Zippy Co has 1,000,000 issued ordinary shares which are traded in an efficient capital market. The company has just paid dividend of $0.50 per

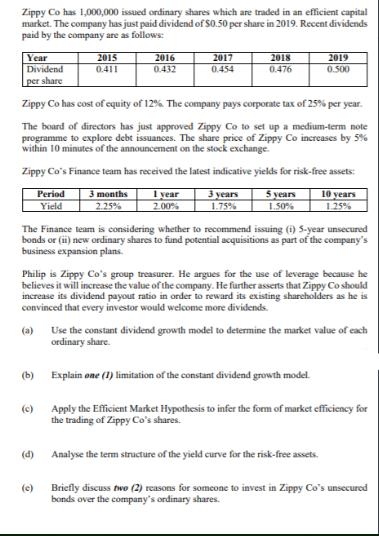

Zippy Co has 1,000,000 issued ordinary shares which are traded in an efficient capital market. The company has just paid dividend of $0.50 per share in 2019. Recent dividends paid by the company are as follows: Year Dividend per share (b) (c) 2015 0.411 Zippy Co has cost of equity of 12%. The company pays corporate tax of 25% per year. The board of directors has just approved Zippy Co to set up a medium-term note programme to explore debt issuances. The share price of Zippy Co increases by 5% within 10 minutes of the announcement on the stock exchange. Zippy Co's Finance team has received the latest indicative yields for risk-free assets: 3 months 1 year 2.00% 2.25% Period Yield (d) 2016 0.432 (c) 2017 0.454 2018 0.476 3 years 1.75% The Finance team is considering whether to recommend issuing (i) 5-year unsecured bonds or (ii) new ordinary shares to fund potential acquisitions as part of the company's business expansion plans. 5 years 1.50% Philip is Zippy Co's group treasurer. He argues for the use of leverage because he believes it will increase the value of the company. He further asserts that Zippy Co should increase its dividend payout ratio in order to reward its existing shareholders as he is convinced that every investor would welcome more dividends. 2019 0.500 10 years 1.25% Explain one (1) limitation of the constant dividend growth model. Use the constant dividend growth model to determine the market value of each ordinary share. Apply the Efficient Market Hypothesis to infer the form of market efficiency for the trading of Zippy Co's shares. Analyse the term structure of the yield curve for the risk-free assets. Briefly discuss two (2) reasons for someone to invest in Zippy Co's unsecured bonds over the company's ordinary shares. (g) Discuss the assumptions made by Philip and whether his statement on using leverage to increase firm value is valid. (5 marks) Critically evaluate Philip's assertion that all investors would welcome high dividend payouts. (6 marks)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The constant dividend growth model also known as the Gordon Growth Model can be used to determine the market value of each ordinary share The formula is Market Value per Share D1 r g Where D1 Expect...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started