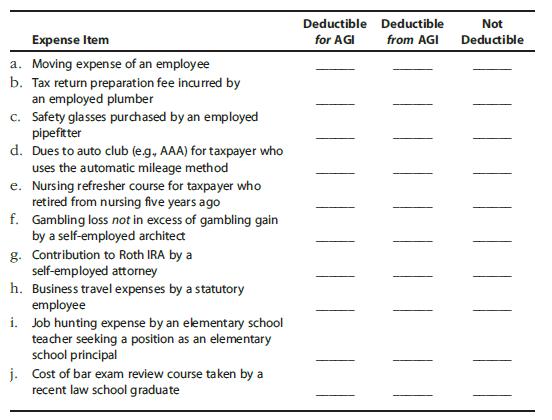

Complete the following table by classifying each of the independent expenditures (assume that no reimbursement takes place).

Question:

Complete the following table by classifying each of the independent expenditures (assume that no reimbursement takes place).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Expense Item Deductible for AGI Deductible from AGI Not Deductible a Moving expenses of an employee Yes Yes No b Tax return preparation fee incurred by an employed plumber No No Yes c Safety glasses purchased by an employed pipefitter Yes Yes No d Dues to auto club eg AAA for the taxpayer who uses the automatic mileage method Yes Yes No e Nursing refresher course for taxpayers who retired from nursing five years ago No No Yes f Gambling loss not in excess of gambling gain by a selfemployed architect Yes No No g Contribution to Roth IRA by a selfemployed attorney No No Yes h Business travel expenses by a statutory employee Yes No No i Job hunting expense ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Complete the following table by classifying each of the independent expenditures (assume that no reimbursement takes place). Deductible Deductible Not Expense ltem Moving expense of an employee for...

-

Complete the following table by indicating whether the transactions or economic events would increase, decrease, or have no effect on the financial ratios listed. Assume that the current ratio is...

-

Come up with two mentally-stimulating questions pertaining to the effects of economic inequality, answerable by yes or no or true/false. Give a reason/ explanation why more people may lean on a...

-

The Kc for the following reaction is 9.30 X 10^-2 at 25C:PCl5(g) <-> PCl3(g) + Cl2(g) How many moles & grams of PCl5 must be added to a 2-literflask to obtain a Cl2 concentration of 0.150M...

-

Little Kona is a small coffee company that is considering entering a market dominated by Big Brew. Each companys profit depends on whether Little Kona enters and whether Big Brew sets a high price or...

-

Why is the fit between the community and tourism important? LO.1

-

What are the steps involved in planning an ad campaign?

-

Does It Matter Where You Sell? Some marketers feel that the image of the particular channel in which they sell their products does not matterall that matters is that the right customers shop there...

-

d. Present the assets in the statement of financial position On January 1, 2017, Epitome Company acquired the following c. Prepare journal entry to record the piecemeal realization b. Prepare journal...

-

Elijah is employed as a full-time high school teacher. The school district where he works recently instituted a policy requiring all of its teachers to start working on a masters degree. Pursuant to...

-

Addison Parker, single and age 32, lives at 3218 Columbia Drive, Spokane, WA 99210. She is employed as regional sales manager by VITA Corporation, a manufacturer and distributor of vitamins and food...

-

Explain how businesses can benefit from autonomic computing, virtualization, green computing, and multicore processors.

-

On October 1, Deloitte \& Coopers Price started a consulting firm. The asset, liability, and stockholders' equity account balances after each of the firm's first six transactions are shown below....

-

On June 1, a group of bush pilots in British Columbia, Canada, formed the Adventure Airlines, Inc., by selling \(\$ 51,000\) of common stock for cash. The group then leased several aircraft and...

-

During the first year of operation, 2011, Martin's Appliance recognized \$292,000 of service revenue on account. At the end of 2011 , the accounts receivable balance was \(\$ 57,400\). Even though...

-

During May, Willett Corp. purchased direct materials for 4,250 units at a total cost of \($61,625\). Willetts standard direct materials cost is \($14\) per unit. Prepare the journal entry to record...

-

Determine a positive real root of this equation using appropriate software: \[ 3.5 x^{3}-10 x^{0.5}-3 x=-4 \]

-

On January 1, 2017, Hillock Brewing Company sold 50,000 bottles of beer to various customers for $45,000 using credit terms of 3/10, n/30. These credit terms mean that customers receive a cash...

-

g(x) = x 5 5x 6 a. Show that g(x) = 0 has a root, , between x = 1 and x = 2. b. Show that the equation g(x) = 0 can be written as x = (px + q) 1/r , where p, q and r are integers to be found. The...

-

Rise Above This, Inc., has an average collection period of 33 days. Its average daily investment in receivables is $42,300. What are annual credit sales? What is the receivables turnover? Assume 365...

-

Essence of Skunk Fragrances, Ltd., sells 8,200 units of its perfume collection each year at a price per unit of $430. All sales are on credit with terms of 1y10, net 40. The discount is taken by 60...

-

Devour, Inc., is considering a change in its cash only sales policy. The new terms of sale would be net one month. Based on the following information, determine if Devour should proceed or not....

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App