Daniel, age 38, is single and has the following income and expenses in 2022: a. Calculate Daniels

Question:

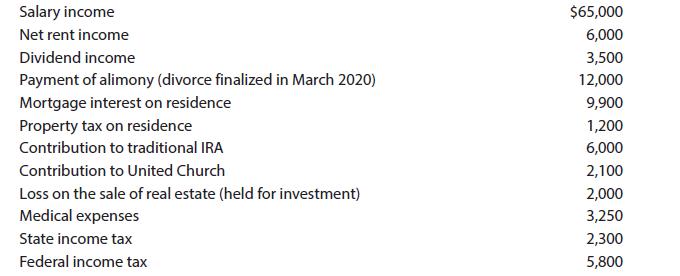

Daniel, age 38, is single and has the following income and expenses in 2022:

a. Calculate Daniel’s AGI.

b. Should Daniel itemize his deductions from AGI or take the standard deduction? Explain.

Transcribed Image Text:

Salary income Net rent income Dividend income Payment of alimony (divorce finalized in March 2020) Mortgage interest on residence Property tax on residence Contribution to traditional IRA Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax $65,000 6,000 3,500 12,000 9,900 1,200 6,000 2,100 2,000 3,250 2,300 5,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

a b Because the standard deduction for 2022 12950 is less than Daniels itemized deduct...View the full answer

Answered By

Swapnil Kumari

Myself Swapnil kumari.I have completed my Master’s in Microbiology with 70% from Bangalore University and Bachelor’s in Biotechnology with 80% from Jiwaji University. I won many Prizes in School, Inter school, District, State Chess Tournament and also played National Levels. I won Prizes at State and National Art and Painting Competitions and University Dance competition. I worked in CCIVA as a Director, Operations in USA and Center Head in Crayon International. My Hobbies is Reading Books, teaching, writing, Playing Chess, Dancing, Painting and traveling.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Daniel, age 38, is single and has the following income and expenses in 2021: Salary income $135,000 Net rent income 5,500 Dividend income 1,100 Payment of alimony (divorce finalized in March 2019)...

-

Daniel, age 38, is single and has the following income and expenses in 2014. Salary income .................................................................. $60,000 Net rent income...

-

Daniel, age 38, is single and has the following income and expenses in 2016. Salary income ......................................................................$60,000 Net rent income...

-

Saeed does not keep proper books of account for his business but he has provided the following details of his assets and liabilities. Further information 1. Land and buildings have been revalued at...

-

Describe a technique you use to help you complete the activity Get to class on time. What are some tools you use with the technique?

-

Six-month T-bills have a nominal rate of 7 percent, while default-free Japanese bonds that mature in 6 months have a nominal rate of 5.5 percent. In the spot exchange market, one yen equals SO. 009.'...

-

Define each of the following in your own words and as a formula: a. Annual ordering cost. b. Annual carrying cost. c. Total annual cost. LO.1

-

The historical returns on a portfolio had an average return of 8 percent and a standard deviation of 12 percent. Assume that returns on this portfolio follow a bell-shaped distribution. a. What...

-

In January of 2019, Carol Brady is trying to decide if she should purchase a new vehicle for her business, We Are Brady, Inc. Carol has asked you to calculate the amount of depreciation that she will...

-

The Purdue Pegboard Task is a standard test for motor skills. It consists of a board with a series of holes and pegs, stored in depressions at the top of the board (shown below). One version of a...

-

Duck, an accrual basis corporation, sponsored a rock concert on December 29, 2022. Gross receipts were $300,000. The following expenses were incurred and paid as indicated: Because the coliseum was...

-

Classify each of the following expenditures paid in 2022 as a deduction for AGI, a deduction from AGI, or not deductible: a. Barak contributes to his H.R. 10 plan (i.e., a retirement plan for a...

-

Are Carbon or Steel Bikes Faster? Dr. Jeremy Groves was interested in whether his carbon bike or his steel bike led to a shorter commute time. To answer this, he flipped a coin each day to randomly...

-

PP Company purchases a material that is then processed to yield three chemicals: anarol, estyl, and betryl.In June, PPC purchased 10,000 gallons of the material at a cost of $250,000, and the company...

-

Suppose Boyson Inc. free cash flow for the next year is $ 1 5 0 , 0 0 0 and the FCF is expected to grow a concert rate of 6 . 5 % if WACC is 1 2 . 5 % what is the market value of the firm?

-

An eight lane urban freeway (four lanes in each direction) is on rolling terrain and has 11-ft lanes with a 4-ft right-side shoulder. The interchange density is 1.25 per mile. The base free-flow...

-

For the following business events, please indicate the increase (+) or decrease (-) on the following income statement and balance sheet categories. If there is no effect, leave the box blank. If...

-

4. Change the magnet to the original orientation and drag through the coil. a. What happens to the voltage and light bulb as the North Pole moves through the coil? b. What happens to the voltage and...

-

Which internal control procedure would be most cost-effective in dealing with the following expenditure cycle threats? a. A purchasing agent orders materials from a supplier that he partially owns....

-

Before the 1973 oil embargo and subsequent increases in the price of crude oil, gasoline usage in the United States had grown at a seasonally adjusted rate of 0.57 percent per month, with a standard...

-

What is the difference between the Federal income tax on individuals and that imposed on corporations?

-

Mike Barr was an outstanding football player in college and expects to be drafted by the NFL in the first few rounds. Mike has let it be known that he would prefer to sign with a club located in...

-

Mike Barr was an outstanding football player in college and expects to be drafted by the NFL in the first few rounds. Mike has let it be known that he would prefer to sign with a club located in...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App