Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zinc Corp. obtained a $100,000 loan from First Capital Bank on December 31, 2018. It purchased a piece of heavy equipment for $95,000 on January

Zinc Corp. obtained a $100,000 loan from First Capital Bank on December 31, 2018. It purchased a piece of heavy equipment for $95,000 on January 2, 2019. The loan bears interest at 8% per year on the unpaid balance and is repayable in four annual blended payments of $30,192 on December 31 each year, starting in 2019.

| Required: | ||

| 1. | Prepare the journal entries to record the following transactions: | |

| ? | a. | Receipt of loan proceeds from the bank |

| ? | b. | Purchase of the equipment. |

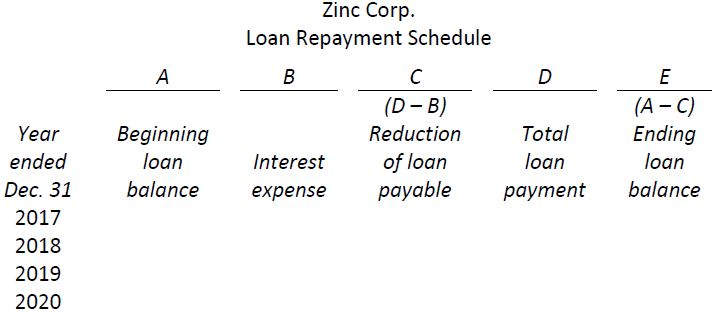

| 2. | Prepare the loan repayment schedule in the following format: | |

| 3. | Prepare the journal entry to record the last loan payment. | |

| 4. | Prepare a partial balance sheet showing the loan liability at December 31, 2018. | |

Zinc Corp. Loan Repayment Schedule A B C D E (D - B) (A - C) Ending Year Beginning Reduction Total of loan payable ended loan Interest loan loan Dec. 31 balance expense ent balance 2017 2018 2019 2020

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Date General Journal Debit Credit a Dec 31 Cash 100000 2018 Bank loan payable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e1004261e6_181129.pdf

180 KBs PDF File

635e1004261e6_181129.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started