Wood Corporation was a C corporation in 2018 but elected to be taxed as an S corporation

Question:

Wood Corporation was a C corporation in 2018 but elected to be taxed as an S corporation in 2019. At the end of 2018, its earnings and profits were $15,500.

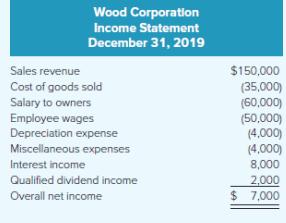

The following table reports Wood Corp.’s (taxable) income for 2019 (its first year as an S corporation)

What is Wood Corporation’s excess net passive income tax for 2019?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

McGraw Hills Essentials Of Federal Taxation 2020 Edition

ISBN: 9781260433128

11th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: