The Tiller family has an adjusted gross income of $200,000 in 2020. The Tillers have two children,

Question:

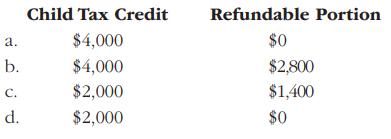

The Tiller family has an adjusted gross income of $200,000 in 2020. The Tillers have two children, ages 12 and 13, who qualify as dependents. All of the Tillers’ income is from wages. What is the Tillers’ child tax credit, and what portion of their child tax credit is refundable?

Transcribed Image Text:

a. b. C. d. Child Tax Credit $4,000 $4,000 $2,000 $2,000 Refundable Portion $0 $2,800 $1,400 $0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Solution The Tiller children have a total of 500 in personal exemptions an...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

The Tiller family has an adjusted gross income of $200,000. The Tillers have two children, ages 12 and 13, who qualify as dependents. All of the Tillers income is from wages. What is the Tillers...

-

Tony and Jeannie Nelson are married and file a joint return. They have four children whose ages are: 12,15,19 & 23. The three youngest live at home with their parents and qualify as their...

-

1. Russ and Linda are married and file a joint tax return claiming their three children, ages 4, 7, and 18, as dependents. Their adjusted gross income for 2014 is $105,300. What is Russ and Lindas...

-

Suppose that, in an attempt to raise more revenue, Nowhere State University (NSU) increases its tuition. Will this necessarily result in more revenue? Under what conditions will revenue (a) rise, (b)...

-

Suppose that ln(S) and ln(Q) have correlation =0.3 and that S(0) = $100, Q(0) = $100, r = 0.06, S = 0.4, and Q = 0.2. Neither stock pays dividends. Use equation (20.38) to find the price today of...

-

John died in 2016. What amount, if any, was included in his gross estate in each of the following situations: a. In 1997, John created a revocable trust, funded it with $400,000 of assets, and named...

-

From the valuation bases used on the balance sheet, provide an example of conservatism.

-

Sean Browne owns and manages a computer repair service, which had the following trial balance on December 31, 2016 (the end of its fiscal year). Summarized transactions for January 2017 were as...

-

Compute the discounted payback statistic for Project D if the appropriate cost of capital is 11 percent and the maximum allowable discounted payback is four years. (Do not round intermediate...

-

What factors may explain the apparent contradiction between the EEOC litigation and the Diversity Business Practices Global Leadership Award received by L'Oreal?

-

Casey is a U.S. citizen employed by a multinational corporation at its London office. Casey is married to Michael, a British citizen, and they reside in England. Michael receives substantial rent...

-

Mark and Lisa were divorced in 2020. In 2021, Mark has custody of their children, but Lisa provides nearly all of their support. Who is entitled to claim the children as dependents?

-

How can a firms managers influence market risk as reflected in beta?

-

The English statistician Karl Pearson (1857-1936) introduced a formula for the skewness of a distribution. P = 3 ( x median ) s Pearson's index of skewness Most distributions have an index of...

-

You are to specify an orifice meter for measuring the flow rate of a $35^{\circ} \mathrm{API}$ distillate $(\mathrm{SG}=0.85$ ) flowing in a $2 \mathrm{in}$. sch 160 pipe at $70^{\circ} \mathrm{F}$....

-

Let $\theta$ and $\phi$ be the polar coordinates. Introduce the complex numbers $z$ and $\bar{z}$, where $$\begin{equation*} z=e^{i \phi} \tan (\theta / 2) \equiv \xi+i \eta \tag{5.393}...

-

Suppose the profit \(P\) (in dollars) of a certain item is given by \(P=1.25 x-850\), where \(x\) is the number of items sold. a. Graph this profit relationship. b. Interpret the value of \(P\) when...

-

(a) Draw a simplified ray diagram showing the three principal rays for an object located outside the focal length of a diverging lens. (b) Is the image real or virtual? (c) Is it upright or inverted?...

-

Find the slope of the line tangent to the following polar curves at the given points. At the points where the curve intersects the origin (when this occurs), find the equation of the tangent line in...

-

Which of the following raises the credibility of areport? Which of the following raises the credibility of a report? Multiple Choice avoiding predictions avoiding the use of cause-effect statements...

-

Cite two examples of business products that require a substantial amount of service in order to be useful.

-

Explain why a new law office might want to lease furniture rather than buy it.

-

Would you expect to find any wholesalers selling the various types of business products? Are retail stores required (or something like retail stores)?

-

On February 1, 2021, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,600,000. During 2021, costs of $2,200,000 were incurred with...

-

Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons...

-

Stockholders do not have the power to bind the corporation to contracts. This is referred to as lack of mutual agency. True false question. True False

Study smarter with the SolutionInn App