Answered step by step

Verified Expert Solution

Question

1 Approved Answer

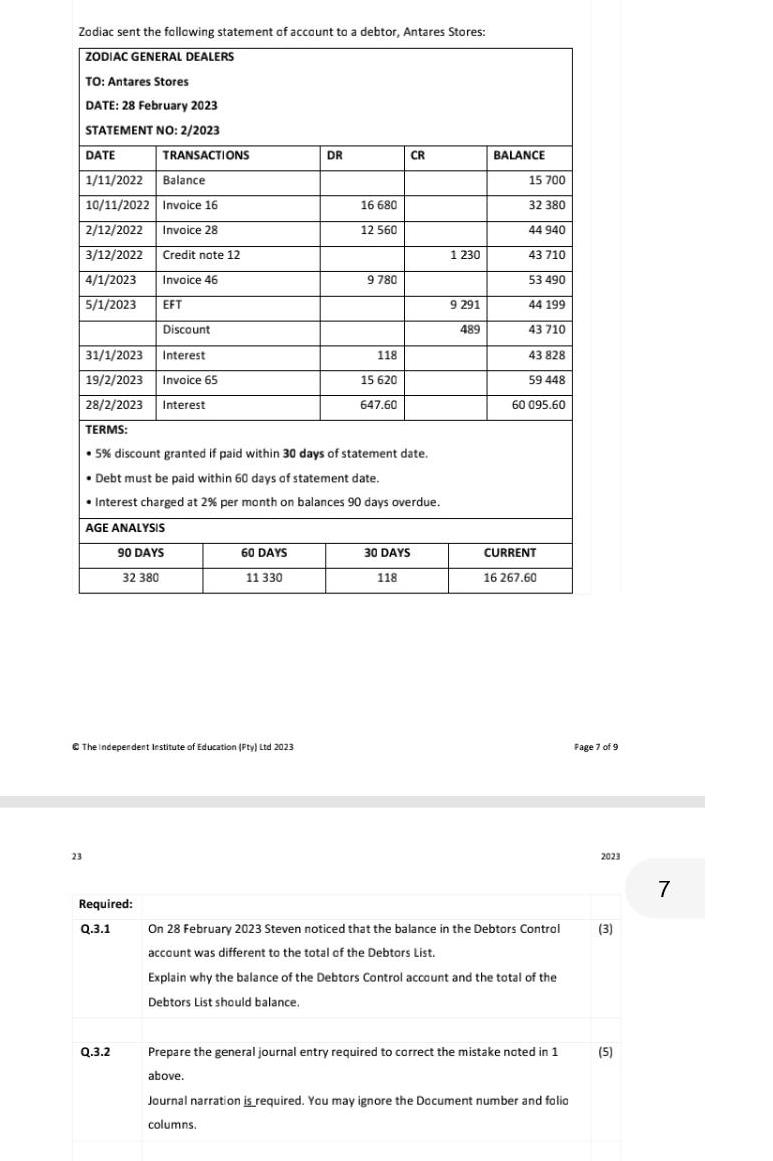

Zodiac sent the following statement of account to a debtor, Antares Stores: ZODIAC GENERAL DEALERS TO: Antares Stores DATE: 28 February 2023 STATEMENT NO:

Zodiac sent the following statement of account to a debtor, Antares Stores: ZODIAC GENERAL DEALERS TO: Antares Stores DATE: 28 February 2023 STATEMENT NO: 2/2023 23 DATE 1/11/2022 Balance 10/11/2022 Invoice 16 2/12/2022 Invoice 28 3/12/2022 Credit note 12 4/1/2023 Invoice 46 5/1/2023 EFT TRANSACTIONS The Independent Institute of Education (Pty) Ltd 2023 Required: Q.3.1 Q.3.2 60 DAYS 11 330 DR Discount 31/1/2023 Interest 19/2/2023 Invoice 65 28/2/2023 Interest TERMS: 5% discount granted if paid within 30 days of statement date. Debt must be paid within 60 days of statement date. Interest charged at 2% per month on balances 90 days overdue. AGE ANALYSIS 90 DAYS 32 380 16 680 12 560 9780 118 15 620 647.60 CR 30 DAYS 118 1 230 9 291 489 BALANCE 15 700 32 380 44 940 43 710 53 490 44 199 43 710 43 828 59 448 60 095.60 CURRENT 16 267.60 On 28 February 2023 Steven noticed that the balance in the Debtors Control account was different to the total of the Debtors List. Explain why the balance of the Debtors Control account and the total of the Debtors List should balance. Prepare the general journal entry required to correct the mistake noted in 1 above. Journal narration is required. You may ignore the Document number and folia columns. Page 7 of 9 2023 (3) (5) 7

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q31 Explanation on Balancing Debtors Control Account and Debtors List The Debtors Control account in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started