Calculate the taxpayers 2021 qualified business income deduction for a qualified trade or business: Filing status: Taxable

Question:

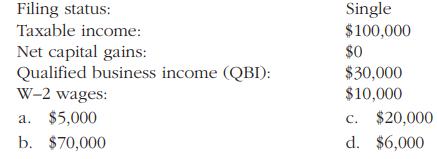

Calculate the taxpayer’s 2021 qualified business income deduction for a qualified trade or business:

Transcribed Image Text:

Filing status: Taxable income: Net capital gains: Qualified business income (QBI): W-2 wages: a. $5,000 b. $70,000 Single $100,000 $0 $30,000 $10,000 c. $20,000 d. $6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Calculation a The taxpayers 2021 qualified business inco...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Answer the following questions regarding the qualified business income deduction under 199A. a. What is the purpose of the qualified business income deduction under 199A? The qualified business...

-

In section 15-3c, the text defines qualified business income. In section 15-5g, the text defines specified service trade or business income, which cannot be treated as qualified business income by...

-

Write a static method lg() that takes an int argument n and returns the largest integer not larger than the base-2 logarithm of n. Do not use the Math library.

-

Suppose you observe the following zero-coupon bond prices per $1 of maturity payment: 0.96154 (1-year), 0.91573 (2-year), 0.87630 (3-year), 0.82270 (4-year), 0.77611 (5-year). For each maturity year...

-

Journalize the following assumed transactions for Shoppers Drug Mart Corporation. Show amounts in millions. Cash purchases of inventory, $3,900 million Sales on account (including credit cards),...

-

A company reports the following for the current year. Its cost of goods manufactured for the current year is a. $1,500. b. $1,700. c. $7,500. d. $2,800. e. $4,700. Finished goods inventory, beginning...

-

A local bank makes automobile loans. It charges 4% per year in the following manner: if$3600 is borrowed to be repaid over a 3-year period, the bank interest charge is $3600 x 0.04 x 3 years = $432....

-

A letter of credit is issued by a bank at the request of an ____ , and states the bank will pay a specified sum of money to a beneficiary, normally the ____ , on presentation of particular, specified...

-

Division A produces a product that it sells to the outside market. It has compiled the following: Variable manufacturing cost per unit $9 Variable selling costs per unit $3 Total fixed manufacturing...

-

In the current year, Barlow moved from Chicago to Miami to start a new job, incurring costs of $1,200 to move household goods and $2,500 in temporary living expenses. Barlow was not reimbursed for...

-

In 2021, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a 179 election with respect to the computer. He does not claim any available...

-

Wilson Distributors is a provider of automotive products. The company recently reported the following: Required Evaluate Wilson Distributors' operations during 2014 in comparison with 2013. Consider...

-

As shown on the attached chart, what is the approximate current 7-year spread premium for Kellogg Bonds? 25 Basis Points 75 Basis Points 200 Basis Points AUS Treasury Actives Curve X-ads Tenor...

-

A pharmaceutical company claims to have invented a new pill to aid weight loss. They claim that people taking these pills will lose more weight than people not taking them. A total of twenty people...

-

Let U = {a, b, c, d, e, f} be the universal set and let A = {a, b, c, d, e, f}. Write the set A. Remember to use correct set notation. Provide your answer below: A=

-

Produce a poster series of three (3) A3 sized posters on creativity in the early years. As a collective the poster series must articulate the importance of aesthetics and creativity for young...

-

Find the second derivative of the function. g(x) = ex In(x) g"(x) = Need Help? Read It

-

Determine the radius of convergence of the following power series. Then test the endpoints to determine the interval of convergence. , (x 1)*

-

Suppose the index goes to 18 percent in year 5. What is the effective cost of the unrestricted ARM?

-

Which company and business model do you think is most likely to dominate the Internet and why ?

-

What difference would it make to a business or to an individual consumer if Apple, Google, or Facebook dominated the Internet experience? Explain your answer.

-

Identify the problem and the control weaknesses described in this case.

-

As a Financial Analyst in the Finance Department of Zeta Auto Corporation they are seeking to expand production. The CFO asks you to help decide whether the firm should set up a new plant to...

-

Chapter 4 When an Auditor finds misstatements in entities financial statements which may be the result of fraudulent act, what should be the role of an auditor under that situation? (2 Points)

-

Suppose the following input prices are provided for each year: Required: $

Study smarter with the SolutionInn App