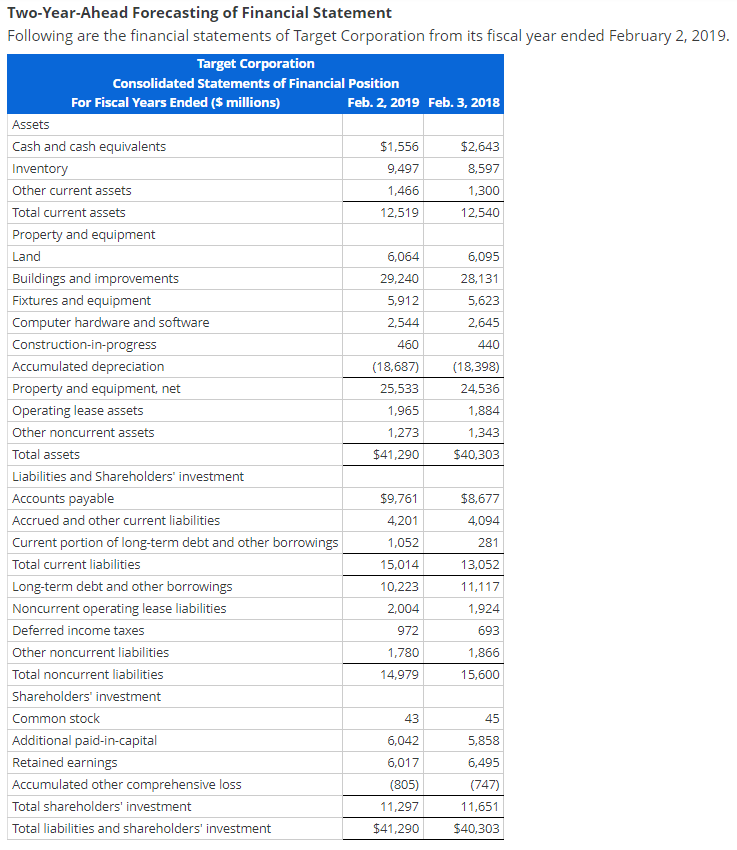

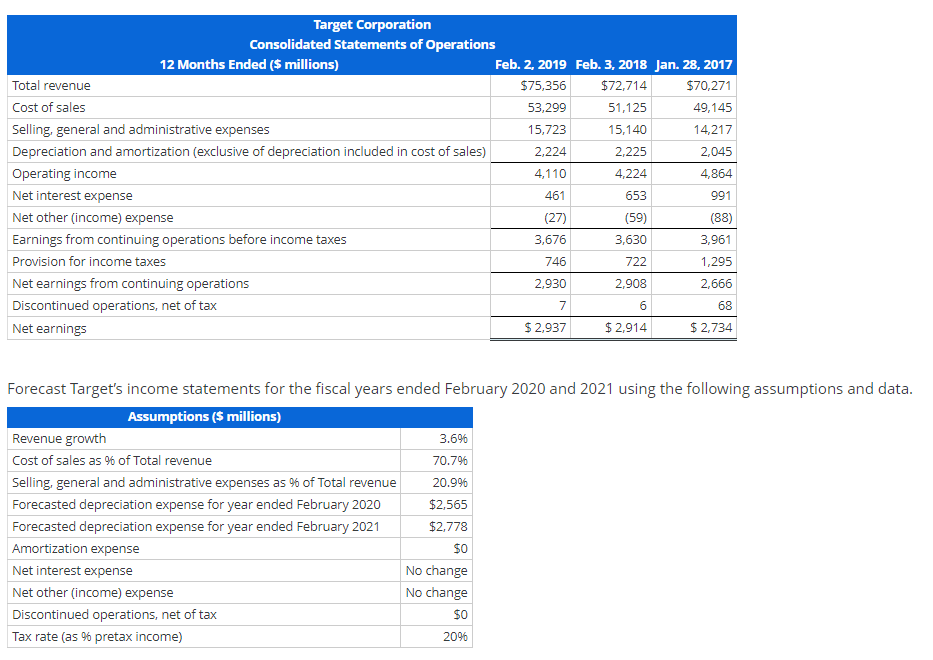

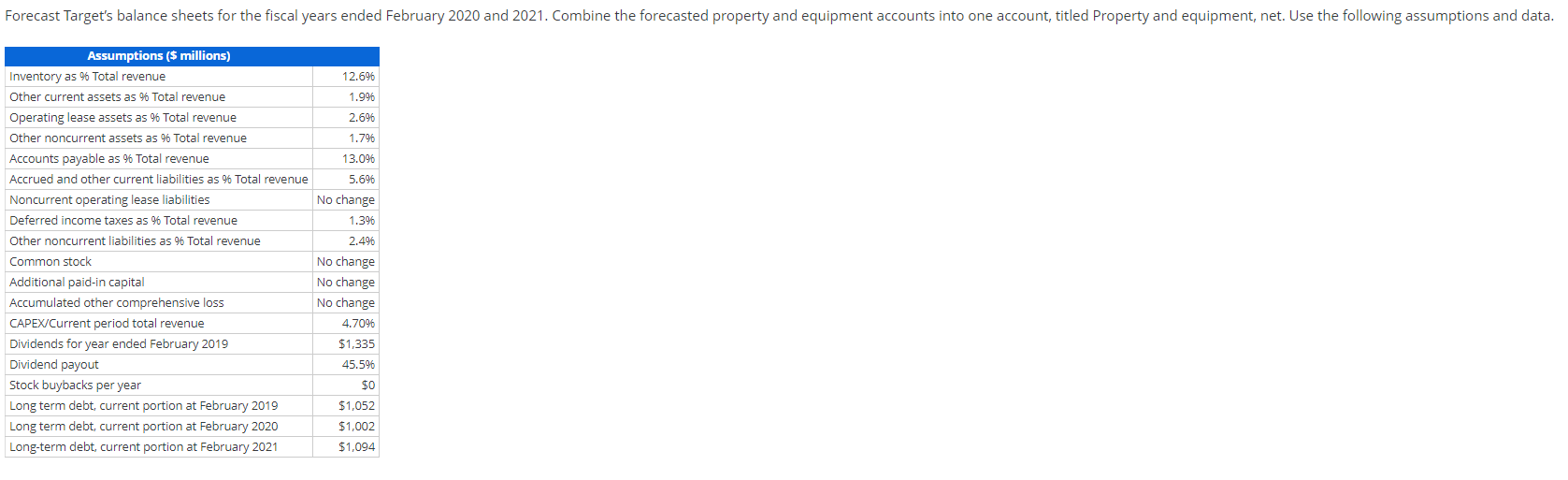

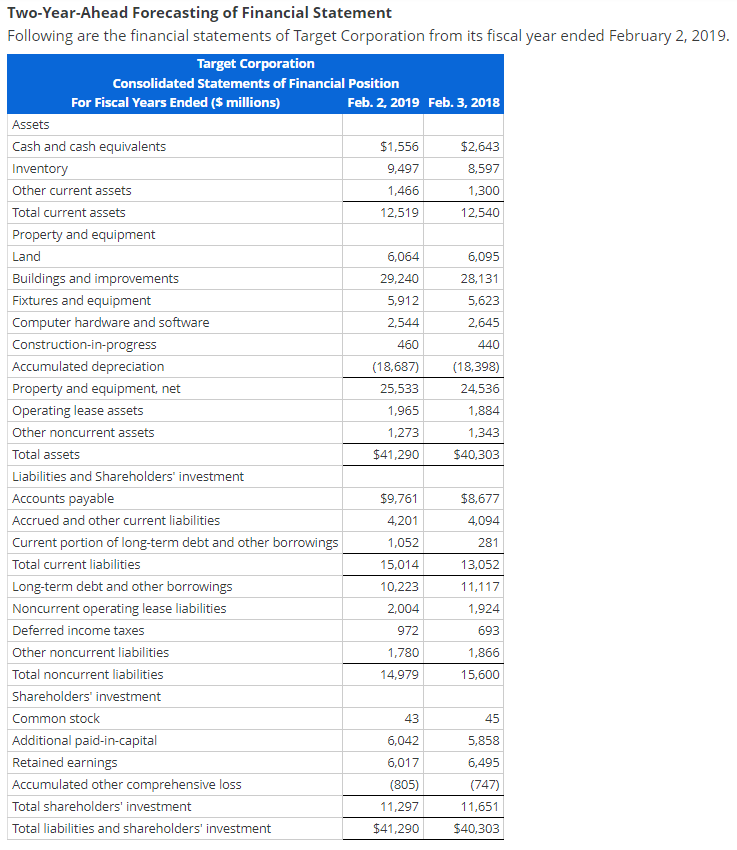

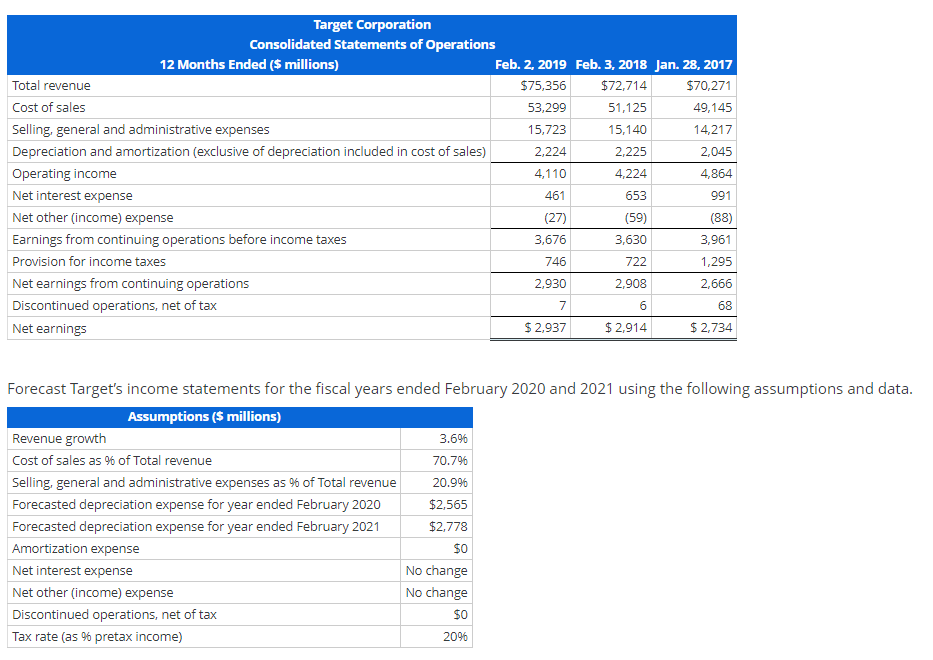

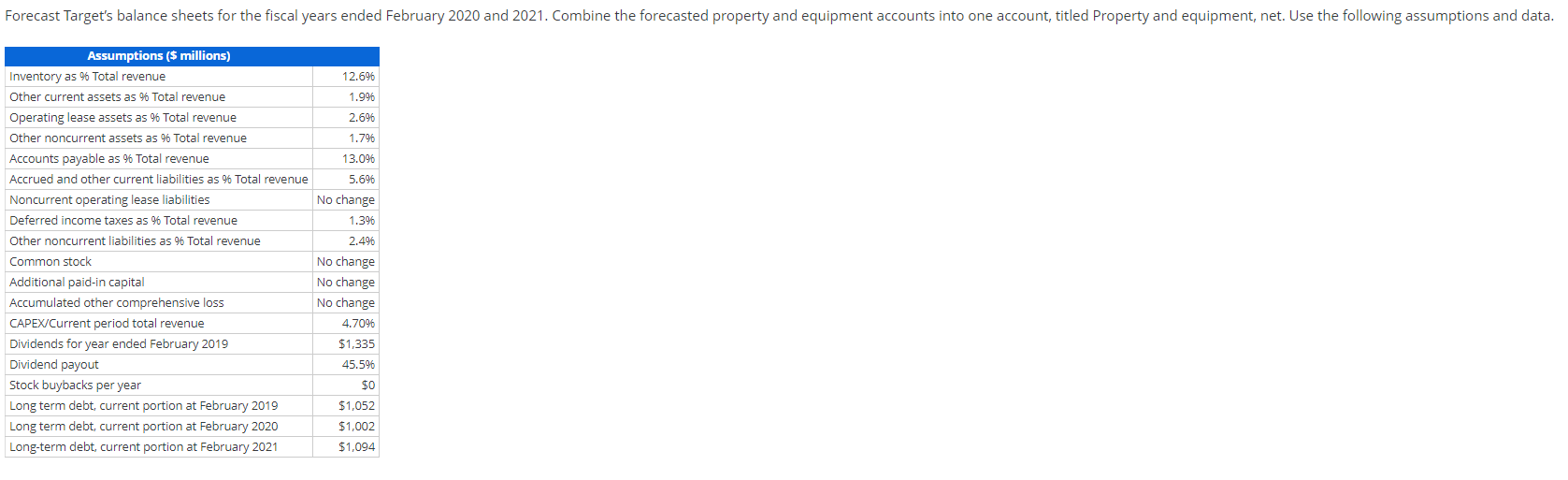

zl year ended February 2, 2019 Forecast Target's income statements for the fiscal years ended February 2020 and 2021 using the following assumptions and data. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Assumptions (\$ millions) } \\ \hline Revenue growth & 3.6% \\ \hline Cost of sales as % of Total revenue & 70.7% \\ \hline Selling, general and administrative expenses as % of Total revenue & 20.9% \\ \hline Forecasted depreciation expense for year ended February 2020 & $2,565 \\ \hline Forecasted depreciation expense for year ended February 2021 & $2,778 \\ \hline Amortization expense & $0 \\ \hline Net interest expense & No change \\ \hline Net other (income) expense & No change \\ \hline Discontinued operations, net of tax & $0 \\ \hline Tax rate (as \% pretax income) & 20% \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Assumptions (\$ millions) } \\ \hline Inventory as % Total revenue & 12.6% \\ \hline Other current assets as % Total revenue & 1.9% \\ \hline Operating lease assets as \% Total revenue & 2.6% \\ \hline Other noncurrent assets as \% Total revenue & 1.7% \\ \hline Accounts payable as \% Total revenue & 13.0% \\ \hline Accrued and other current liabilities as \% Total revenue & 5.6% \\ \hline Noncurrent operating lease liabilities & No change \\ \hline Deferred income taxes as % Total revenue & 1.3% \\ \hline Other noncurrent liabilities as \% Total revenue & 2.4% \\ \hline Common stock & No change \\ \hline Additional paid-in capital & No change \\ \hline Accumulated other comprehensive loss & No change \\ \hline CAPEXCurrent period total revenue & 4.70% \\ \hline Dividends for year ended February 2019 & $1,335 \\ \hline Dividend payout & 45.5% \\ \hline Stock buybacks per year & $0 \\ \hline Long term debt, current portion at February 2019 & $1,052 \\ \hline Long term debt, current portion at February 2020 & $1,002 \\ \hline Long-term debt, current portion at February 2021 & $1,094 \\ \hline \end{tabular} Instructions: - Round answers to the nearest whole number. - Ilse a negative cign with vour Arrumulated nther romnrehencive Inec anciwers. zl year ended February 2, 2019 Forecast Target's income statements for the fiscal years ended February 2020 and 2021 using the following assumptions and data. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Assumptions (\$ millions) } \\ \hline Revenue growth & 3.6% \\ \hline Cost of sales as % of Total revenue & 70.7% \\ \hline Selling, general and administrative expenses as % of Total revenue & 20.9% \\ \hline Forecasted depreciation expense for year ended February 2020 & $2,565 \\ \hline Forecasted depreciation expense for year ended February 2021 & $2,778 \\ \hline Amortization expense & $0 \\ \hline Net interest expense & No change \\ \hline Net other (income) expense & No change \\ \hline Discontinued operations, net of tax & $0 \\ \hline Tax rate (as \% pretax income) & 20% \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Assumptions (\$ millions) } \\ \hline Inventory as % Total revenue & 12.6% \\ \hline Other current assets as % Total revenue & 1.9% \\ \hline Operating lease assets as \% Total revenue & 2.6% \\ \hline Other noncurrent assets as \% Total revenue & 1.7% \\ \hline Accounts payable as \% Total revenue & 13.0% \\ \hline Accrued and other current liabilities as \% Total revenue & 5.6% \\ \hline Noncurrent operating lease liabilities & No change \\ \hline Deferred income taxes as % Total revenue & 1.3% \\ \hline Other noncurrent liabilities as \% Total revenue & 2.4% \\ \hline Common stock & No change \\ \hline Additional paid-in capital & No change \\ \hline Accumulated other comprehensive loss & No change \\ \hline CAPEXCurrent period total revenue & 4.70% \\ \hline Dividends for year ended February 2019 & $1,335 \\ \hline Dividend payout & 45.5% \\ \hline Stock buybacks per year & $0 \\ \hline Long term debt, current portion at February 2019 & $1,052 \\ \hline Long term debt, current portion at February 2020 & $1,002 \\ \hline Long-term debt, current portion at February 2021 & $1,094 \\ \hline \end{tabular} Instructions: - Round answers to the nearest whole number. - Ilse a negative cign with vour Arrumulated nther romnrehencive Inec anciwers