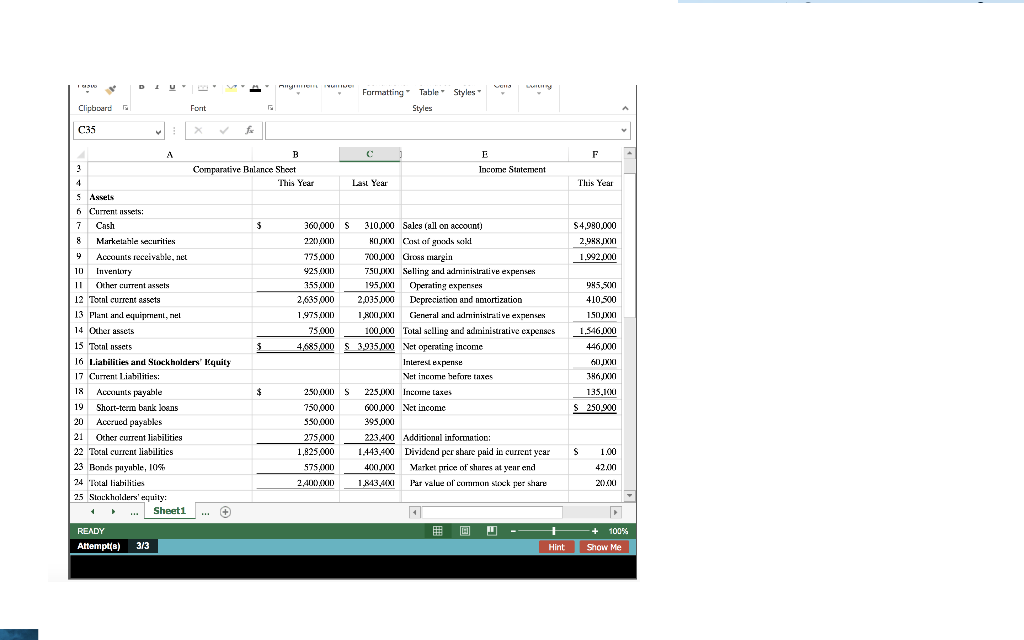

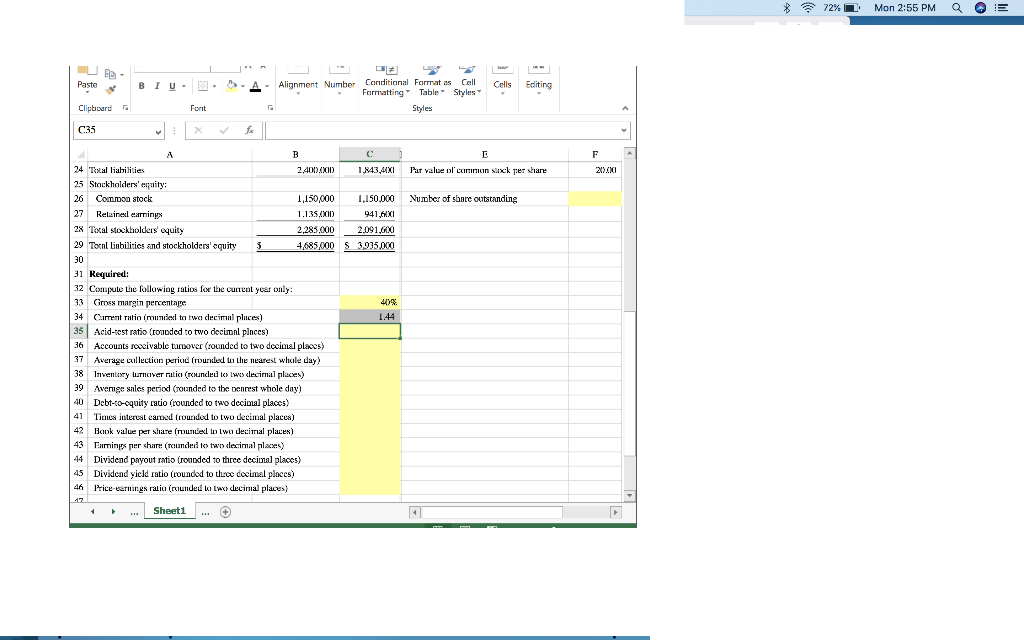

Zimmer, Inc. has provided its recent financial statements. The Controller has asked you to use this information to compute and interpret financial ratios that managers are going to use to assess liquidity and use for asset and debt management purposes. Use the information included in the Excel Simulation and the Excel functions described below to complete the task.

Formatting Styles - Table Styles Clipboard font C35 Income Statement Last Year This Year S4,980,000 2.0 JWIG 1.992.000 985,500 410.500 150.pa 1.346.000 446,000 Comparative Balance Sheet This Year 5 Assets 6 Current is 7 Cash 360,000 & Marketuhle securities 221.XID 9 Accounts receivable, nel 775.000 10 Invenlurry 925.ID 1 Other current assets 355.000 12 Tocal current assets 2,635,000 13 Plail and equipment, nel 1.975.CXCID 14 Oder assets 75.000 15 Tornl nssets 4.685.000 16 Liabilities and Stockholders' Equity 17 Current Liabilities: 18 Acexiunts payable 250.000 19 Short-term bank loans 750,000 20 Accrued payables 550.000 21 Other current liabilities 22 Total current liabilities 1,825,000 23 Bonds payable, 105 57500 24 Total liabilities 2.400 XXID 25 Stockholders' equily: ) ... Sheet1 ... READY Attempts) 3/3 S 310.000 Sales all on account) KOSI Cast af goxxx skl 700.000 Gros margin TSCOXXI Selling and aclmnaristrative expenses 195/ixi Operating expenses 2,035,000 Depreciation and Amortization 1.A.XXI General anciacministrative expenses 100.000 Total selling and administrative cxpenses S 3935.000 Net operating income Inletest expense Net income before taxes $ 225,00 Incone Laxes 600.000 Net income 395,000 223.400 Additional information: 1.443,400 Dividend per sbare paid is current year 400. Market price of shures at yenir end 1.843,4 Par value of curren suck per share 61JXO 386.X 135,100 250.000 S 275000 S 1.00 42.00 200.00 E -- + 10056 Hint Show Me * 72% 1 Mon 2:55 PM Q Q E B I A Alignment Number Conditional Format as Cell - Formatting Table Styles U . Fort Cells - Editing Paste Clipboard C35 Styles 2.400.00 1.843,44X1 Par value ol' cuman suck per shrane 20.000 Number of sbare outstanding 24 "Tatal liabilities 25 Stockholders' equity: 26 Common stock 27 Relzineslearninyx 28 Tocal stockholders' equity 29 Totnl Gubilities and stockholders' equity 1,150,000 1.1.35 ACID 2,285,000 4685,000 1.150.000 941,60X1 2,091,600 S 3,935.000 $ 40% 144 31 Required: 32 Compute the following ratios for the current year only: 33 Gross margin percentage 34 Cment rutio mundesi to two decimal places) 35 Acid-test ratio (rounded to two decimnl places) 36 Accounts roocivable tumour (rounded to two decimal places) 37 Average cullection period (Turned to the nearest whole day) 38 Inventory lamngiver ritici (reundled to w decimal places) 39 Averige sales period (rounded to the genrest whole day) 40 Debt-to-cquity ratio (rounded to two decimal places) 41 Times interest eamed (rounded to two decimal places) 42 Book value per stare (ruudel llwe decirial places) 43 Tamins per shares (rounded to two decimal places) 44 Dividend payout ratio (rounded to three decimal places) 45 Dividend yield ratio (rounded to three decimal places) 46 lice-cernangs ralio (runded La La decimal places) ... Sheet1