Question

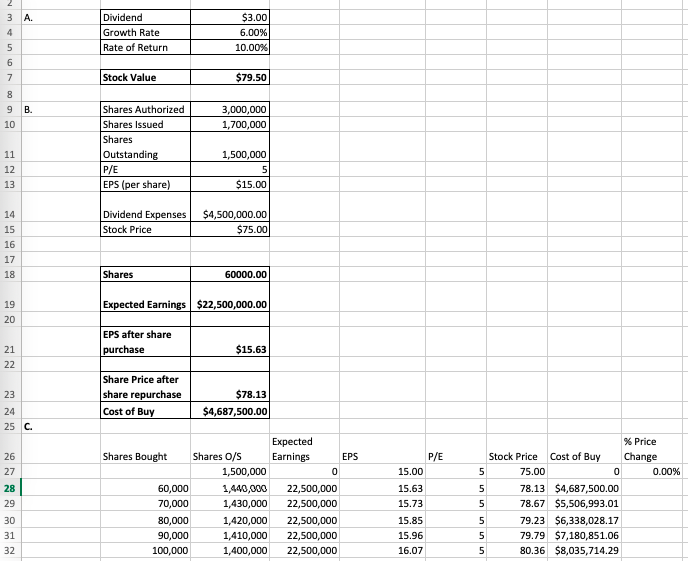

Zoomba Inc. is trying to decide about a cash or stock dividend. Given the table below, fill in the % Price Change, and answer parts

Zoomba Inc. is trying to decide about a cash or stock dividend.

Given the table below, fill in the % Price Change, and answer parts (E) through (G)

(E) If the company choses the cash dividend, what is the PV of the expected outflows for each of the next 11 years (count the current dividend year as year zero + 10 years) if the WACC is 8%?

(F) What is the IRR on a $25,000,000 investment made this year (year 0) to fund the future cash dividends?

(G) If the company cannot fund the project with retained earnings and the cost of debt to fund the project is 4%, should the company take on the project as a way to fund dividends? Explain your response.

3 A. 4 Dividend Growth Rate Rate of Return $3.00 6.00% 10.00% 5 6 7 Stock Value $79.50 8 B. 9 10 3,000,000 1,700,000 Shares Authorized Shares Issued Shares Outstanding P/E EPS (per share) 11 12 13 1,500,000 5 $15.00 Dividend Expenses Stock Price $4,500,000.00 $75.00 14 15 16 17 18 Shares 60000.00 19 20 Expected Earnings $22,500,000.00 EPS after share purchase $15.63 21 22 23 Share Price after share repurchase Cost of Buy $78.13 $4,687,500.00 24 25 C. P/E 26 27 28 29 30 31 32 Expected Shares Bought Shares O/S Earnings EPS 1,500,000 0 60,000 1,490,000 22,500,000 70,000 1,430,000 22,500,000 80,000 1,420,000 22,500,000 90,000 1,410,000 22,500,000 100,000 1,400,000 22,500,000 15.00 15.63 15.73 15.85 15.96 16.07 % Price Stock Price Cost of Buy Change 5 75.00 0 0.00% 5 78.13 $4,687,500.00 5 78.67 $5,506,993.01 5 79.23 $6,338,028.17 5 79.79 $7,180,851.06 5 80.36 $8,035,714.29 3 A. 4 Dividend Growth Rate Rate of Return $3.00 6.00% 10.00% 5 6 7 Stock Value $79.50 8 B. 9 10 3,000,000 1,700,000 Shares Authorized Shares Issued Shares Outstanding P/E EPS (per share) 11 12 13 1,500,000 5 $15.00 Dividend Expenses Stock Price $4,500,000.00 $75.00 14 15 16 17 18 Shares 60000.00 19 20 Expected Earnings $22,500,000.00 EPS after share purchase $15.63 21 22 23 Share Price after share repurchase Cost of Buy $78.13 $4,687,500.00 24 25 C. P/E 26 27 28 29 30 31 32 Expected Shares Bought Shares O/S Earnings EPS 1,500,000 0 60,000 1,490,000 22,500,000 70,000 1,430,000 22,500,000 80,000 1,420,000 22,500,000 90,000 1,410,000 22,500,000 100,000 1,400,000 22,500,000 15.00 15.63 15.73 15.85 15.96 16.07 % Price Stock Price Cost of Buy Change 5 75.00 0 0.00% 5 78.13 $4,687,500.00 5 78.67 $5,506,993.01 5 79.23 $6,338,028.17 5 79.79 $7,180,851.06 5 80.36 $8,035,714.29Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started