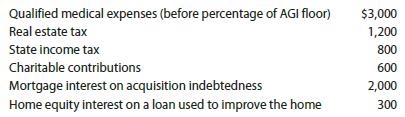

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions

Question:

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions for Betty:

What are the itemized deductions allowed for the AMT?

a. $2,500

b. $2,900

c. $3,400

d. $3,700

Transcribed Image Text:

Qualified medical expenses (before percentage of AGI floor) $3,000 Real estate tax 1,200 State income tax 800 Charitable contributions 600 Mortgage interest on acquisition indebtedness Home equity interest on a loan used to improve the home 2,000 300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

To determine the itemized deductions allowed for the alternative minimum tax AMT we need to make adj...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Betty is age 34 and has AGI of $50,000 and regular taxable income of $35,000. The following items may qualify as itemized deductions for Betty: What is the alternative minimum taxable income (AMTI)?...

-

The following items may appear on a bank statement: 1. Bank correction of an error from recording a $4,800 deposit as $8,400 2. EFT payment 3. Note collected for company 4. Service charge Using the...

-

The following items may appear on a ban statement: 1. EFT payment 2. Note collected for company 3. Bank correction of an error from recording a $7,200 deposit as $2,700 4. Service charge using the...

-

You will act as a senior HR manager of a very large, publicly traded company known as XYZ Inc. The CEO of XYZ Inc. has asked you to prepare an important orientation presentation for the global HR...

-

Develop two approaches using reference group theory to reduce drug, alcohol, or cigarette consumption among teenagers.

-

How has the Sarbanes-Oxley Act had a significant impact on corporate governance?

-

Under communism, religion was frowned on in the countries of Eastern Europe. Do these countries remain less religious than the countries of Western Europe? Use the WVS variable RELPERSON in a t -test...

-

North Mark (NM) owns vast amounts of corporate bonds. Suppose that on June 30, 2012, NM buys $800,000 of CitiSide bonds at a price of 102. The CitiSide bonds pay cash interest at the annual rate of...

-

(ii) Show that amun = ant un tum "Am

-

Jason receives semiannual annuity checks of $4,500. Jason purchased the annuity five years ago for $110,000 when his expected return under the annuity was $200,000. How much of Jasons total annual...

-

Indigo, Inc., a closely held C corporation, incurs the following income and losses. a. Calculate Indigos taxable income. b. Would the answer in part (a) change if the passive loss was $320,000 rather...

-

In an e-mail to your instructor, outline an AMT planning opportunity not mentioned in the chapter. In the e-mail, discuss the feasibility of the suggested planning opportunity.

-

A 40-kg package is at rest on an incline when a force P is applied to it. Determine the magnitude of P if 4 s is required for the package to travel 10 m up the incline. The static and kinetic...

-

Silver Company makes a product that is very popular as a Mothers Day gift. Thus, peak sales occur in May of each year, as shown in the companys sales budget for the second quarter given below: April...

-

Among the following statements, select the ones which have a positive environmental impact. Choose several answers Minimising the impact of a product on the environment Avoiding the destruction of a...

-

Developing Financial Statements: All organizations, including those in the healthcare industry, need to make money to be profitable and survive. Financial statements, such as balance sheets, profit...

-

The engineers estimated that on average, fuel costs, assuming existing routes and number of flights stay the same, would decrease by almost 18% from an average of 42,000 gallons of jet fuel per...

-

It's the latest Berkeley trend: raising chickens in a backyard co-op coop. (The chickens cluck with delight at that joke.) It turns out that Berkeley chickens have an unusual property: their weight...

-

During certain periods, Yang Company invests its excess cash until it is needed. During 2010 and 2011, Yang engaged in these transactions: 2010 Jan. 16 Invested $146,000 in 120-day U.S. Treasury...

-

Imagine that your best friend knows you are taking a psychology course and wonders what psychology is all about. How would you define psychology for your friend? Write an essay on the discipline of...

-

Consider the following tax rate structure. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not? Taxpayer Salary Total Tax...

-

Consider the following tax rate structure. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not? Taxpayer Salary Total Tax...

-

Consider the following tax rate structure. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not? Taxpayer Salary Total Tax...

-

Al preparar el estado de resultados pro forma, cules de las siguientes partidas se deducen de las utilidades brutas para llegar a las ganancias despus de impuestos? Pregunta de seleccin mltiple....

-

Lawson Inc. is expanding its manufacturing plant, which requires an investment of $4 million in new equipment and plant modifications. Lawson's sales are expected to increase by $3 million per year...

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

Study smarter with the SolutionInn App