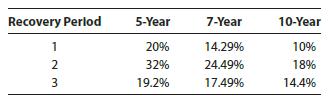

Data, Inc., purchased and placed in service a $5,000 compute on August 24, year 3. This is

Question:

Data, Inc., purchased and placed in service a $5,000 compute on August 24, year 3. This is the only asset purchase during the year. Code § 179 expensing and bonus depreciation were not elected. The computer was sold during year 5. Using the excerpt of the MACRS half-year convention table below, what is the MACRS depreciation in year 5 for the computer?

a. $360

b. $437

c. $480

d. $960

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted: