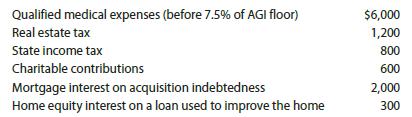

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions

Question:

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions for Betty:

What is the itemized deduction add-back for the AMT?

a. $2,000

b. $2,800

c. $3,800

d. $8,800

Transcribed Image Text:

Qualified medical expenses (before 7.5% of AGI floor) $6,000 Real estate tax 1,200 State income tax 800 Charitable contributions 600 Mortgage interest on acquisition indebtedness Home equity interest on a loan used to improve the home 2,000 300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (18 reviews)

To calculate the itemized deduction addback for the AMT we need to add back any deductions ...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Betty is age 34 and has AGI of $50,000 and regular taxable income of $35,000. The following items may qualify as itemized deductions for Betty: What is the alternative minimum taxable income (AMTI)?...

-

The following items may appear on a bank statement: 1. Bank correction of an error from recording a $4,800 deposit as $8,400 2. EFT payment 3. Note collected for company 4. Service charge Using the...

-

The following items may appear on a ban statement: 1. EFT payment 2. Note collected for company 3. Bank correction of an error from recording a $7,200 deposit as $2,700 4. Service charge using the...

-

Molybdenum forms a substitutional solid solution with tungsten. Compute the weight percent of molybdenum that must be added to tungsten to yield an alloy that contains 1.0 10 22 Mo atoms per cubic...

-

Could Asch-type situation be used to sell the product or activity?

-

What is the role of the internal auditor in systems development?

-

Do groups of countries differ on their confidence in banks? Using WVS data, run an ANOVA using the COUNTRY6CAT and CONBANKS variables. Then, by selecting cases, remove the set of countries with the...

-

On January 1, 2018, Nguyen Electronics leased equipment from Nevels Leasing for a four-year period ending December 31, 2021, at which time possession of the leased asset will revert back to Nevels....

-

Variable and Absorption Costing Three Products Winslow Inc. manufactures and sells three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as...

-

The Cotswold Limestone Company produces thin limestone sheets that are used for the facings on buildings. As can be seen in the contribution margin statement, last year the company had a net profit...

-

In an e-mail to your instructor, outline an AMT planning opportunity not mentioned in the chapter. In the e-mail, discuss the feasibility of the suggested planning opportunity.

-

Which of the following statements is most correct? a. Tax preference items for the alternative minimum tax are always added back to regular taxable income. b. Itemized deductions that are added back...

-

Find the indefinite integral xexdx as in Example 4.3.9. In Examples 4.3.9 and 4.3.10, we chose the constant c = 0 when finding v(x). Follow the steps for integration by parts, but leave c as an...

-

Why is it critical to immediately contact your Engagement Partner when you suspect or identify non-compliance? He or she will ensure that the non-compliance doesn't affect the Client's reputation He...

-

Question 9: Determine the current and its direction, in each resistor, for the circuit shown below. Show your calculations. R=152 9.0 V + 12V ww R=75 2 R3= 50

-

how can The High - Tech Way To Recycle Clothes sustainable. and what they offer and what are their ecofriendly

-

James Bondbuyer purchases a Treasury bond on Monday, May 2, regular way settlement. The bond pays interest on January 15 and July 15. How many days of accrued interest will be owed to the seller? A...

-

Aviation and air traffic control have come a long way in the last 100-years. Some believethat we have reached a plateau and that growth in aviation will stop. Aviation may go the way of the railroads...

-

The balance sheets of Ola and Jake Companies as of December 31, 2010, appear below. Assume that Ola Company purchased 100 percent of Jakes common stock for $350,000 immediately prior to December 31,...

-

Refrigerant-134a enters an adiabatic compressor as saturated vapor at 120 kPa at a rate of 0.3 m3/min and exits at 1-MPa pressure. If the isentropic efficiency of the compressor is 80 percent,...

-

Paolo is a 50% partner in the Capri Partnership and has decided to terminate his partnership interest. Paolo is considering two options as potential exit strategies. The first is to sell his...

-

In year 2, Julio and Milani each received distributions of $25,000 from Falcons Corporation. a. What amount of ordinary income and separately stated items are allocated to them for year 2 based on...

-

Meg works for Freedom Airlines in the accounts payable department. Meg and all other employees receive free flight benefits (for the employee, family, and 10 free buddy passes for friends per year)...

-

3. How much life insurance do you need? Calculating resources - Part 2 Aa Aa E Paolo and Maria Rossi have completed Step 1 of their needs analysis worksheet and determined that they need $2,323,000...

-

On March 1, LGE asks to extend its past-due $1,200 account payable to Tyson, Tyson agrees to accept $200 cash and a 180-day, 8%, $1,000 note payable to replace the account payable. (Use 360 days a...

-

*Prepare the plant assets section of Amphonie's balance sheet at December 31, 2021 using the information below. At December 31, 2020, Amphonie Company reported the following as plant assets. Land $...

Study smarter with the SolutionInn App