Answered step by step

Verified Expert Solution

Question

1 Approved Answer

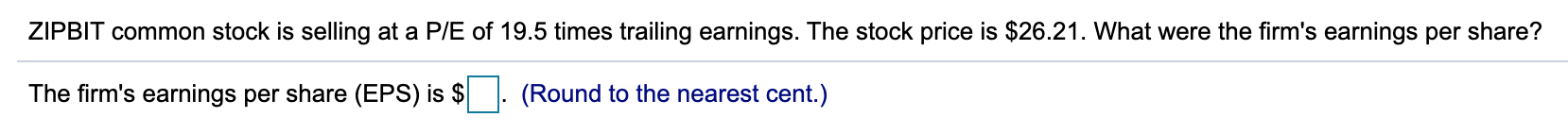

ZIPBIT common stock is selling at a P/E of 19.5 times trailing earnings. The stock price is $26.21. What were the firm's earnings per

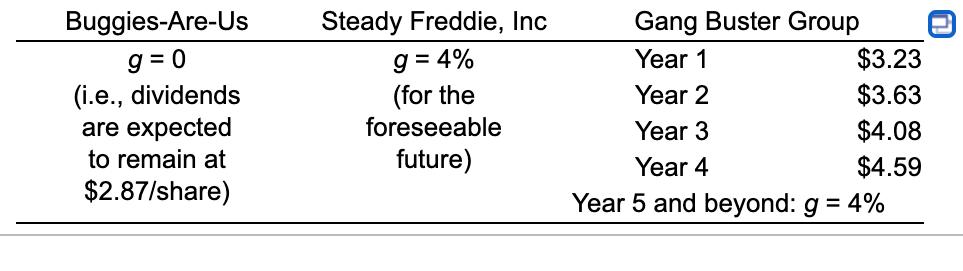

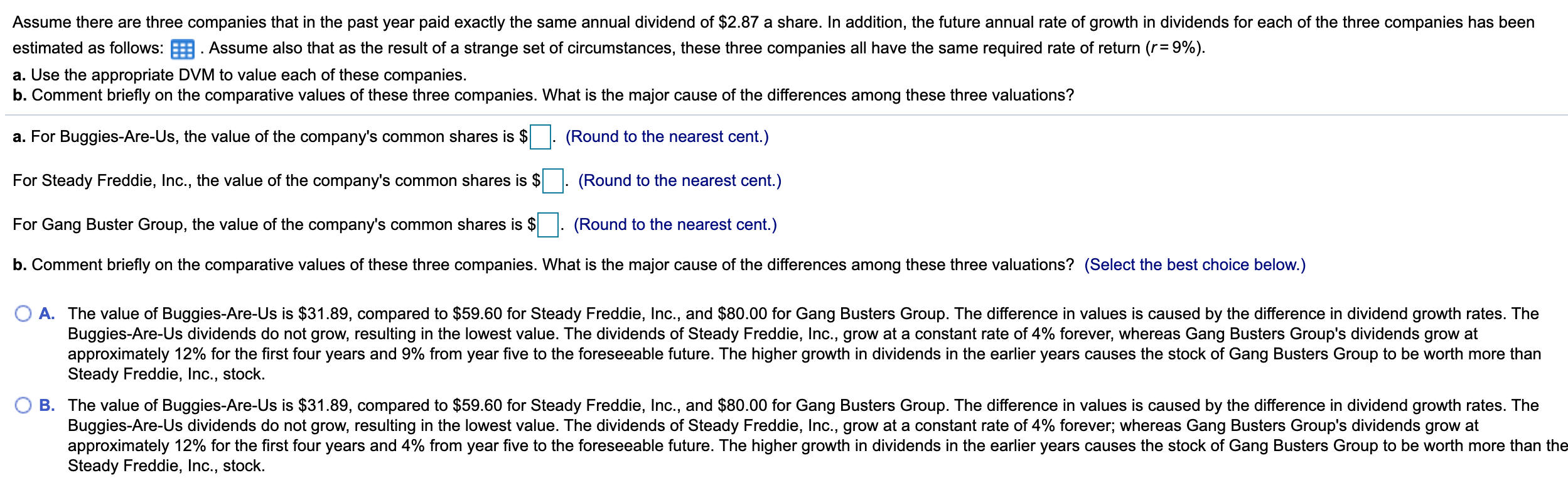

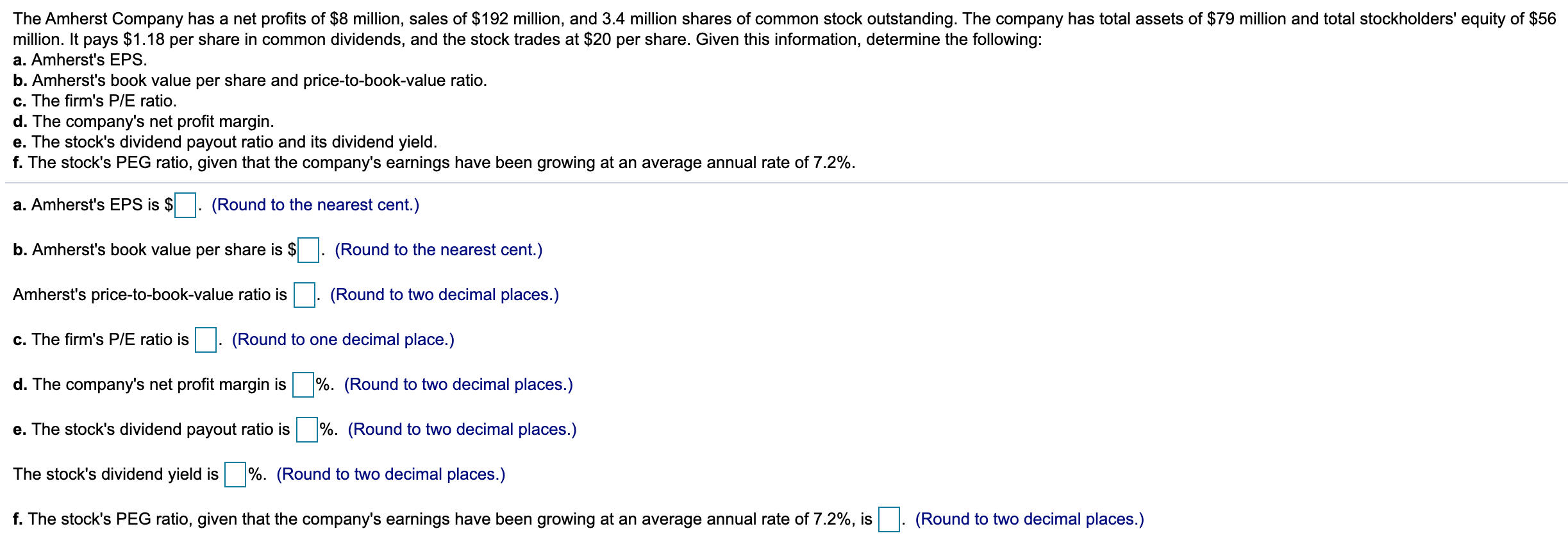

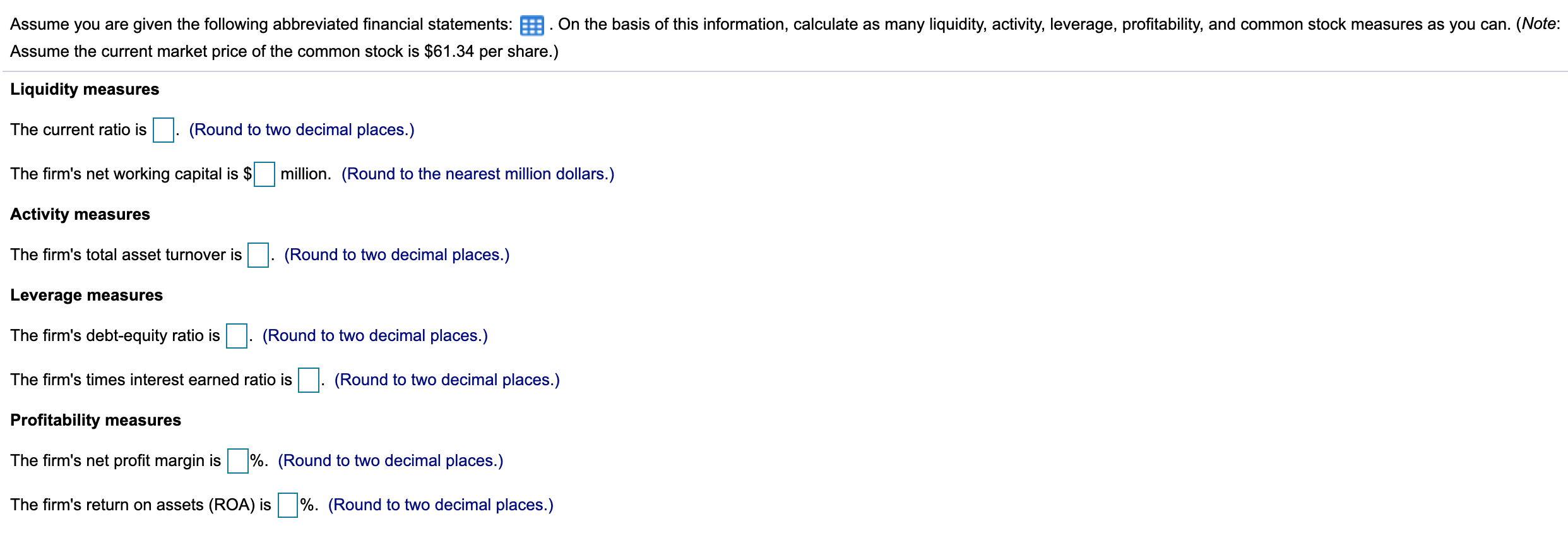

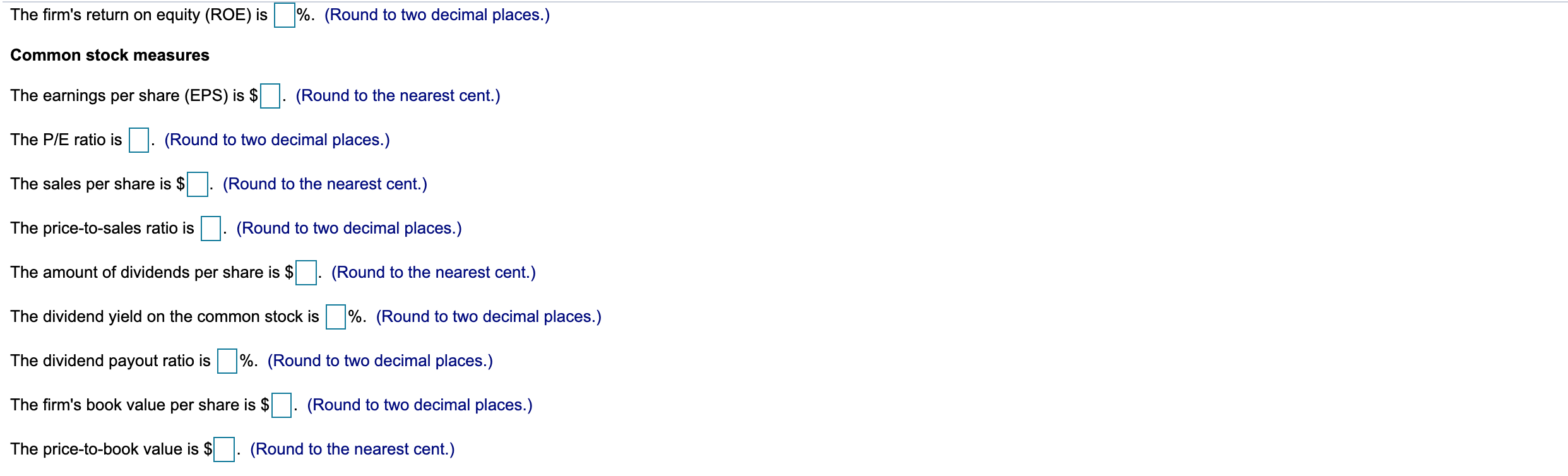

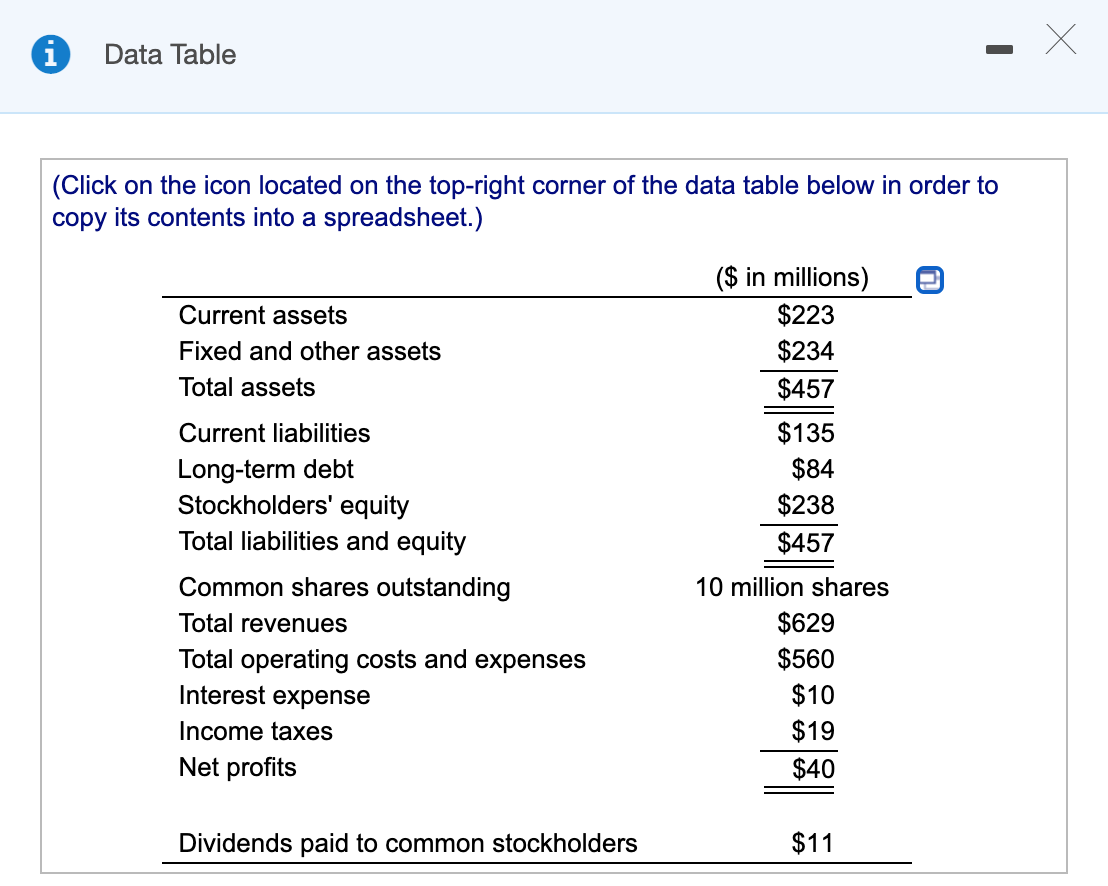

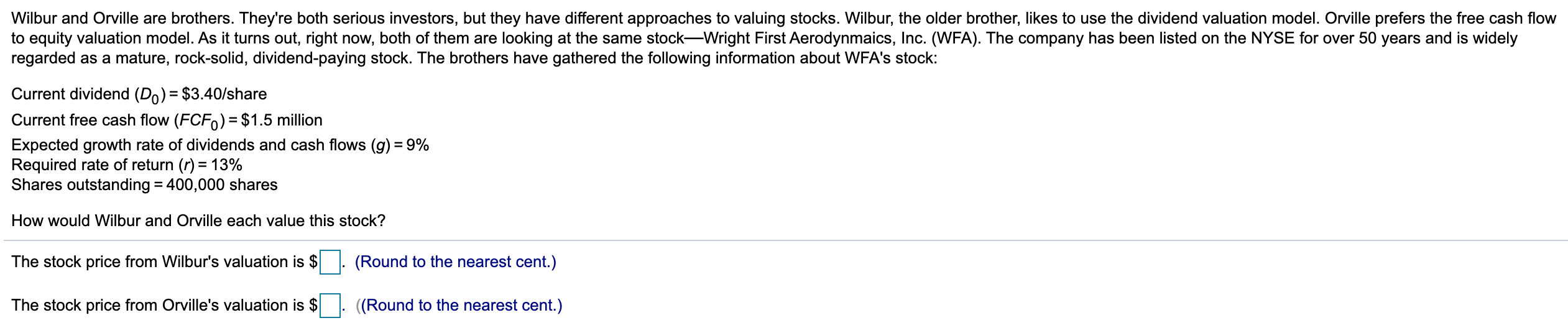

ZIPBIT common stock is selling at a P/E of 19.5 times trailing earnings. The stock price is $26.21. What were the firm's earnings per share? The firm's earnings per share (EPS) is $ (Round to the nearest cent.) Buggies-Are-Us g=0 (i.e., dividends are expected to remain at $2.87/share) Steady Freddie, Inc g = 4% (for the foreseeable future) Gang Buster Group Year 1 Year 2 Year 3 Year 4 Year 5 and beyond: g = 4% $3.23 $3.63 $4.08 $4.59 Assume there are three companies that in the past year paid exactly the same annual dividend of $2.87 a share. In addition, the future annual rate of growth in dividends for each of the three companies has been estimated as follows:. Assume also that as the result of a strange set of circumstances, these three companies all have the same required rate of return (r=9%). a. Use the appropriate DVM to value each of these companies. b. Comment briefly on the comparative values of these three companies. What is the major cause of the differences among these three valuations? a. For Buggies-Are-Us, the value of the company's common shares is $. (Round to the nearest cent.) For Steady Freddie, Inc., the value of the company's common shares is $ (Round to the nearest cent.) For Gang Buster Group, the value of the company's common shares is $ (Round to the nearest cent.) b. Comment briefly on the comparative values of these three companies. What is the major cause of the differences among these three valuations? (Select the best choice below.) A. The value of Buggies-Are-Us is $31.89, compared to $59.60 for Steady Freddie, Inc., and $80.00 for Gang Busters Group. The difference in values is caused by the difference in dividend growth rates. The Buggies-Are-Us dividends do not grow, resulting in the lowest value. The dividends of Steady Freddie, Inc., grow at a constant rate of 4% forever, whereas Gang Busters Group's dividends grow at approximately 12% for the first four years and 9% from year five to the foreseeable future. The higher growth in dividends in the earlier years causes the stock of Gang Busters Group to be worth more than Steady Freddie, Inc., stock. B. The value of Buggies-Are-Us is $31.89, compared to $59.60 for Steady Freddie, Inc., and $80.00 for Gang Busters Group. The difference in values is caused by the difference in dividend growth rates. The Buggies-Are-Us dividends do not grow, resulting in the lowest value. The dividends of Steady Freddie, Inc., grow at a constant rate of 4% forever; whereas Gang Busters Group's dividends grow at approximately 12% for the first four years and 4% from year five to the foreseeable future. The higher growth in dividends in the earlier years causes the stock of Gang Busters Group to be worth more than the Steady Freddie, Inc., stock. World Wide Web Wares (4W, for short) is an online retailer of small kitchen appliances and utensils. The firm has been around for a few years and has created a nice market niche for itself. In fact, it actually turned a profit last year, albeit a fairly small one. After doing some basic research on the company, you've decided to take a closer look. You plan to use the price-to-sales ratio to value the stock, and you have collected P/S multiples on the following Internet retailer stocks:. Find the average P/S ratio for these three firms. Given that 4W is expected to generate $50 million in sales next year and will have 7 million shares of stock outstanding, use the average P/S ratio you computed above to put a value on 4W's stock. x The average P/S ratio for the 3 firms is (Round to two decimal places.) The value of 4W's stock is $ (Round to the nearest cent.) 1 Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Company Amazing.com ReallyCooking.com Fixtures & Appliances Online P/S Multiples 4.3 3.8 3.6 The Amherst Company has a net profits of $8 million, sales of $192 million, and 3.4 million shares of common stock outstanding. The company has total assets of $79 million and total stockholders' equity of $56 million. It pays $1.18 per share in common dividends, and the stock trades at $20 per share. Given this information, determine the following: a. Amherst's EPS. b. Amherst's book value per share and price-to-book-value ratio. c. The firm's P/E ratio. d. The company's net profit margin. e. The stock's dividend payout ratio and its dividend yield. f. The stock's PEG ratio, given that the company's earnings have been growing at an average annual rate of 7.2%. a. Amherst's EPS is $ (Round to the nearest cent.) b. Amherst's book value per share is $ Amherst's price-to-book-value ratio is (Round to the nearest cent.) (Round to two decimal places.) c. The firm's P/E ratio is (Round to one decimal place.) d. The company's net profit margin is%. (Round to two decimal places.) e. The stock's dividend payout ratio is %. (Round to two decimal places.) The stock's dividend yield is %. (Round to two decimal places.) f. The stock's PEG ratio, given that the company's earnings have been growing at an average annual rate of 7.2%, is (Round to two decimal places.) AviBank Plastics generated an EPS of $4.67 over the last 12 months. The company's earnings are expected to grow by 17.6% next year, and because there will be no significant change in the number of shares outstanding, EPS should grow at about the same rate. You feel the stock should trade at a P/E of around 22 times earnings. Use the P/E approach to set a value on this stock. Using the P/E approach, the value on this stock is $ (Round to the nearest cent.) Assume you are given the following abbreviated financial statements:. On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $61.34 per share.) Liquidity measures The current ratio is (Round to two decimal places.) The firm's net working capital is $ Activity measures The firm's total asset turnover is million. (Round to the nearest million dollars.) (Round to two decimal places.) Leverage measures The firm's debt-equity ratio is (Round to two decimal places.) The firm's times interest earned ratio is (Round to two decimal places.) Profitability measures The firm's net profit margin is %. (Round to two decimal places.) The firm's return on assets (ROA) is %. (Round to two decimal places.) The firm's return on equity (ROE) is Common stock measures The earnings per share (EPS) is $ The P/E ratio is %. (Round to two decimal places.) (Round to the nearest cent.) (Round to two decimal places.) The sales per share is $ The price-to-sales ratio is The amount of dividends per share is $ (Round to the nearest cent.) The dividend yield on the common stock is%. (Round to two decimal places.) The dividend payout ratio is %. (Round to two decimal places.) The firm's book value per share is $ (Round to two decimal places.) The price-to-book value is $. (Round to the nearest cent.) (Round to the nearest cent.) (Round to two decimal places.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Current assets Fixed and other assets Total assets Current liabilities Long-term debt Stockholders' equity Total liabilities and equity Common shares outstanding Total revenues Total operating costs and expenses Interest expense Income taxes Net profits Dividends paid to common stockholders ($ in millions) $223 $234 $457 $135 $84 $238 $457 10 million shares $629 $560 $10 $19 $40 $11 Wilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (Do) = $3.40/share Current free cash flow (FCF) = $1.5 million Expected growth rate of dividends and cash flows (g) = 9% Required rate of return (r) = 13% Shares outstanding = 400,000 shares How would Wilbur and Orville each value this stock? The stock price from Wilbur's valuation is $ The stock price from Orville's valuation is $ (Round to the nearest cent.) ((Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings 1 The PS multiples for the three compara...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started