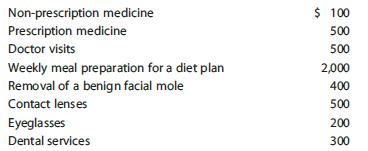

Aaron, age 55, has an adjusted gross income in 2016 of $30,000. His expenses are as follows:

Question:

Aaron, age 55, has an adjusted gross income in 2016 of $30,000. His expenses are as follows:

What is Aaron’s itemized deduction for medical expenses?

a. $0

b. $1,500

c. $2,000

d. $4,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To calculate Aarons itemized deduction for medical expen...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Multiple Choice Questions 1. Walters, an individual, received the following in 2016: W-2 income .........................................................................$10,000 Federal tax refund for...

-

1- How might a taxpayer postpone or delay the recognition of income? 2-Are there advantages to leasing rather than buying assets? 3-How can donating appreciated stock to a charitable organization,...

-

1. The current income tax system was: a. Designed solely to raise money to run the government b. Authorized by the founding fathers when the government was formed c. Not designed with social...

-

Asset allocation explains a large portion of a portfolio return. However, the implementation issues involved inthe asset allocation process may reduce the efficiency of the asset allocation strategy,...

-

River Corporation, the investment banking company, often has extra cash to invest. Suppose River buys 600 shares of Eathen, Inc., stock at $40 per share. Assume River expects to hold the Eathen stock...

-

How can the purchase of treasury stock be equivalent to a dividend?

-

. How could the drum buffer concepts from Critical Chain Portfolio Management be applied to this problem? Jack Palmer, head of the Special Projects Division for Ramstein Products, had been in his new...

-

Robert in Chicago entered into a contract to sell certain machines to Terry in New York. The machines were to be manufactured by Robert and shipped F.O.B. Chicago not later than March 25. On March...

-

Cash Budget The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: May June July...

-

Kellye, a teacher, volunteers for eight hours per week at a school for high-risk children, a qualified charitable organization. Kellyes normal rate for teaching is $30 per hour. Kellyes out-of-pocket...

-

Compare the thickness required for a 2 m diameter flat plate, designed to resist a uniform distributed load of 10 kN/m 2 , if the plate edge is a. Completely rigid; b. Free to rotate. Take the...

-

What is an affinity marketing program?

-

15.5 please help will give like if answers r correct Exercise 15-8 (Static) Sales-type lease with selling profit; lessor; calculate lease payments [LO15-3] Manufacturers Southern leased high-tech...

-

When my son was young, he had 8 different plastic dinosaurs to arrange. How many ways could he arrange his 8 dinos? He had favorite dinos, so placing them in proper order was very important. How many...

-

Process P1 init (mutEx); num = 0; loop1 = 0; while (loop1 < 3) wait (mutEx); num num + 1; signal (mutEX); loop1 loop1 + 1; Process P2 loop2 = 0; while (loop2 < 2) wait (mutEx); num num + 10;...

-

PROBLEM 3-5B Following is the chart of accounts of Smith Financial Services: Assets 111 Cash 113 Accounts Receivable 115 Supplies 117 Prepaid Insurance 124 Office Furniture Liabilities 221 Accounts...

-

4. Identify a service you could refer Casey to and write a referral for her (up to 300 words).

-

Use the data from Exercise 5 and find the equation of the regression line. Then find the best predicted value of the DJIA in the year 2004, when the sunspot number was 61. How does the result compare...

-

1. What are some current issues facing Saudi Arabia? What is the climate for doing business in Saudi Arabia today? 2. Is it legal for Auger's firm to make a payment of $100,000 to help ensure this...

-

Find the monthly mortgage payments on the following mortgage loans using either your calculator or the table in Exhibit: a. $80,000 at 6.5 percent for 30 years b. $105,000 at 5.5 percent for 20 years...

-

Use Worksheet 5.2. Aurelia Montenegro is currently renting an apartment for $725 per month and paying $275 annually for renters insurance. She just found a small town-house that she can buy for...

-

Use Worksheet 5.3. Jennie and Caleb McDonald need to calculate the amount that they can afford to spend on their first home. They have a combined annual income of $47,500 and have $27,000 available...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App