A closed-end, commingled opportunity fund is being created with an expected three-year life. It expects to acquire

Question:

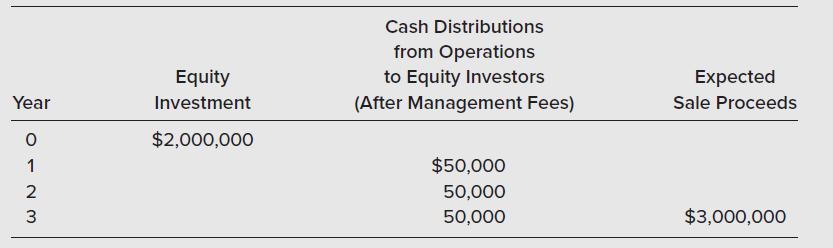

A closed-end, commingled opportunity fund is being created with an expected three-year life. It expects to acquire properties that it expects to turnaround and sell at the end of three years for a gain. It also plans a minimum target return of 10 percent to investors, which will be based on cash distributions from operations and from the sale of properties at the end of the life of the fund. The opportunity fund manager expects to receive a promote equal to 25 percent of cash flows remaining after sale of the assets and after equity investors receive their minimum 10 percent target return. Cash flows are expected as follows: an expected three-year life.

a. What must be the cash flows to equity investors at the end of year 3 in order to achieve their total target 10 percent return on equity investment?

b. How much of the proceeds from property sales must the fund manager receive in order to earn its 25 percent promote?

c. After the equity investors earn their 10 percent target return (IRR) and the fund manager earns the 25 percent promote, how much will be distributed to equity investors?

d. After the promote is paid to the fund manager in year 3, what will be the IRR to equity investors for the three-year investment period?

Step by Step Answer:

Real Estate Finance And Investments

ISBN: 9781264072941

17th Edition

Authors: William Brueggeman, Jeffrey Fisher