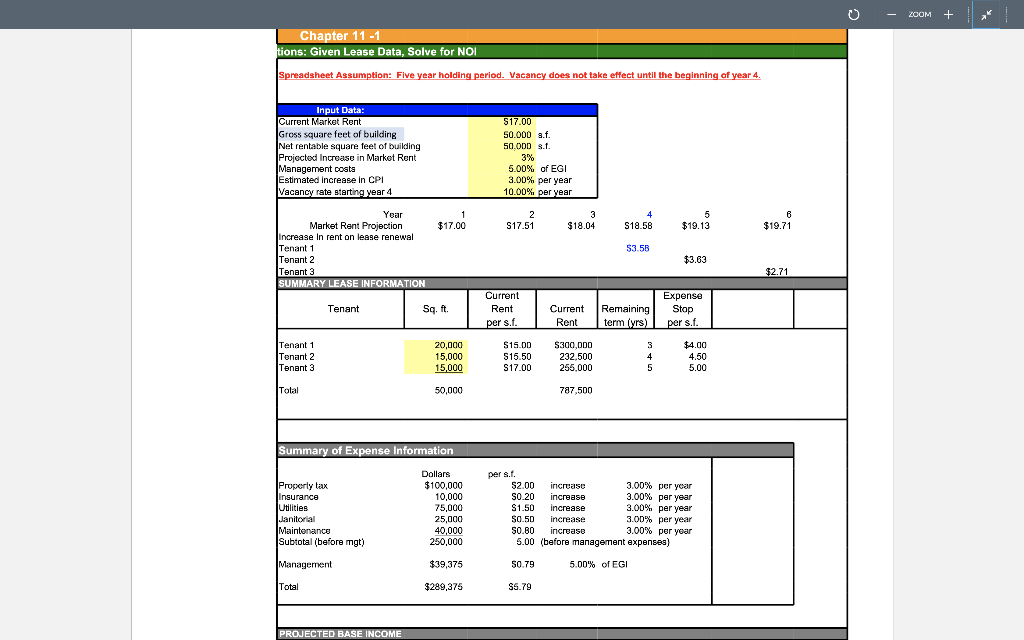

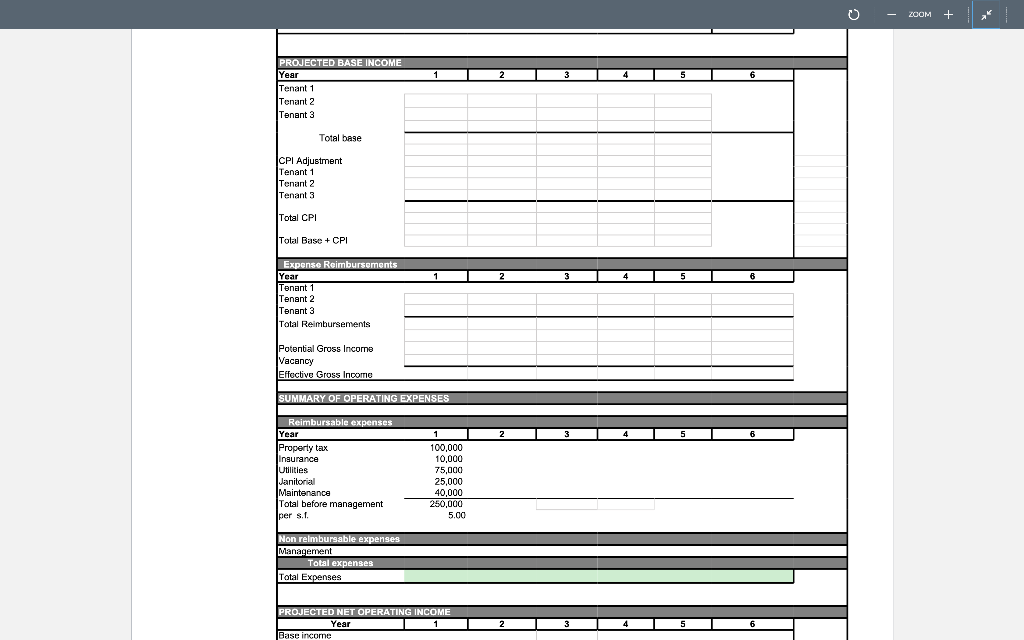

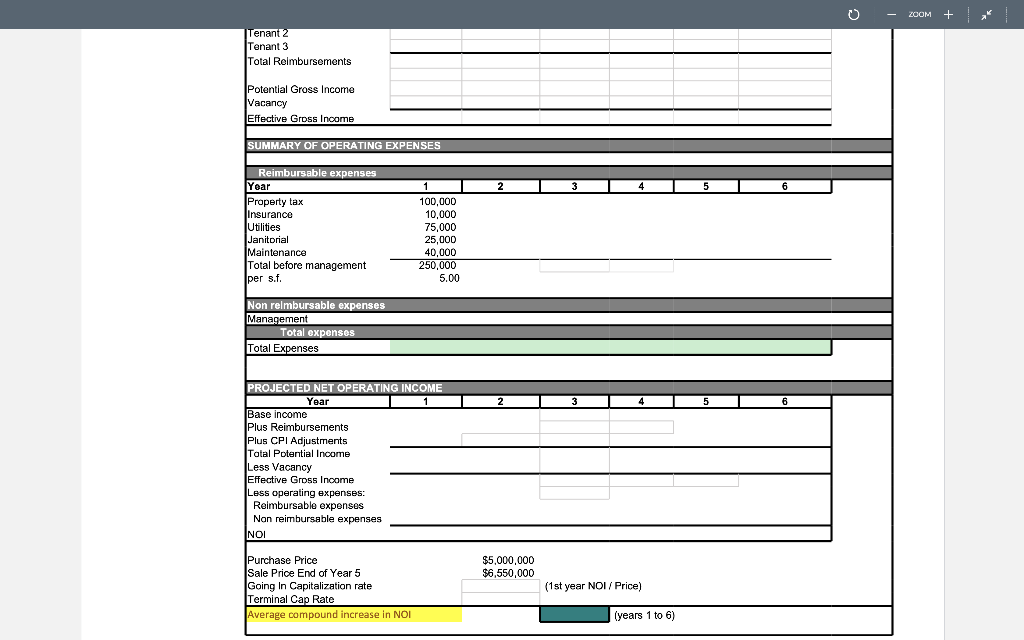

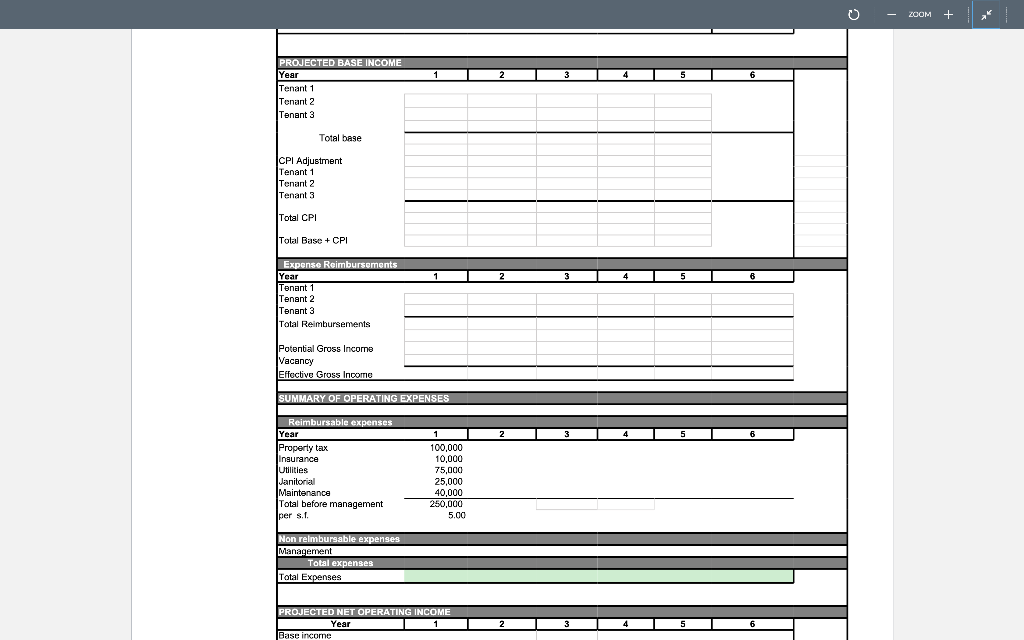

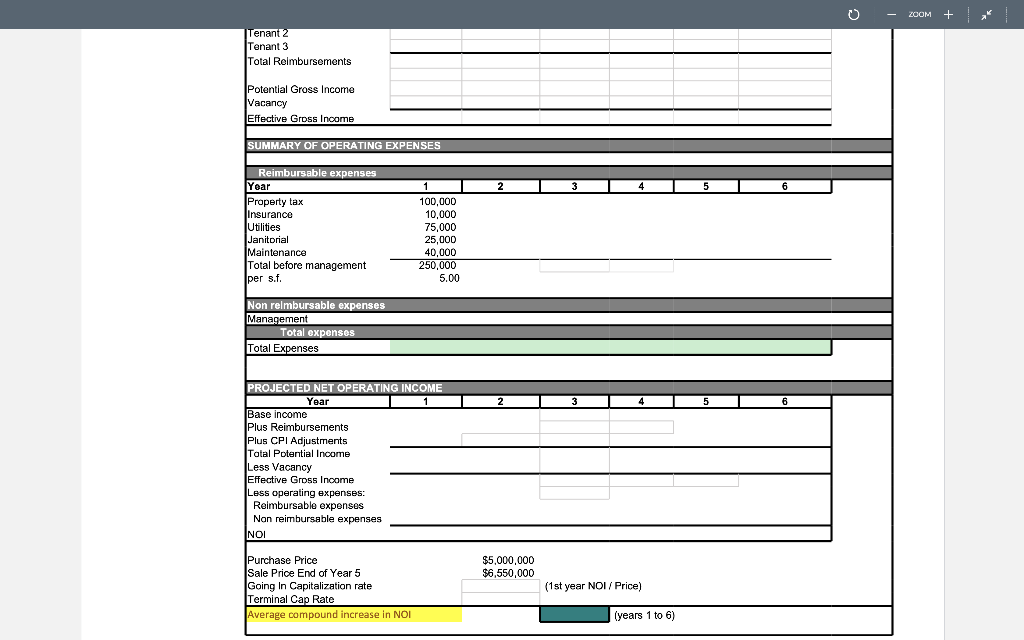

ZOOM + Chapter 11-1 tions: Given Lease Data, Solve for NOI Spreadsheet Assumption: Five year holding period. Vacancy does not take effect until the beginning of year 4 $17.00 Input Data: Current Market Runt Gross square feet of building Net rentable square feet of building Projected Increase in Market Rent Management costs Estimated increase in CPI Vacancy rate starting year 4 50.000 3.f. 50 ODD s.r. 3% 5.00% of EGI 3.00% per year 10.00% per year $17.00 2 S17.51 3 $18.04 4 S18.58 5 $19.13 6 $19.71 Year Market Rent Projection Increase in rent on lease renewal Tenant 1 Tenant 2 Tenant 3 SUMMARY LEASE INFORMATION $3.58 $3.63 $2.71 Tenant Sq. ft. Current Rent per s. Expense Stop Current Rent Remaining term (yrs) per s.r. Tenant 1 Tenant 2 Tenant 3 20,000 15,000 15,000 $15.0D $15.50 S17.00 $300,000 232.500 255.000 3 4 5 $4.00 4.50 5.00 Tolal 50,000 787,500 Summary of Expense Information Property tax Insurance Utilities Janitorial Maintenance Subtotal (before mgt) Dollars $100,000 10,000 75,000 25,000 40,000 250,000 per s.r. 52.00 increase 3.00% per year S0.20 increase 3.00% per year S1.50 increase 3.00% per year $0.50 increase 3.00% per year S0.80 increaso 3.00% per year 5.00 (before management expenses) Management $39,375 50.79 5.00% of EGI Total $289,375 S5.79 PROJECTED BASE INCOME - ZOOM + 1 2 3 5 6 PROJECTED BASE INCOME Year Tenant 1 Tenant 2 Tenant 3 Total base CPI Adjustment ITenant 1 Tenant 2 Tenant 3 Total CPI Total Base + CPI 1 2 3 5 Expense Reimbursements Year Tenant 1 Tenant 2 Tenant 3 Total Reimbursements Potential Gross Income Vacancy Effective Gross Income SUMMARY OF OPERATING EXPENSES 2 5 Reimbursable expenses Year Property tax insurance Utilities Janitorial Maintenance Total before management per s.r. 1 100,000 10,000 75,000 25,000 40,000 250,000 5.00 Non reimbursable expenses Management Total expenses Total Expenses PROJECTED NET OPERATING INCOME Year Base incorne 2 ZOOM + Tenant 2 Tenant 3 Total Reimbursements Potential Gross Income Vacancy Effective Gross Income SUMMARY OF OPERATING EXPENSES 2 3 4 5 6 Reimbursable expenses Year Property tax Insurance Utilities Janitorial I Maintenance Total before management per s.r. 1 100,000 10,000 75,000 25,000 40,000 250,000 5.00 Non relmbursable expenses Management Total expenses Total Expenses 2 3 4 5 6 PROJECTED NET OPERATING INCOME Year Base income Plus Reimbursements Plus CPI Adjustments Tatal Potential Income Less Vacancy Effective Gross Income Less operating expenses: Reimbursable expenses Non reimbursable expenses NOI $5,000,000 $6,550,000 Purchase Price Sale Price End of Year 5 Going In Capitalization rate Terminal Cap Rate Average compound increase in NOI (1st year NOI / Price) (years 1 to 6) ZOOM + Chapter 11-1 tions: Given Lease Data, Solve for NOI Spreadsheet Assumption: Five year holding period. Vacancy does not take effect until the beginning of year 4 $17.00 Input Data: Current Market Runt Gross square feet of building Net rentable square feet of building Projected Increase in Market Rent Management costs Estimated increase in CPI Vacancy rate starting year 4 50.000 3.f. 50 ODD s.r. 3% 5.00% of EGI 3.00% per year 10.00% per year $17.00 2 S17.51 3 $18.04 4 S18.58 5 $19.13 6 $19.71 Year Market Rent Projection Increase in rent on lease renewal Tenant 1 Tenant 2 Tenant 3 SUMMARY LEASE INFORMATION $3.58 $3.63 $2.71 Tenant Sq. ft. Current Rent per s. Expense Stop Current Rent Remaining term (yrs) per s.r. Tenant 1 Tenant 2 Tenant 3 20,000 15,000 15,000 $15.0D $15.50 S17.00 $300,000 232.500 255.000 3 4 5 $4.00 4.50 5.00 Tolal 50,000 787,500 Summary of Expense Information Property tax Insurance Utilities Janitorial Maintenance Subtotal (before mgt) Dollars $100,000 10,000 75,000 25,000 40,000 250,000 per s.r. 52.00 increase 3.00% per year S0.20 increase 3.00% per year S1.50 increase 3.00% per year $0.50 increase 3.00% per year S0.80 increaso 3.00% per year 5.00 (before management expenses) Management $39,375 50.79 5.00% of EGI Total $289,375 S5.79 PROJECTED BASE INCOME - ZOOM + 1 2 3 5 6 PROJECTED BASE INCOME Year Tenant 1 Tenant 2 Tenant 3 Total base CPI Adjustment ITenant 1 Tenant 2 Tenant 3 Total CPI Total Base + CPI 1 2 3 5 Expense Reimbursements Year Tenant 1 Tenant 2 Tenant 3 Total Reimbursements Potential Gross Income Vacancy Effective Gross Income SUMMARY OF OPERATING EXPENSES 2 5 Reimbursable expenses Year Property tax insurance Utilities Janitorial Maintenance Total before management per s.r. 1 100,000 10,000 75,000 25,000 40,000 250,000 5.00 Non reimbursable expenses Management Total expenses Total Expenses PROJECTED NET OPERATING INCOME Year Base incorne 2 ZOOM + Tenant 2 Tenant 3 Total Reimbursements Potential Gross Income Vacancy Effective Gross Income SUMMARY OF OPERATING EXPENSES 2 3 4 5 6 Reimbursable expenses Year Property tax Insurance Utilities Janitorial I Maintenance Total before management per s.r. 1 100,000 10,000 75,000 25,000 40,000 250,000 5.00 Non relmbursable expenses Management Total expenses Total Expenses 2 3 4 5 6 PROJECTED NET OPERATING INCOME Year Base income Plus Reimbursements Plus CPI Adjustments Tatal Potential Income Less Vacancy Effective Gross Income Less operating expenses: Reimbursable expenses Non reimbursable expenses NOI $5,000,000 $6,550,000 Purchase Price Sale Price End of Year 5 Going In Capitalization rate Terminal Cap Rate Average compound increase in NOI (1st year NOI / Price) (years 1 to 6)