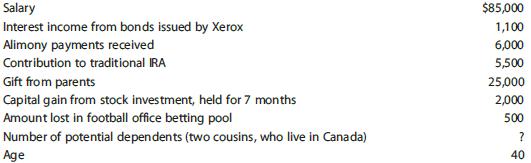

Compute Emilys 2016 taxable income on the basis of the following information. Her filing status is single.

Question:

Compute Emily’s 2016 taxable income on the basis of the following information. Her filing status is single.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

To compute Emilys taxable income for 2016 we need to consider her income deductions and any potentia...View the full answer

Answered By

BRIAN MUSINGA

I possess a Bachelors of Commerce degree(Marketing option) and am currently undertaking an MBA in marketing. I believe that I possess the required knowledge and skills to tutor in the subject named. I have also written numerous research academic papers much to the satisfaction of clients and my professors.

5.00+

2+ Reviews

17+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Compute the taxable income for 2017 for Emily on the basis of the following information. Her filing status is single. Salary...

-

Compute Aiden's 2016 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years. Salary...

-

Compute the taxable income for 2014 for Emily on the basis of the following information. Her filing status is single. Salary ............................... $85,000 Interest income from bonds issued...

-

Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on buildings and equipment, $17,500...

-

The April transactions of Wise Company are described in Problem 7-1A. Required 1. Prepare a general journal, a purchases journal like that in Exhibit 7.9 and a cash disbursements journal like that in...

-

CAN IT REALLY BE HARD TO STOP CURSING?

-

15. The profit calculation in the chapter assumes that you borrow at a fixed interest rate to finance investments. An alternative way to borrow is to short-sell stock. What complications would arise...

-

Information related to Miracle Company for 2015 is summarized below. Total credit sales ..............$1,000,000 Accounts receivable at December 31 ...... 369,000 Bad debts written off ...............

-

Required: a. Joumalize the transactions under the direct write-olf method. b. Joumalize the transactions under the allowance method. Shipway Company uses the percent of credi sales mothod of...

-

During 2025, Kate Holmes Co.s first year of operations, the company reports pretax financial income at $250,000. Holmess enacted tax rate is 45% for 2025 and 20% for all later years. Holmes expects...

-

Paul and Sonja, who are married, reported 2016 itemized deductions of $8,200 and $400, respectively. Paul suggests that they file their Federal income tax returns separatelyhe will itemize his...

-

Determine the amount of the 2016 standard deduction allowed in the following independent situations. In each case, assume that the taxpayer is claimed as another persons dependent. a. Curtis, age 18,...

-

Choose one of the following firms and identify which marketing channel or channels you think would be best for its goods or services. Then explain the market factors, product factors, and...

-

Use Table 19-4 to calculate the building, contents, and total property insurance premiums for the policy (in $). Area Structural Rating Class Building Value 4 B $86,000 $ Building Premium Contents...

-

What are some reasons why leadership theory has evolved? Which theory of leadership is most applicable to today's organizations? Identify a leader that you admire and answer the following: What makes...

-

Identifying one major OSHA standard and one EPA law that are important to aviation and discussing how each has improved aviation safety

-

What is network optimization and what are some of the best practices that are used in the industry to optimize networks? Also, why is network documentation important and what are the security...

-

Demonstrate your understanding of data types by examining a public dataset and identifying the NOIR analytical data types of each of the data field (variables). This skill will be used frequently in...

-

The night manager of Willis Transportation Service, who had no accounting background, prepared the following balance sheet for the company at February 28, current year. The dollar amounts were taken...

-

Solve for the equilibria of the following discrete-time dynamical systems Pr pt+1 = Pr+2.0(I-Pr)

-

During 2016, Siskin Corporation (a C corporation) had the following transactions: Income from operations ................................................................................... $500,000...

-

Auburn Company manufactures and sells furnishings for hospitals (e.g., special needs bathroom fixtures). In the current year, it donates some of its inventory to a newly constructed hospice. The...

-

Tern Corporation manufactures a motor scooter at a cost of $5,000 and sells it to Snipe Corporation for $7,000. Snipe spends $2,000 marketing the scooter and sells it to the general public for...

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App