Mario, a single taxpayer with two dependent children, has the following items of income and expense during

Question:

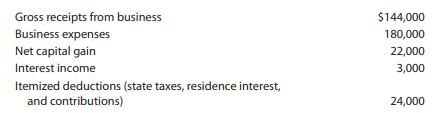

Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2021:

a. Determine Mario’s taxable income for 2021.

b. Determine Mario’s NOL for 2021.

Transcribed Image Text:

Gross receipts from business Business expenses Net capital gain Interest income Itemized deductions (state taxes, residence interest, and contributions) $144,000 180,000 22,000 3,000 24,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

a Taxable income for 2021 is given by Income Gross Receipts Business ...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Mary, a single taxpayer with two dependent children, has the following items of income and expense during 2014: Gross receipts from business ............ $144,000 Business expenses ...................

-

The Miller family has owned several large apartment buildings for many years. They organized Miller Properties, Inc., to own and manage the properties. The corporation is an accrual basis taxpayer...

-

The Viking Corporation has the following items of income for 2016: Operating income ........................................................ $350,000 Dividend income (12%-owned corporations)...

-

What are the premises for successful paleostress analysis?

-

Suppose the S&P 500 index futures price is currently 1200. You wish to purchase four futures contracts on margin. a. What is the notional value of your position? b. Assuming a 10% initial margin,...

-

Five years ago, Bridget decided to purchase a limited partnership interest in a fast-food restaurant conveniently located near the campus of Southeast State University. The general partner of the...

-

When two investment alternatives have the same total expected cash flows but differ in the timing of those flows, which method of evaluating those investments is superior, (a) accounting rate of...

-

At December 31, 2016, Shutdown Manufacturing Limited had outstanding a $300,000, 12% note payable to Thornton National Bank. Dated January 1, 2014, the note was issued at par and due on December 31,...

-

Calculate expected holding period return based on prices. 12 month target price= 291.26 current price=229.19

-

Internet Consulting Service, Inc., adjusts its accounts every month. The company's year-end unad- justed trial balance dated December 31, 2018 follows. (Bear in mind that adjusting entries already...

-

On July 24 of the current year, Trevor Pickard was involved in an accident with his business use automobile. Trevor had purchased the car for $30,000. The automobile had a fair market value of...

-

Valeria and Trey are married and file a joint tax return. For 2021, they have $4,800 of nonbusiness capital gains, $2,300 of nonbusiness capital losses, $500 of interest income, and no itemized...

-

Define the controlling interest in consolidated net income using the t-account or analytical approach.

-

What are the formulae for Static Error coefficient,Speed Error and Acceleration Error in Linear Control Systems?

-

How do we design a solenoid valve?

-

How do individual and group decision processes aid or impede business decision-making?

-

RQ2: What recent advancements have been made in the formulation and use of strategy?

-

Match functions af with Taylor polynomials AF (all centered at 0). Give reasons for your choices. a. 1 + 2x A. p 2 (x) = 1 + 2x + 2x 2 b. 1/1 + 2x B. p 2 (x) = 1 - 6x + 24x 2 c. e 2x C. p 2 (x) = 1 +...

-

Evaluate the line integral, where C is the given curve. C x 2 dx + y 2 dy, C consists of the arc of the circle x 2 + y 2 = 4 from (2, 0) to (0, 2) followed by the line segment from (0, 2) to (4, 3)

-

Calculate the 2015 AMT exemption amount for the following cases for a married taxpayer filing jointly, and for a married taxpayer filing separately. Case ___________________ AMTI 1...

-

Lisa holds 2015 nonrefundable Federal income tax credits of $65,000. Her regular income tax liability before credits is $190,000, and her tentative minimum tax is $150,000. a. What is the amount of...

-

Angela, who is single, incurs circulation expenditures of $153,000 during 2015. She is deciding whether to deduct the entire $153,000 or to capitalize it and elect to deduct it over a three-year...

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

Stock in ABC has a beta of 0.9. The market risk premium is 8%, and T-bills are currently yielding 5%. The company's most recent dividend is $1.60 per share, and dividends are expected to grow at a 6%...

Study smarter with the SolutionInn App