During 2015, Mitchael, a single individual, made the following cash gifts: Alexandra used the money to pay

Question:

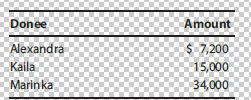

During 2015, Mitchael, a single individual, made the following cash gifts:

Alexandra used the money to pay for her medical expenses, whereas Kaila and Marinka used the money for personal purposes. Mitchael did not make any gifts in prior years.

In filing the 2015 gift tax return, Mitchael will report a taxable gift of:

a. $0

b. $14,200

c. $21,000

d. $56,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: