Question

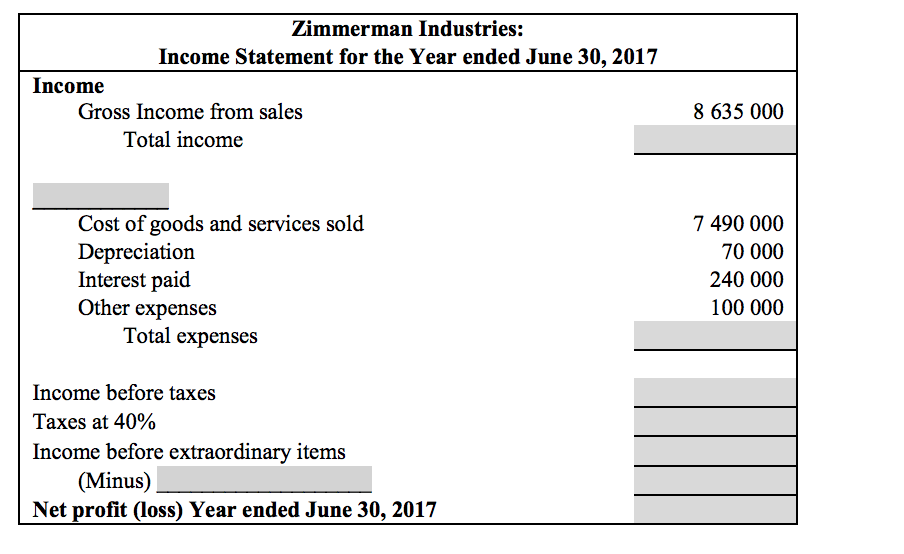

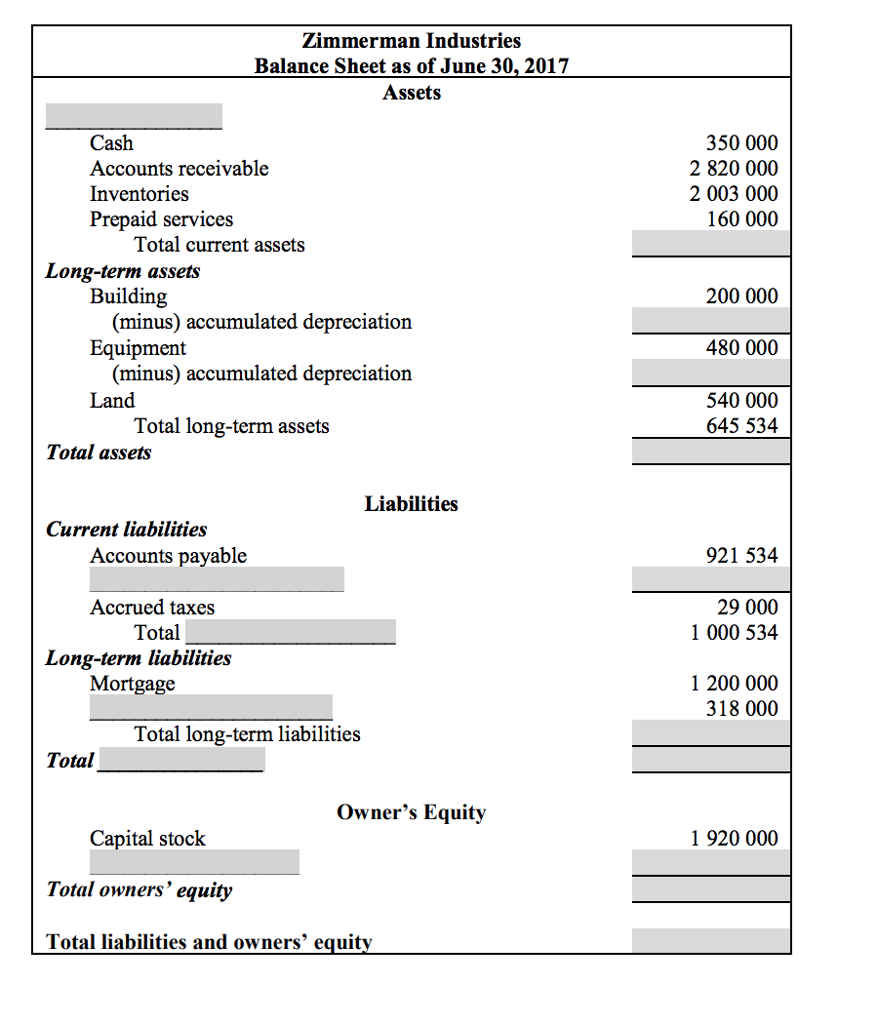

Zimmerman Industries bought land and built its plant 20 years ago. The depreciation on the building is calculated using the straight-line method, with a life

Zimmerman Industries bought land and built its plant 20 years ago. The depreciation on the building is calculated using the straight-line method, with a life of 30 years and a salvage value of $50,000. Land is not depreciated. The depreciation for the equipment, all of which was purchased at the same time the plant was constructed, is calculated using declining balance at 20 percent (ignore first year rule). Zimmerman Industries currently has two outstanding loans: one for $50,000 due December 31, 2017, and another one for which the next payment is due in four years. During April 2017, there was a flood in the building because a nearby river overflowed its banks after a heavy rainfall (classic Vancouver). Pumping out the water and cleaning up the basement and the first floor of the building took a week. During this week, manufacturing was suspended, and some inventory was damaged. Due to inadequate insurance, this unexpected event cost the company $100,000 net.

Fill in the blanks and complete a copy of the balance sheet and income statement (both on next page), using any of the above information you feel is necessary. Show any relevant calculations.

Fill in the blanks and complete a copy of the balance sheet and income statement (both on next page), using any of the above information you feel is necessary. Show any relevant calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started