Adams, Beck, and Carr organized Flexo Corp, with authorized voting common stock of $100,000. Adams received 10%

Question:

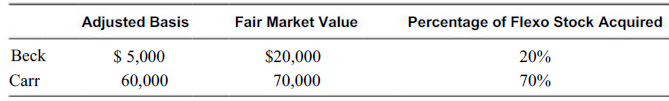

Adams, Beck, and Carr organized Flexo Corp, with authorized voting common stock of $100,000. Adams received 10% of the capital stock in payment for the organizational services that he rendered for the benefit of the newly formed corporation. Adams did not contribute property to Flexo and was under no obligation to be paid by Beck or Carr. Beck and Carr transferred property in exchange for stock as follows:

What amount of gain did Carr recognize from this transaction?

a. $40,000

b. $15,000

c. $10,000

d. $0

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: