is this the bond selling at premium, discount or per value at those interest rate? NOTE: solution must be written in hand not in Excel.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

i Value of the Bond at 8 10 12 At 8 Interest Rate At 8 interest rate the present value of the bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

10th Canadian edition

1259261018, 1259261015, 978-1259024979

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App