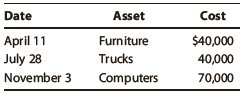

Debra acquired the following new assets during 2017. Determine Debras cost recovery deductions for the current year.

Question:

Determine Debra€™s cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any available additional first-year depreciation.

Transcribed Image Text:

Cost Date Asset April 11 July 28 November 3 $40,000 40,000 Furniture Trucks Computers 70,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

The midquarter convention must be used because the cost ...View the full answer

Answered By

Mehwish Aziz

What I have learnt in my 8 years experience of tutoring is that you really need to have a friendly relationship with your students so they can come to you with their queries without any hesitation. I am quite hardworking and I have strong work ethics. Since I had never been one of those who always top in the class and always get A* no matter what, I can understand the fear of failure and can relate with my students at so many levels. I had always been one of those who had to work really hard to get decent grades. I am forever grateful to some of the amazing teachers that I have had who made learning one, and owing to whom I was able to get some extraordinary grades and get into one of the most prestigious universities of the country. Inspired by those same teachers, I am to be like one of them - who never gives up on her students and always believe in them!

5.00+

3+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Debra acquired the following new assets during 2017: Date _________________ Asset ____________ Cost April 11 .................. Furniture .............. $40,000 July 28 ..................... Trucks...

-

Debra acquired the following new assets during 2013: Determine the cost recovery for the current year. Debra does not elect immediate expensing under § 179. She does take additional first-year...

-

Debra acquired the following new assets during 2015. Date Asset Cost April 11........Furniture.............$40,000 July 28............Trucks..................40,000 November...

-

Read the case study of Statistics regarding the Lawler Grocery Store chain. The use of the sign test is demonstrated in this case study. In your opinion, what is the biggest benefit of the sign test?...

-

Cherry Corporation, a calendar year C corporation, is formed and begins business on April 1, 2017. In connection with its formation, Cherry incurs organizational expenditures of $54,000. Determine...

-

SBDCs (Small Business Development Centers) seem to contribute positively to the launch of an entrepreneurial venture. In your opinion, what accounts for this positive relationship? If you were...

-

Measuring pain. The Department of Veterans Affairs offers medical care to 5.5 million patients. It wants doctors and nurses to treat pain as a fifth vital sign, to be recorded along with blood...

-

A U.S. company has two manufacturing plants, one in the United States and one in another country. Both produce the same item, each for sale in their respective countries. However, their productivity...

-

"Don't tell me we've lost another bid! exclaimed Janice Hudson, president of Prime Products Inc. I'm afraid so, replied Doug Martin, the operations vice president. One of our competitors underbid us...

-

Calculate the NPV of the proposed overhaul of the Vital Spark, with and without the new engine and control system. To do the calculation, you will have to prepare a spreadsheet table showing all...

-

Juan acquires a new 5-year class asset on March 14, 2017, for $200,000. This is the only asset Juan acquired during the year. He does not elect immediate expensing under 179. He does not claim any...

-

On June 5, 2016, Leo purchased and placed in service a new car that cost $20,000. The business use percentage for the car is always 100%. Leo claims any available additional first-year depreciation....

-

Under GAAP, if a company learns that its estimate for inventory obsolescence last year was too high, should it revise the previous years financial statements? Explain.

-

Convex Productions produces full-length motion pictures for distribution worldwide. Convex has just purchased the rights to a movie script entitled Native Sun, which it intends to develop as its next...

-

You are visiting the Engineering Office of Denton Hospital, as part of a consulting project. You notice some charts on one wall which look familiar to you: One of the employees notices you reading...

-

Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: What is the firms optimal capital structure? (Hint: Calculate its corporate cost...

-

Suppose a sample yields estimates \(\widehat{\theta}_{1}=5, \widehat{\theta}_{2}=3\), se \(\left[\widehat{\theta}_{1} ight]=2\), and se \(\left[\widehat{\theta}_{2} ight]=1\) and the correlation...

-

Helium expands in a nozzle from \(0.8 \mathrm{MPa}, 500 \mathrm{~K}\), and negligible velocity to \(0.1 \mathrm{MPa}\). Calculate the throat and exit areas for a mass flow rate of \(0.34 \mathrm{~kg}...

-

Why is it that some business analysts do not include the technique presented in this section for estimating the population variance among their statistical repertoire?

-

Determine the reactions in supports A and D and connections B and C. Sketch its shear and moment diagram and determine the magnitude ankoration of the maximum shear and moment for every member. 18 3...

-

Schedule M1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporations income tax return as follows: net income per books + additions subtractions =...

-

Schedule M1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporations income tax return as follows: net income per books + additions subtractions =...

-

Schedule M1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporations income tax return as follows: net income per books + additions subtractions =...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App